By: Johnny Bradigan on December 18, 2024

What’s the construction economy outlook for 2025? Experts are cautiously optimistic

The U.S. is spending more on commercial construction this year, but economists view the outlook for 2025 with cautious optimism. That was the consensus during ConstructConnect®'s fall 2024 webinar, "The Construction Economy Outlook: 2025 Starts Now."

Several leading economists offered their insights on the state of the industry, including Michael Guckes, ConstructConnect's Chief Economist; Kermit Baker, Chief Economist for the American Institute of Architects (AIA); and Ken Simonson, Chief Economist for the Associated General Contractors of America (AGC). They were also joined by Kristy O’Brien, ConstructConnect’s Director of Content Acquisition.

Here are the top five takeaways from the webinar.

- Spending is up, but expected to slow in 2025

According to numbers from the United States Census Bureau, non-residential commercial construction spending has increased by almost 7% this year compared to 2023. Baker says that's healthy growth but predicts that month-by-month drops in spending mean we will really close the year with a growth rate of about 5% to 5.5%.

Spending is expected to fall even more in 2025. Citing the most recent AIA Consensus Construction Forecast Panel survey from July 2024, Baker says forecasters predict total non-residential spending to grow only 2% next year.

While these are still technically increases, Baker is quick to point out that they continue to get smaller.

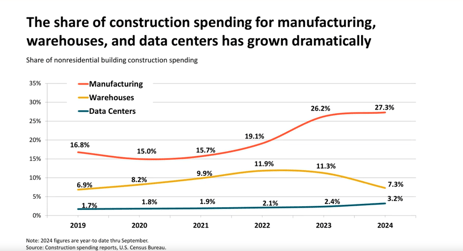

- Manufacturing, warehouses, data centers playing their role in 2024

Baker says, “[Manufacturing, warehouses, and data center projects] have had an outsized impact on the trends we’re seeing in the non-residential building market.”

The Census Bureau reports that spending on manufacturing projects has grown by 23% in 2024.

A curious statistic is found in office construction spending, which has risen by 1.8% this year. Baker acknowledges that the office category is historically the weakest in commercial construction. He says the noted increase in spending is because the Census Bureau considers data centers a part of the office category.

Data centers are facilities housing computer systems and servers for data storage and processing. They continue to be big business. In late November 2024, Meta announced it would spend $5 billion on a data center project in rural Louisiana.

When it comes to all non-residential commercial construction spending in 2024, the Census Bureau says:

- Data centers make up 3% of all spending.

- Warehouse construction has fallen from peak numbers in 2022 but still makes up 7% of spending.

- The manufacturing category continues to be the biggest spending driver. More than 27% of all non-residential projects this year have been manufacturing.

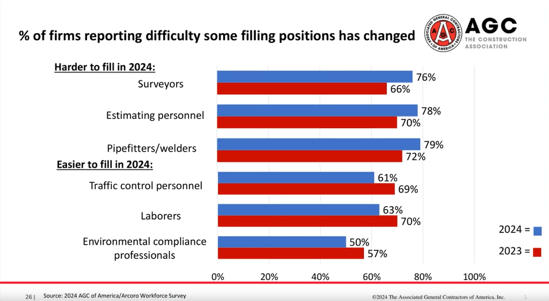

- Labor is still a mixed bag

Labor shortages continue to be a challenge. A recent AGC survey found that more than 90% of contractors report trouble finding both hourly and salaried positions. Those figures were in the 80% range just last year.

Despite these figures, Simonson says employment in non-residential construction is up nearly 4% in 2024. That’s according to the U.S. Bureau of Labor Statistics, which also says 40 states report an increase in construction employment. Alaska, Hawaii, Oklahoma, Nevada, and Montana are the five states with the biggest increases.

Oregon reported the biggest loss, with a 4% drop in construction jobs. Maryland, Maine, Vermont, and New York complete the bottom five states.

“Nevertheless,” Simonson says, “contractors tell us that finding workers is still their number one challenge.”

He adds that the hardest roles to fill continue to be trained positions, such as surveyors, estimators, pipefitters, and welders. However, he does say firms have reported finding it easier this year to fill entry-level positions, like traffic control and general labor.

“People who shunned construction because they thought they could get an indoor job, perhaps with flexible hours, [are now] finding those aren’t so available, or they’re not paying as well as construction. So, more people are showing up to apply for entry-level construction jobs,” Simonson theorizes.

- Bidding is up in the U.S.

Bidding on U.S.-based construction projects rose by about 5% this year, according to data collected by O’Brien’s Content Acquisition team at ConstructConnect. Her team collaborates with companies, contractors, and other professionals to curate and verify active and upcoming construction projects across North America.

The increase in bids indicates more new projects as well. O’Brien notes that the U.S. is experiencing a 7% increase in new construction projects compared to 2023’s numbers.

- Expect to see more hotels, stores, and even military projects in 2025

Of the nearly 30 different types of U.S. commercial construction that ConstructConnect collects data on, Guckes says nearly 75% are expected to experience strong growth next year.

This growth is driven by a predicted 56% increase in military project spending, an almost 28% rise in hotel projects, and a projected 25% increase for shopping and retail.

“Part of that is just a turnaround story,” Guckes explains. “The military sector really struggled this year, and hotels and motels had a similar experience. Some areas where we saw weaknesses in ’24 are expected to see strong rebounds in ’25.”

Conversely, some areas that experienced growth in 2024 will likely see declines in projects next year, including prisons and airports.

Wrapping up

The outlook for the U.S. construction industry in 2025 combines both optimism and caution. While commercial construction spending continues to grow, it will likely do so at a slower rate next year. Despite an increase in entry-level construction staffing, finding experienced help is still a challenge. Still, companies are bidding on more projects.

As is the case every year, it will be important for contractors and firms to keep a keen eye on market factors and trends in 2025. The good news is that ConstructConnect collects this information for you in the Economic Insights section of our website. Get free, up-to-date metrics, news, and reports you won’t find anywhere else.

Sign In

Sign In