BPMs: Use the Right Data to Easily Monitor Your Market Share Trend

See how charting your market share trend can help identify losses and gains in sales and specification rates for building product manufacturers.

Understanding the performance of construction industry segments is the key to maximizing sales and profits for building product manufacturers. Currently the construction industry is in a fluid state, breaking from, and yet still anchored to, some long-established processes. This blog will attempt to identify and address the key segments which need monitoring and the use of contemporary tools to identify and maximize marketing and sales efforts for BPMs.

In 1999, a prominent industry executive opined, “Doug, no one will ever use the internet for building design and/or product specification.” He made this declarative statement just prior to my presentation to an audience at a construction strategy conference, explaining how the internet was going to change building product marketing forever.

A short time after that presentation, “there was more data collected, aggregated, and published from 2006 to 2010 since the beginning of time.” This statement was made by a Google executive at a technology conference that I attended in 2012. That statement, at least for me, although believable, was shocking.

From the late 1990s until now our collective society has experienced a colossal cultural shift, arguably the most transformative in human history, and the construction industry is no different. Our once slow to adapt, siloed corner of the world is one of the most targeted business segments by big tech and investors looking to invest in the most transformative tools that can make building design and construction better and more efficient.

The introduction of Building Information Modeling and the enabling software; Revit, ArchiCad, and others, now cloud-based, are allowing building teams to collaborate from design through construction phases and into facilities management concurrently with unprecedented dispatch and proficiency. BIM has added more velocity to the expansion of more efficient construction processes like Integrated Project Delivery, Construction Management-at-Risk, and Design-Build, which is quickly making the siloed and inefficient Design-Bid-Build process more and more rare. Its development is bringing general contractors, trade contractors, and suppliers closer together in product decisions than in the past.

In addition, technology has advanced how data can be collected, aggregated and interpreted to provide valuable optics into market trends and strategies for BPMs.

As much as technology is changing the speed and efficiency of how the construction industry works, for BPMs, the fundamentals are still paramount in the profitable growth and maintenance of sales.

Many of the self-proclaimed Construction Tech Evangelists continue to proselytize notions like, “building product distributors will soon be a thing of the past,” while companies like Graybar Electric, Ferguson Supply, Beacon Roofing Supply, and others continue being strong, integral links in the building product supply chain.

Why does the distributor stay anchored to the building process, not replaced by direct ordering as in the Amazon business model? The answer is simple. Like many other industries, construction is local, and distributors are the BPMs’ face to the local contracting community. In many cases, they also buy and carry significant rotating BPM inventory, creating just-in-time deliveries to local contractors, which produces a more consistent and predictable revenue flow for the BPM, more than the episodic chasing and acquisition of new construction projects. Also, in many cases distributors can provide system assemblies of products for digital model integration.

So, the industry has made considerable technological advances, which empowers a more seamless collaboration between owners, architects, engineers, and contractors, from pre-project planning to facilities management. However, for manufacturers the most significant tech advances have been in the ability to collect, parse, and interpret the quantitative and qualitative information required to build data-driven business strategies.

This data can answer and provoke important questions that are critical to most of the relevant strategic goals of a BPM’s business, namely, increased sales, profitability, and market share. The next few portions of this blog will be dedicated to the identification and targeting of the project sectors based upon their ability to drive longer term sales growth and profitability.

From a macro perspective, most building products are consumed by commercial and institutional building. Several structure types make up these two segments and their sensitivity to price and product specifications adherence vary. Also, a couple of factors are important to consider related to price and product specification sensitivity and these are new construction and additions versus the renovation and retrofit of existing commercial buildings.

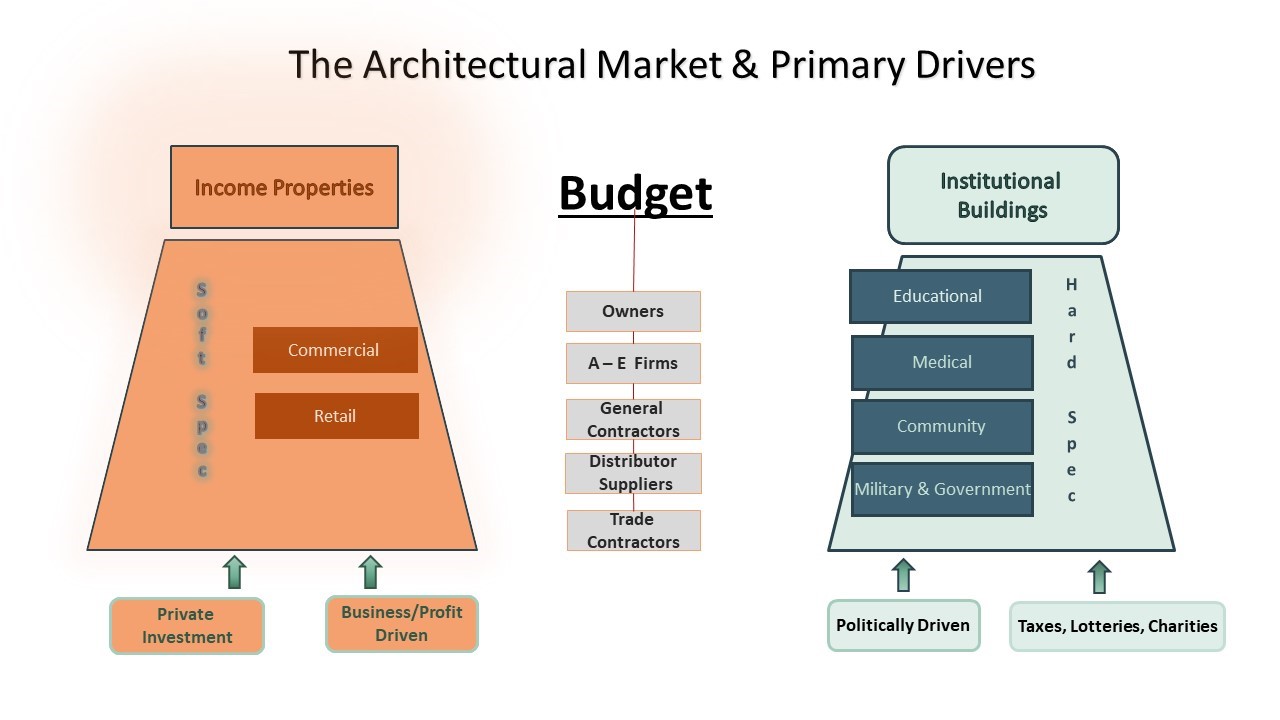

In today’s commercial construction market, with contractors taking a more active role in design and final product selection, there is incentive to value engineer all projects. The genesis regarding the importance of what is installed in the building varies on the intended purpose of the building. The graph below illustrates two buckets comparing the dynamics or motivations related to the “why” of their existence.

The design and specification process for the segments do not vary with any level of significance, but the core motivation for the existence of the building greatly impacts the commitment to design intent and especially product specification adherence. Both building types share a budgeting process which in large part impacts building design as well as the quality and type of products that are included. They also share a similar collaboration/building team for the purpose of design and construction.

The core existence for income properties is profit; therefore, even though there is a budget, the goal generally is to complete the building as quickly and inexpensively as possible. Time is money, so speed to completion and the value engineering of specified building products is quite prevalent. These buildings are a veritable feeding ground for (me too building products) that meet or claim to meet the performance of the original product that is specified but are less expensive.

Many BPMs offer both types of products, those of higher quality, and a VE alternative. Many BPMs or their distributors will submit two bids on the project, a bid according to the original specification and a VE bid, just in case. To be clear, there is nothing wrong with “me too products” being substituted on income properties, or buying projects, so to speak, is an effective way to prove the specification worthiness of your new solutions for future projects.

To the above point, I ran a door hardware company where we launched three new product families which needed to be installed on a few projects for a period before the architects would even consider including them as a specified product. We targeted income properties specifically as a VE strategy for a couple of years and now these products are showing up regularly in project specifications.

Another important underlying factor to remember is that in most cases, the original owner of these buildings has a shelf life of some five years and then they flip the property. So, first costs are an important factor to the owner. If a product can last the length of time prior to flipping, it is good enough to be installed. Vanity projects like Apple, or Google’s new headquarters are an obvious exception to this.

The core motivation for institutional buildings is not profit, but rather the owner is in it for the long haul. So quality and better than average form, function, and efficiency are paramount. Construction budgets are built around the more altruistic purpose of the building, so there is no overarching profit motivation for the owner; meaning defendable product specifications tend to hold.

However, it is important to note, if your products are in the specifications, the general contractors and other building team members do have motivations to substitute less expensive products for their own bottom line motives. This again emphasizes the importance of defendable in lieu of generic specifications. Given this, it is very important that your salespeople track these projects and keep a diligent open line of communications with your distributor and trade contractor customers, to defend any substitution attempts.

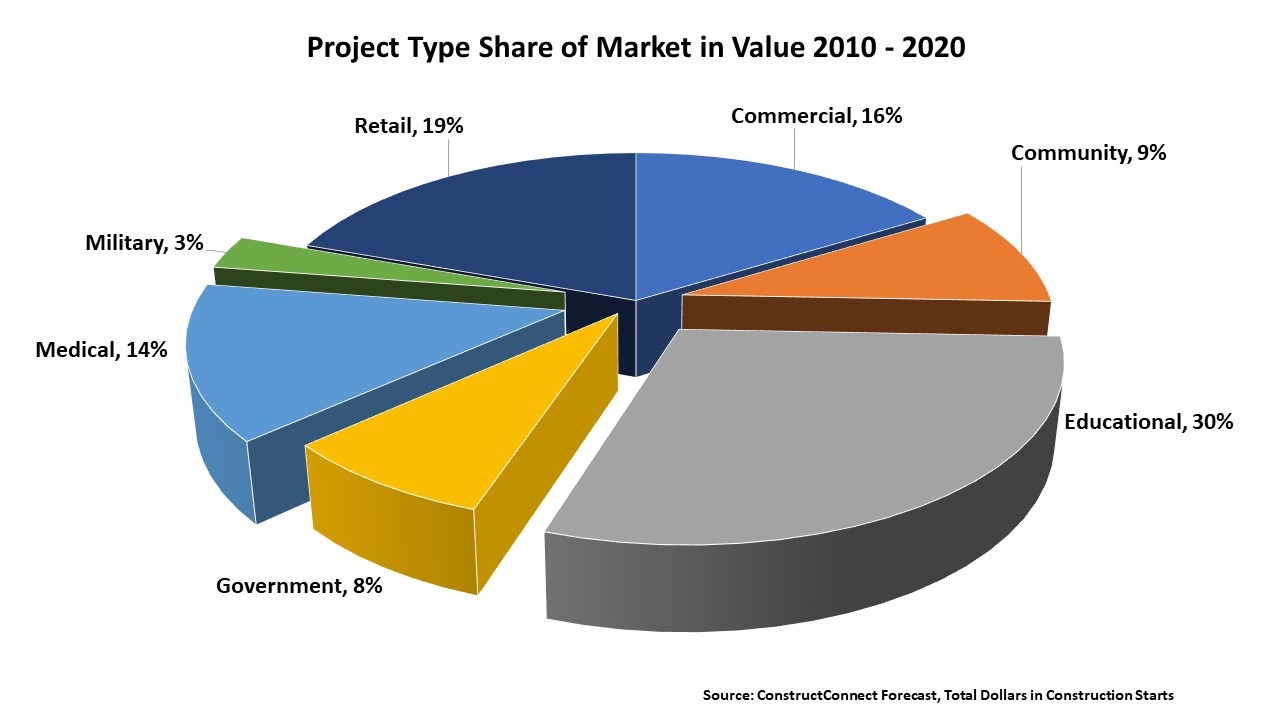

Below is a graph depicting the last decade of construction project types and their respective share of the market.

The most profitable project sectors for BPMs in new construction are institutional buildings because of the motivational dynamics of function rather than profit. They are built to heal, educate, and perform public services that need to stand the test of time and higher than usual usage. Of these, the largest markets are education and medical as indicated in the above graph.

The other part of the industry that consistently delivers higher margins is renovations and retrofits. These projects do not generate new square footage, and in most cases do not have product specifications as in new construction and building additions. This holds true for both institutional construction and income properties.

Generally, with renovation projects the owner will partner with a general contractor, and together they will collaborate on the design and the contractor will move quickly to trade contractor bids. It is in these types of projects where BPM sales representatives’ relationships with their distributor and trade contractor customers go a long way. Their constant contact and communication inform the manufacturer’s sales reps and keeps them updated on these types of discretionary projects. Without this close-knit relationship, the manufacturer would be lacking notice of renovation and discretionary sales opportunities.

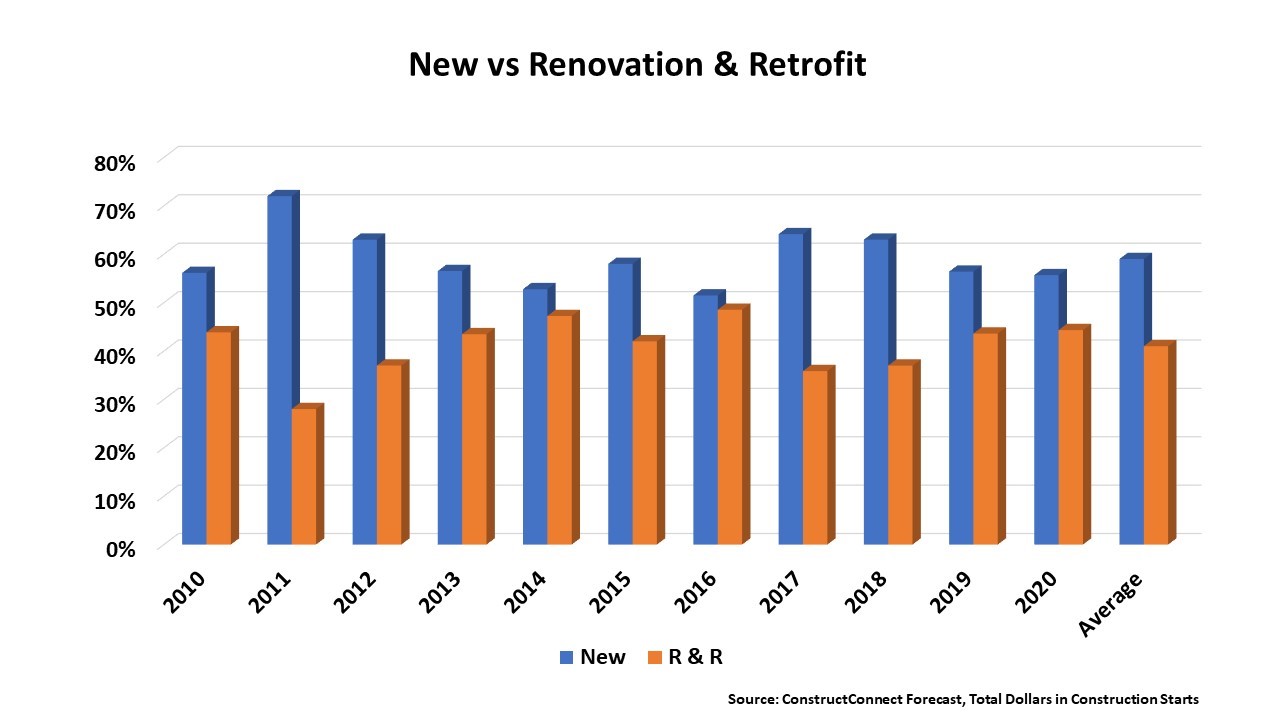

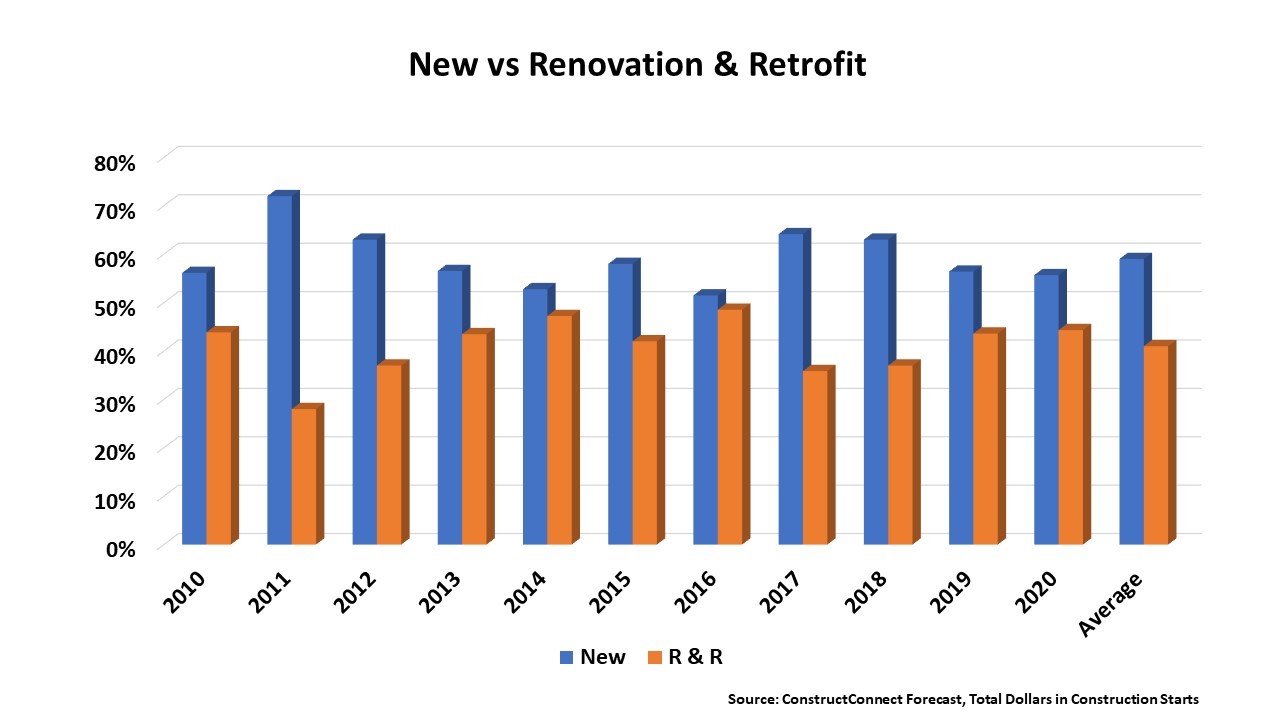

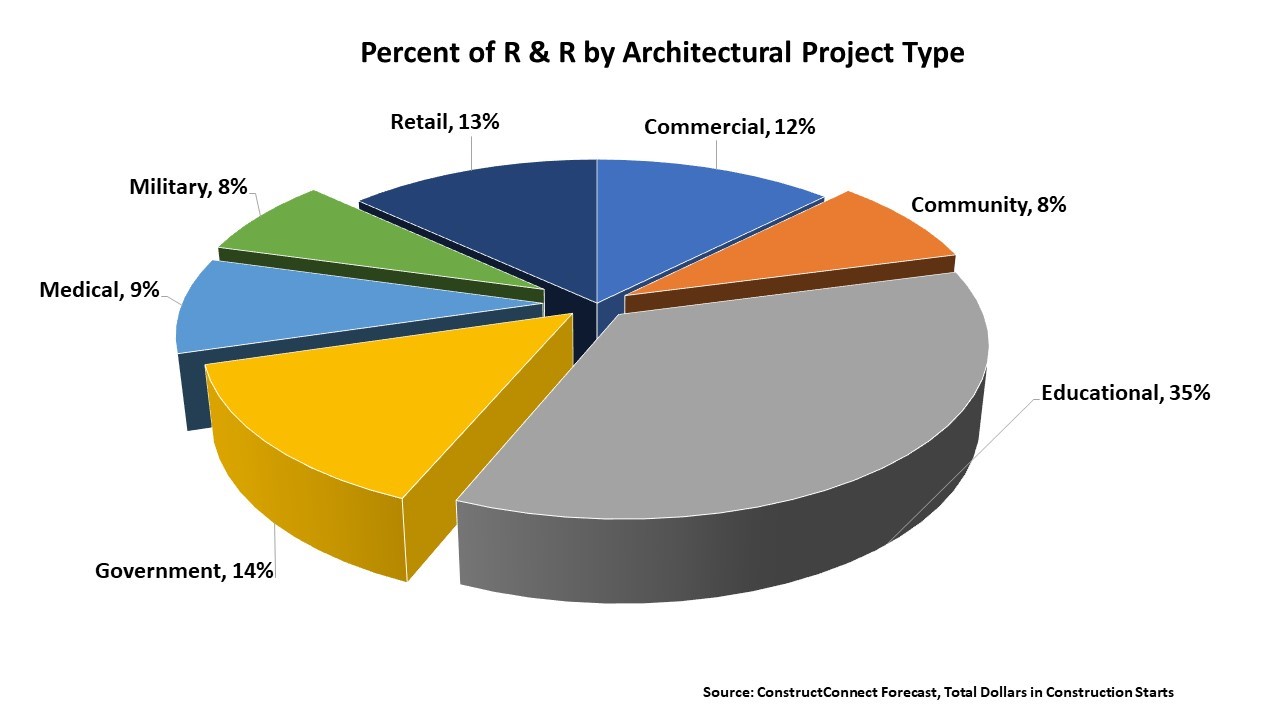

The above graph illustrates the year over year split between renovation and retrofit compared to new construction, and the graph below shows the overall percent share by project segment.

A building is a marketplace for building products and services. Knowing the use and driving motivation for the “why” in the building is akin to wholesaling products to Shoe Carnival or Nordstrom. They both successfully provide a service to the market, but what is supplied differs greatly.

The data needed to isolate, target and attack the most sales, and profit rich segments of the market for your company is readily available. The source for the data used in this blog was ContructConnect Insight.

With over 30 years of industry experience, Doug Bevill - Vice President at ConstructConnect, specializes in consulting with building product manufacturers on general strategy and optimal ways to leverage ConstructConnect’s best-in-class construction information and other marketing solutions to run their businesses.

With over 30 years of industry experience, Doug Bevill - Vice President at ConstructConnect, specializes in consulting with building product manufacturers on general strategy and optimal ways to leverage ConstructConnect’s best-in-class construction information and other marketing solutions to run their businesses.

Prior to joining ConstructConnect, Doug held executive positions with FläktGroup SEMCO, a leading manufacturer on energy recovery technology; The Hager Companies, a global door hardware manufacturer; and is the past president of BIMobject Inc., a global construction technology company.

See how charting your market share trend can help identify losses and gains in sales and specification rates for building product manufacturers.

When it comes to protecting your workers, you should be taking a proactive approach to construction safety by constantly identifying ways to improve.

Construction risk management involves being able to properly assess, control, and monitor construction project risks once they’ve been identified.

Reflections from the AIA Women’s Leadership Summit: Empowering women in the AEC industry through bold ideas, authentic leadership, and meaningful...