The relationship between manufacturers, wholesalers, and end customers has been well documented over the last many decades. To speed the delivery of products to end users, wholesalers preemptively store finished products for quick sale. At the same time, wholesalers can decide whether or not to order replacement inventory from manufacturers which results in further orders to their suppliers. This movement of orders and materials takes time which can be a risk for both manufacturers and wholesalers when economic market conditions rapidly change.

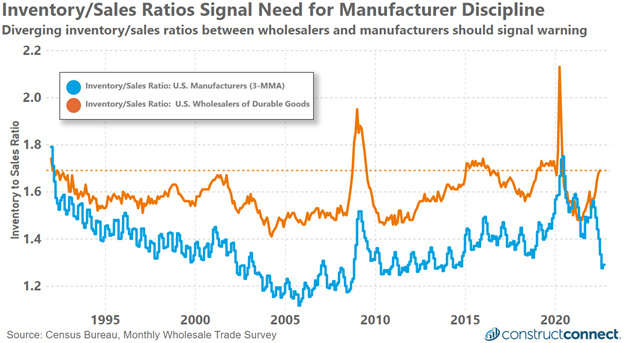

Since the late 1990s, the balance of inventory to sales for both manufacturers and durable goods wholesalers has been generally predictable with wholesalers carrying almost 1.6x inventory to sales and manufacturers carrying slightly less at 1.36. The consistency of this spread as exemplified between 2005 and 2019 suggests that it is possible to find an equilibrium of inventory to sales that allows for the efficient movement of goods and orders under most market conditions.

In the last two years, however, the durability of that relationship has been severely tested, first by COVID-19 and now by unprecedented inflation and monetary policy which is quickly and violently changing both business and consumer behaviors. Since reaching a localized peak in February 2022, U.S. manufacturing inventories relative to sales have fallen to a seven-year low, while simultaneously durable goods wholesalers are pushing up against historically high levels of inventory relative to sales. This has resulted in a rare divergence of inventory to sales levels between these two groups.

As the U.S. and global economy are expected to further slowdown through the remainder of 2022 and well into 2023, it will be in the interest of the wholesalers and distributors to reduce presently elevated inventory levels, thereby reducing the risk of being caught holding obsolete products and too little free cash. In the aftermath of past recessions, wholesaler inventories normalized at levels near or below 1.5x sales.

In the present economy, manufacturers should consider the tenuous position of wholesalers and be very strategic in adjusting their inventory levels to more historic norms. As was the case during the 2000 and 2007 recessions, manufacturer inventory to sales levels rose very quickly implying too much capital was tied up in inventory and too little available for other operational needs.

Today’s manufacturers further need to be concerned with holding too much inventory, especially at a time when many commodity prices are falling—and in some instances rapidly. Holding excessive quantities of devaluing products when potentially entering a recession would only compound the pain of poor inventory management.

For more insights, check out 5 Things You Must Know About the Economy Right Now.