President-elect Trump’s vision for US international trade policy represents a significant departure in policy from both the Biden administration and Trump’s trade policy during his first term.

According to research by Dartmouth College, the use of across-the-board tariffs, beginning at 10% and rising to as high as 60% for targeted countries, including China, would raise the average weighted American tariff to 17%.

For context, the last time tariffs were this high was during the 1930s. Proponents of tariffs argue that they level the playing field for domestic producers by raising the artificially low price of competing imports. Such higher prices incentivize domestic manufacturers to produce more output and alter unfair trade flows.

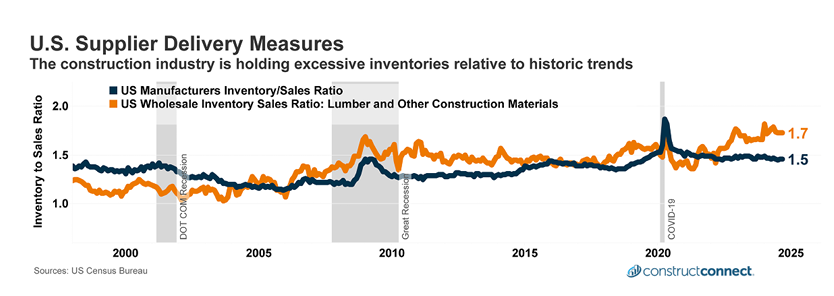

US Supplier Delivery Measures in this chart show that the construction industry holds excessive inventory levels relative to historical trends. Image: ConstructConnect

However, in today’s labor-strapped economy, where skilled baby boomers are being replaced by far less experienced and productive replacements, such logic begins to falter under the question--Where will firms find the necessary domestic labor to increase their production?

Without a significant increase in domestic laborers, manufacturers’ output will be bound by the limits of what little available labor they can find. As experienced during COVID, this could create a new surge in wages which would only increase product costs and make consumers further worse off.

Presently elevated inventory levels among US construction manufacturers and distributors may blunt the initial price hikes caused by the forthcoming round of tariffs. However, higher market prices after this transitory period will reduce unit consumption. Not all products might experience such a pricing transition, either. Lumber prices are already up 11% since Trump’s election victory.

Finally, among those firms that significantly expanded production during COVID, a decline in future unit consumption would mean diminished capacity utilization, resulting in higher overhead costs, which would raise unit costs even more.

Construction and trade firms may find themselves trapped between higher material costs and customers who are unable or unwilling to pay higher prices.

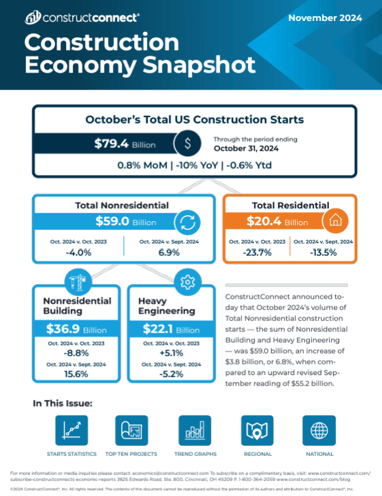

Read the Construction Economy Snapshot for more details on construction labor, trend graphs, and regional analysis.