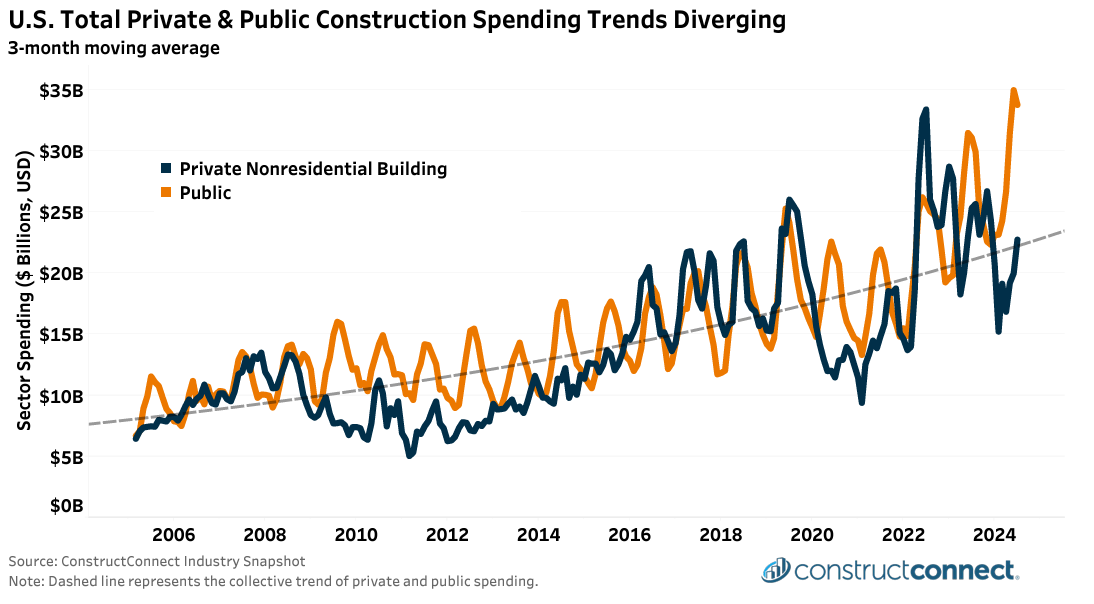

At present, the spread between public and private spending is far wider than usual, given that the country is not in or coming out of a recessionary period. As recently as the end of 2023, the value of monthly nonresidential private and total public starts spending were near parity, with both sectors clocking in monthly starts spending at near $23 billion.

Since then, however, public spending has soared while private spending has languished. In February 2024, private nonresidential monthly spending fell below $15 billion for the first time in two years. However, by July, the 3-month average value of private monthly spending had recovered to $21 billion. This is still well below the comparable pre-pandemic reading of $26 billion in July of 2019.

In contrast, public spending has surged to record highs in 2024. In the three-month period ending July 2024, monthly public spending averaged $33 billion. This spread between public and private spending of $11 billion is the largest in decades outside of the gap caused by pandemic shutdowns in mid-2020. More concerning is the trend in public versus private spending since 2022. Over the last two years, monthly private spending has trended lower while public spending has accelerated.

It is hard to fathom the idea that such a divergence could be sustainable. Public spending has been fueled by levels of deficit spending seen only in war times, while private spending is expected to get a boost as interest rates begin falling, an event that could happen as early as the fourth quarter of 2024.

The necessity for normalization in future sector spending should encourage firms to seek out public sector opportunities in the near term while also being mindful of the sector spending transition that will inevitably come when private demand returns.

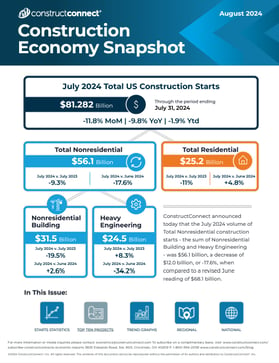

Read the Construction Economy Snapshot for more details, including regional starts, trend graphs, and analysis.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.