Challenging economic conditions in China will have ramifications for U.S. prices, and certainly within the construction industry. In its latest GDP data release, China’s economy grew at an annualized rate of 6.3%, marking one of the slowest pre-COVID-19 growth readings since at least the 1990s.

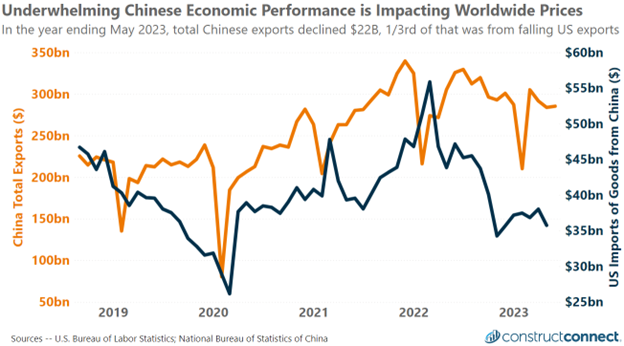

The challenges facing China’s economic growth prospects have only been exacerbated by weakening demand for Chinese exports. Total Chinese exports fell by $21 billion between May 2023 and the same month a year ago. Of that decline, approximately $8 billion was attributed to declining U.S. imports of goods from China.

China’s withdrawal of long-standing COVID-19 restrictions at the end of 2022 opened up additional production capacity at a time of lackluster domestic demand. During the second quarter of 2023, China’s industrial capacity utilization—a measure of how hard factories are working relative to their full potential—fell to 74.5%.

For comparison, between 2017 and the end of 2019, capacity utilization frequently registered between 76% and 78%. The slack in current production output suggests that desired supply levels exceed demand. Classic economic thought would thus argue that under such circumstances, prices will fall to balance the excess supply.

This classic economic argument would appear correct according to U.S. import pricing data. Not only are Chinese production costs in 2023 falling, but so are the prices of downstream products exported abroad by China. Total U.S. import prices in the 12-month period ending June 2023 were down by 6.1%, according to the U.S. Bureau of Labor Statistics.

As America’s largest provider of imports, providing nearly one-fifth of all U.S. foreign goods by dollar volume, no other country has a greater influence on U.S. import prices than China, according to the International Trade Centre.

As a nation that has historically prided itself on being the world’s factory, the idea that China would curtail production to lift world prices is antithetical. Rather, it is more likely that China will seek to capture global market share by underpricing foreign competition and, in doing so, once again achieve its economic growth goals. By this logic, the U.S. construction industry can expect that Chinese suppliers will serve as a check against a significant rebound in U.S. construction material prices, barring future shock events.

Looking ahead, the data would suggest that there is good reason for U.S. industry leaders to manage inventory and supplies using a strategy that sees near and intermediate-term prices for many goods at constant to decreasing prices. This will not be true for every construction material as, for example, warehouse and data center construction remain red-hot segments of the greater construction industry.

However, for many common construction materials, holding excessive inventories now for use in the distant future may result in a considerable cost disadvantage compared to those firms buying products using a just-in-time approach while material prices continue to fall.