Stress readings in the week ending August 12th provided further encouraging news for the industry. Delayed and On hold project levels both fell during the latest week. Historically the third quarter of the year marks the seasonal apex in on hold and abandoned project levels; however, 2023 levels thus far are on track to be their lowest since 2020. These encouraging results have come notwithstanding rising bank standards for CRE loans and higher financing costs.

Click here to download a copy of the Project Stress Index.

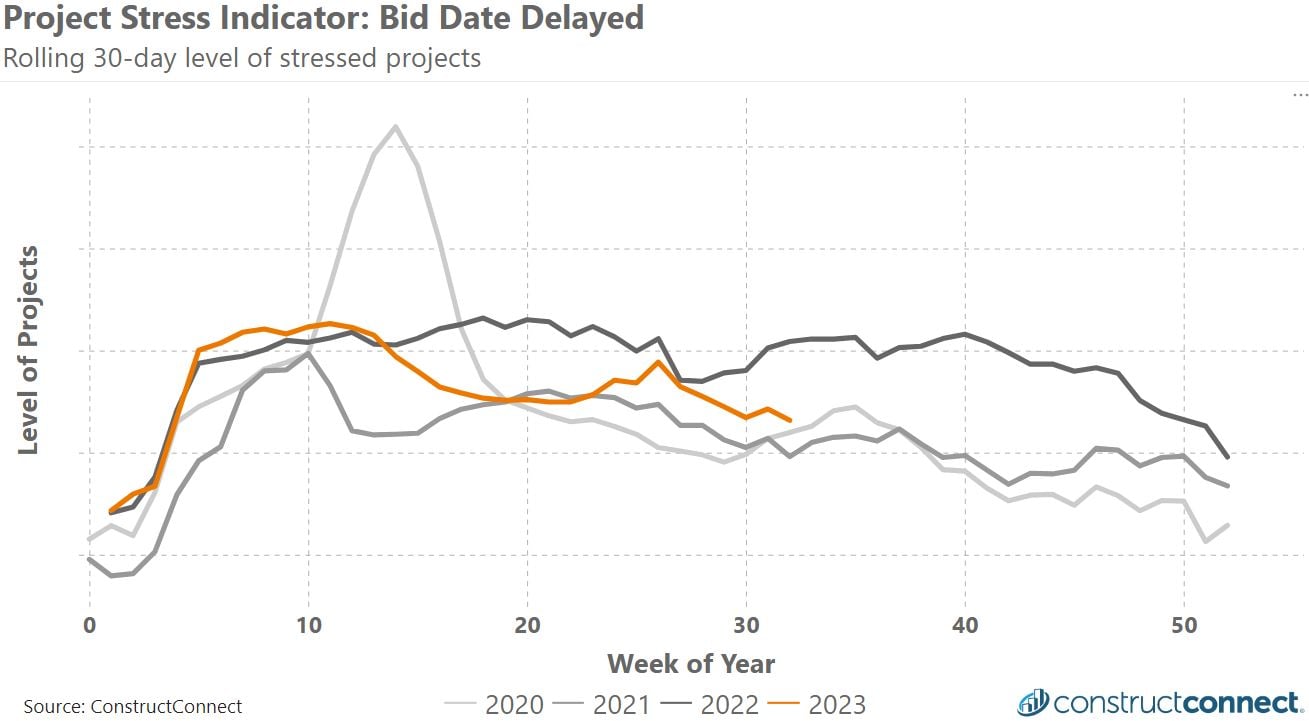

Projects with Delayed Bid Dates

Week-on-week delayed bid date project levels continue to decline since reaching a localized high in late June. Current levels are well below the levels of a year ago. The cyclical behavior of past years suggest that project levels will continue to fall during the second half of the year.

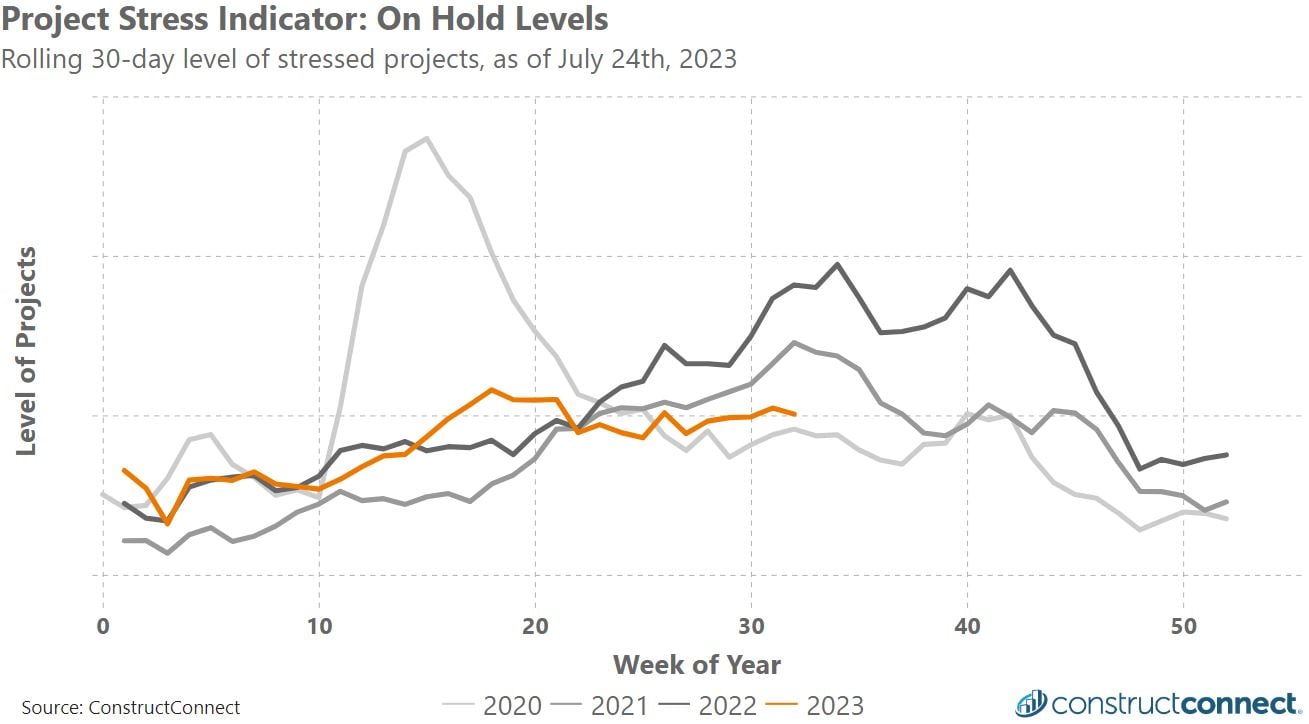

Projects On Hold

The level of on hold projects has remained flat to slightly increasing since late-May. Recent months of near unchanging results contrasts with the series’ historical cyclical behavior. Historically on hold project levels accelerate and climax during the third quarter.

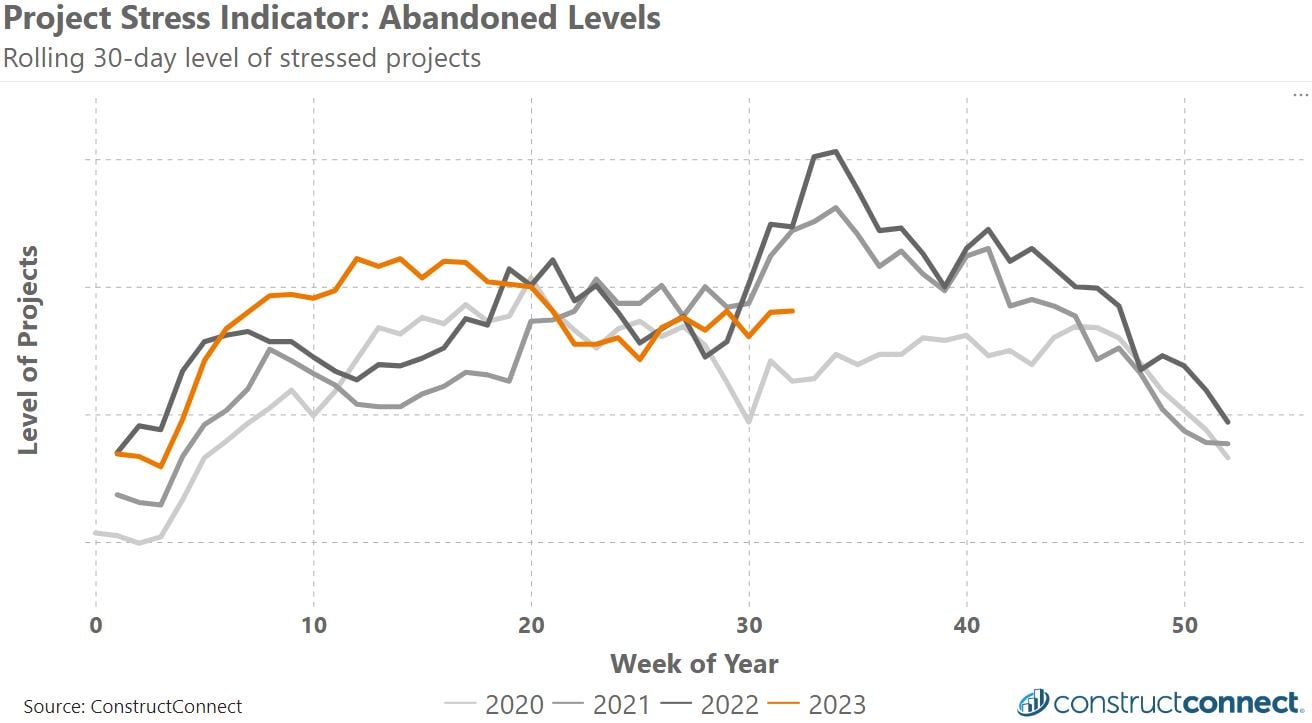

Projects Abandoned

Abandoned project levels have remained largely unchanged in the second half of 2023. Similar to the recent behavior on hold levels, abandoned project levels cyclically climax in the third quarter; however, the latest results have not expressed such behavior

About the Project Stress Index

The Project Stress Index (PSI) monitors the level of U.S. construction projects, excluding single family residential, that have experienced a bid date delay, have been placed on hold, or have been abandoned over the last 30 days. Each component has been indexed against the average of their weekly values recorded during 2021. The independent tracking of each status type gives unique insights into the timing, direction, and amplitude of market changes.

Additional information about the PSI, including detailed data about the individual readings for delayed, on hold, and abandoned projects can be found here.