By: Michael Guckes, Chief Economist on August 28, 2023

ConstructConnect's Project Stress Index - August 28, 2023

Data for the week ending August 26th continues to signal that the transition of nonresidential and civil projects from concept to physical completion remains high. All three measures of project stress remain at or below comparable levels of recent years. Historically the third quarter of each year marks the seasonal apex in on hold and abandoned project levels; however, this year’s results are thus far on track to be their lowest since 2020. These encouraging results have come notwithstanding the headwinds caused by an eroding credit market for construction developers and owners.

Click here to download a copy of the Project Stress Index.

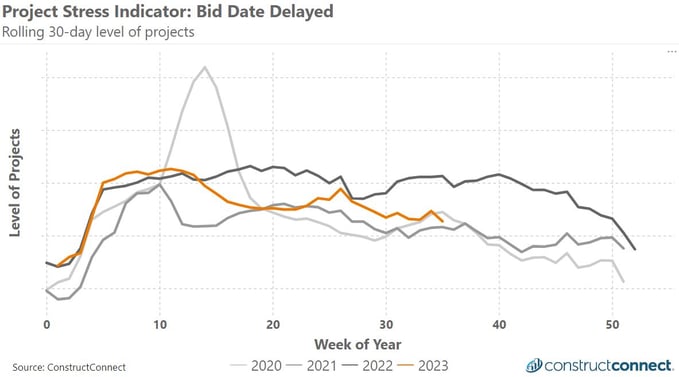

Projects with Delayed Bid Dates

Last week’s delayed bid date data were revised slightly higher in the latest release. Despite this the weekly level of projects remains at or below comparable levels from recent years.

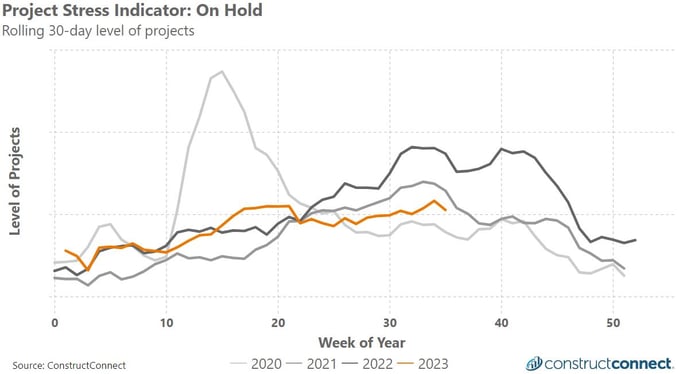

Projects On Hold

On hold project levels have increased at a lackluster rate thus far in the third quarter. The seasonally adjusted level of on hold projects has not been this low since 2020.

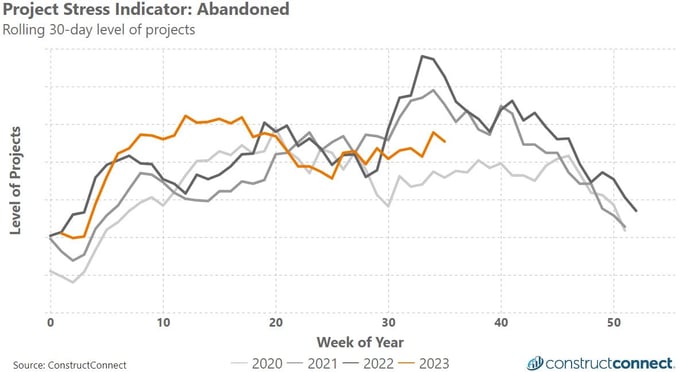

Projects Abandoned

Similar to the results reported for on hold levels, abandoned projects have also trended higher in recent weeks while remaining at multi-year lows.

About the Project Stress Index

The Project Stress Index (PSI) monitors the level of U.S. construction projects, excluding single family residential, that have experienced a bid date delay, have been placed on hold, or have been abandoned over the last 30 days. Each component has been indexed against the average of their weekly values recorded during 2021. The independent tracking of each status type gives unique insights into the timing, direction, and amplitude of market changes.

Additional information about the PSI, including detailed data about the individual readings for delayed, on hold, and abandoned projects can be found here.

About Michael Guckes, Chief Economist

Michael Guckes is regularly featured as an economics thought leader in national media, including USA Today, Construction Dive, and Marketplace from APM. He started in construction economics as a leading economist for the Ohio Department of Transportation. He then transitioned to manufacturing economics, where he served five years as the chief economist for Gardner Business Media. He covered all forms of manufacturing, from traditional metalworking to advanced composites fabrication. In 2022, Michael joined ConstructConnect's economics team, shifting his focus to the commercial construction market. He received his bachelor’s degree in economics and political science from Kenyon College and his MBA from the Ohio State University.

Sign In

Sign In