Click here to download a copy of the Project Stress Index.

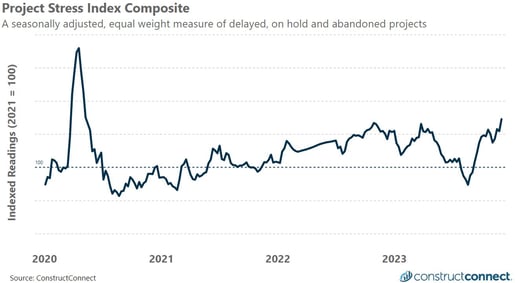

COMPOSITE OVERVIEW: The project stress index composite represents an equal-weight measure of the seasonally adjusted level of pre-construction projects that have experienced a delayed bid date, have been placed on hold, or have been abandoned in the last 30-days. For the week ending December 2th, 2023, the Index registered 129.0, indicating that last week’s project stress conditions were 29% above their 2021 average level. The Index’s week-on-week increase of 5.6% is the 4th fastest weekly increase year-to-date. More importantly, the latest reading caused the Index to break out of the elevated plateau it had formed beginning in early October when weekly readings first began stabilizing around the 120 level. Underpinning the week’s growth was a surge in abandoned project activity coupled with a more modest rise in on hold results. Both metrics set multi-month highs with the seasonally adjusted level of abandoned activity reaching its second highest reading year-to-date. This late fourth quarter surge in abandoned and on hold activity is highly unusual in the 4-year history of the Index, suggesting that market conditions remain fundamentally challenging due at least in part to higher interest rates and contracting CRE prices among existing structures.

COMPONENTS MONITOR:

| Delay Bid Date |

On Hold |

Abandoned |

|

|

|

Sector Status Update: Public and private sector project stress results can trend independently of one another in part due to their different funding mechanisms. There have been several notable trends in recent project stress data by sector. Historically the fourth quarter of the calendar year experiences an absolute decline in the level of private delayed, on hold and abandoned projects. This year however has experienced a departure from such expected quarterly behavior. Rather, on hold and abandoned activity levels since October have remained generally consistent with the levels reported during the third quarter which is also the quarter when stress reading cyclically peak. Stress indicators among public projects are performing substantially better with delayed and on hold project levels more closely keeping to expectations based on past years results. Only abandoned public project levels in 4Q23 have thus far defied historic fourth quarter trends due to elevated readings.

About the Project Stress Index

The Project Stress Index (PSI) monitors the level of U.S. construction projects, excluding single family residential, that have experienced a bid date delay, have been placed on hold, or have been abandoned over the last 30 days. Each component has been indexed against the average of their weekly values recorded during 2021. The independent tracking of each status type gives unique insights into the timing, direction, and amplitude of market changes.

Additional information about the PSI, including detailed data about the individual readings for delayed, on hold, and abandoned projects can be found here.