By: Michael Guckes, Chief Economist on February 19, 2024

ConstructConnect's Project Stress Index - February 19

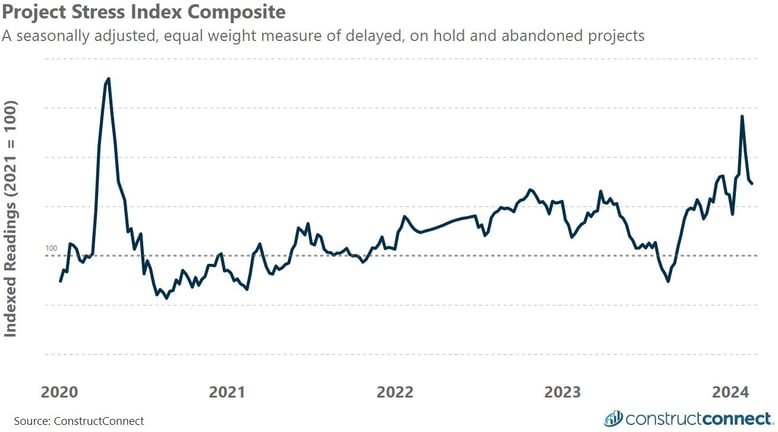

COMPOSITE OVERVIEW: For the week ending February 17th, 2024, the Project Stress Index composite fell 1.2% to close at 129.2. The decline resulted from falling abandoned and delayed bid date activity. However, further declines were foiled by an increase in the level of on hold activity. Our focus remains on abandoned activity which just two weeks ago set an all-time high of 210.2. This indicated that abandoned project activity was more than double the average throughout 2021. Thanks to sequential weekly declines, however, the level of abandoned project activity has since fallen by a dramatic 27% since then. Despite this, the latest reading is only slightly below the previous all-time high record set in March of 2023. At that time several large banks faced a loss of confidence among their depositors after writing down the value of their assets, ultimately resulting in their failures and the biggest U.S. banking crisis since the Great Recession of 2007-2009. It should be noted that on hold activity also continues to trouble the Index. In recent weeks on hold activity readings have been as high as 134. Such readings are well above historic norms yet below the

high readings of March 2023.

COMPONENTS MONITOR:

| Delay Bid Date | On Hold | Abandoned |

|---|---|---|

|

|

|

Sector Status Update: Public and private sector project stress results can and do at times trend independently of one another in part due to their different funding mechanisms. Several trends are beginning to form in our early 2024 data. Within our recent weekly public sector results, there has been as much as a 10-percent upward shift in the level of on hold projects compared to same week 2023 results. Similarly, recent weekly levels of private sector abandoned projects have been 10-percent to over 20-percent above comparable weekly readings from a year ago. However, this upward shift is more concerning as during early 2023, banks found themselves mispositioned due to the Federal Reserve rapidly increasing interest rates. This resulted in a temporary surge of abandoned preconstruction projects in the first quarter.

About the Project Stress Index

The Project Stress Index (PSI) monitors the level of U.S. construction projects, excluding single family residential, that have experienced a bid date delay, have been placed on hold, or have been abandoned over the last 30 days. Each component has been indexed against the average of their weekly values recorded during 2021. The independent tracking of each status type gives unique insights into the timing, direction, and amplitude of market changes.

Additional information about the PSI, including detailed data about the individual readings for delayed, on hold, and abandoned projects can be found here.

About Michael Guckes, Chief Economist

Michael Guckes is regularly featured as an economics thought leader in national media, including USA Today, Construction Dive, and Marketplace from APM. He started in construction economics as a leading economist for the Ohio Department of Transportation. He then transitioned to manufacturing economics, where he served five years as the chief economist for Gardner Business Media. He covered all forms of manufacturing, from traditional metalworking to advanced composites fabrication. In 2022, Michael joined ConstructConnect's economics team, shifting his focus to the commercial construction market. He received his bachelor’s degree in economics and political science from Kenyon College and his MBA from the Ohio State University.

Sign In

Sign In