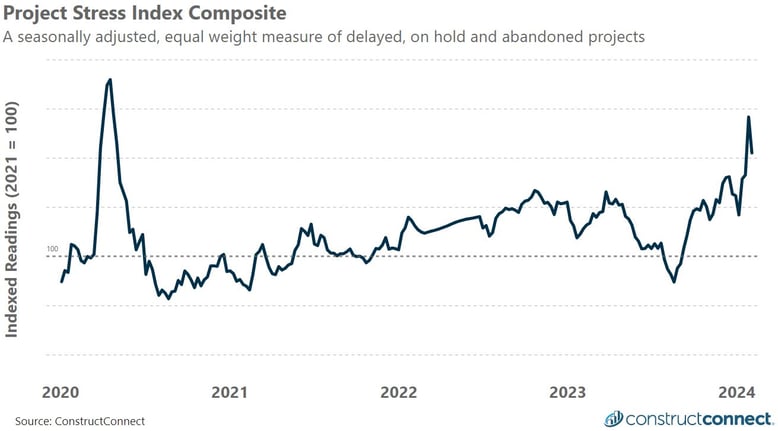

COMPOSITE OVERVIEW: The PSI gave back slightly more than half of its gains from the prior week, falling 9.3% for the week ending February 3rd, 2024, to close at 142.0. The absolute count of projects that experienced a delayed bid date, hold, or abandonment all increased from the prior week, however, due to seasonal adjustment factors, the composite fell for the week. The first full month of data for 2024 has been particularly difficult for the industry when compared to previous years. The first four weeks of 2024 experienced 85% and 56% more abandoned projects compared to the same 4-week period in 2023 and 2022 respectively. Such extreme gains have thus far been limited to abandoned project activity. By comparison, similar 1-

and 2-year look backs for delayed bid date and on hold project counts reveal increases of 10% or less. These latest results are but a continuation of a picture that first began in September of 2023 when indexed abandoned activity readings initially pulled away from the other components of the index. Never in recorded history has abandoned activity been the leading driver of the Project Stress Index for 4-months or longer.

COMPONENTS MONITOR:

| Delay Bid Date |

On Hold |

Abandoned |

|

|

|

Sector Status Update: Public and private sector project stress results can and do at times trend independently of one another in part due to their different funding mechanisms. This year both sectors have reported quickly rising activity in the early weeks of the year, made worse by the fact that that year-end 2023 readings experienced far less seasonal decline than is typical. Starting from this elevated base, the count of private abandoned projects is already 67% higher than in the same week a year ago. While this gain is notable by itself, it is easily eclipsed by the comparable 115% increase observed in public abandonments. Such tremendous gains here have overwhelmed the much smaller changes reported in the number of public projects on hold and delayed. Historically, when public projects are under duress the number of delayed and on hold projects has surged while the level of abandonments remains generally muted.

About the Project Stress Index

The Project Stress Index (PSI) composite represents an equal-weight measure of the seasonally adjusted level of pre-construction projects that have experienced a delayed bid date, have been placed on hold, or have been abandoned in the last 30-days. The PSI monitors nonresidential and multifamily projects in their preconstruction phases only and thus excludes any single-family home construction. Each component has been seasonally adjusted and then indexed against its 2021 average weekly reading. The independent tracking of each status type gives unique insights into the timing, direction, and amplitude of market changes.

Additional information about the PSI, including detailed data about the individual readings for delayed, on hold, and abandoned projects can be found at: https://www.constructconnect.com/construction-economic-news