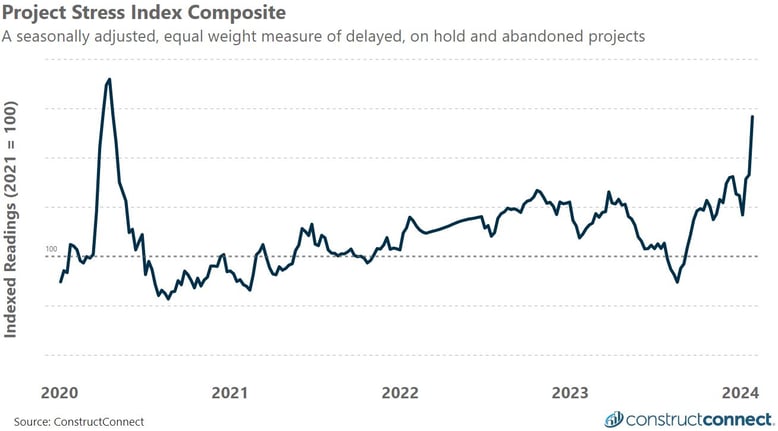

COMPOSITE OVERVIEW: The PSI surged by 19.5% in the week ending January 27th, 2024 to close at 156.6. The week’s severe increase was the result of surging project abandonments coupled with elevated levels of projects that have experienced either a delayed bid date or have been put on hold. The last time that abandoned activity was of such a magnitude was in late-April of 2020 as the COVID pandemic began shutting down the global economy. Unfortunately, the latest results only magnify the recent saw-tooth pattern observed in the data since late-October. Given that current macroeconomic conditions are improving thanks to slowing inflation, falling bond rates, and easing lending standards, multiple factors are now working in favor of owners and developers. As such it is doubtful that recent readings can be sustained. Rather, the surge in abandoned projects early this year may merely be a lagged response to the financial stresses experienced during 2023. The economics team at ConstructConnect will

continue to carefully monitor stress conditions over the coming weeks.

COMPONENTS MONITOR:

| Delay Bid Date |

On Hold |

Abandoned |

|

|

|

Sector Status Update: Public and private sector project stress results can and do at times trend independently of one another in part due to their different funding mechanisms. As measured by the level of abandoned projects, the early weeks of 2024 have been difficult for both the private and public sectors. Public sector abandonments in particular have surged this year with weekly levels more than double those measured in the early weeks of any previous year since at least 2020. While private sector abandonment levels have not doubled compared to results of past years, they remain significantly higher than historic January levels. Furthermore, in the private sector only the level of projects on hold also remains well above historic norms. Here too our team will continue to scrutinize and monitor future results carefully. Across both sectors only bid date delayed levels remain in line with those recorded in each of the past two years.

About the Project Stress Index

The Project Stress Index (PSI) composite represents an equal-weight measure of the seasonally adjusted level of pre-construction projects that have experienced a delayed bid date, have been placed on hold, or have been abandoned in the last 30-days. The PSI monitors nonresidential and multifamily projects in their preconstruction phases only and thus excludes any single-family home construction. Each component has been seasonally adjusted and then indexed against its 2021 average weekly reading. The independent tracking of each status type gives unique insights into the timing, direction, and amplitude of market changes.

Additional information about the PSI, including detailed data about the individual readings for delayed, on hold, and abandoned projects can be found at: https://www.constructconnect.com/construction-economic-news