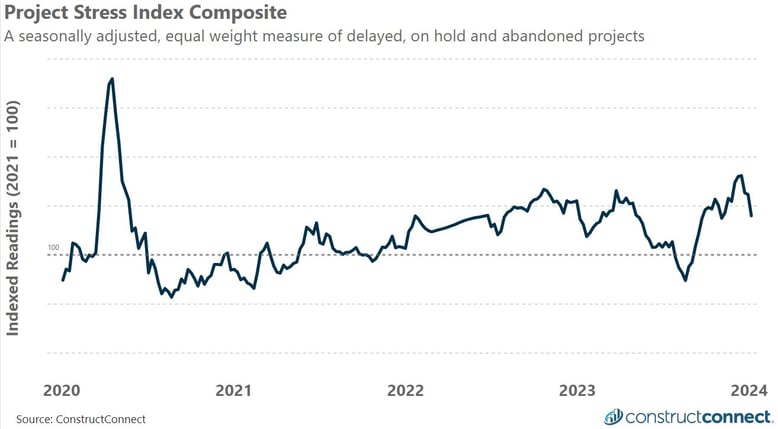

COMPOSITE OVERVIEW: The PSI closed the first week of 2024 at 116.0, down 7.0% from the week prior. The Index's heavy decline was a result of falling readings among each of its three components. Leading the declines was delayed bid date activity which fell 10.5%. This was followed by smaller activity declines in on hold and abandoned project activity of 7.8% and 3.0% respectively. Over the last three weeks the Index has now fallen a total of 12.4%. A decline of such magnitude is not uncommon for the Index in the six to eight weeks before the end of a calendar year and largely because of declining abandoned project levels. However, in 2023 the level of abandoned projects did not begin declining until the final two weeks of the calendar year; thereby keeping the composite’s weekly readings elevated far later into 2023 than would normally be anticipated. It is important to note that the most recent decline in abandoned activity is relative. Since mid-November abandoned project counts have consistently been higher than during any comparable period since at least 2019.

COMPONENTS MONITOR:

| Delay Bid Date |

On Hold |

Abandoned |

|

|

|

Sector Status Update: Public and private sector project stress results can and do at times trend independently of one another in part due to their different funding mechanisms. In recent weeks however it has been made clear that abandoned projects are a growing concern across both sectors. The latest weekly measures of abandoned private and public projects were respectively 30% and 20% higher than their comparable readings from the first week of 2023. However, such dramatic increases have not been observed in on hold and bid date delayed activity in either sector. Rather these indicators of industry stress continue to post results that fall in line with the upper-end of historical norms.

About the Project Stress Index

The Project Stress Index (PSI) composite represents an equal-weight measure of the seasonally adjusted level of pre-construction projects that have experienced a delayed bid date, have been placed on hold, or have been abandoned in the last 30-days. The PSI monitors nonresidential and multifamily projects in their preconstruction phases only and thus excludes any single-family home construction. Each component has been seasonally adjusted and then indexed against its 2021 average weekly reading. The independent tracking of each status type gives unique insights into the timing, direction, and amplitude of market changes.

Additional information about the PSI, including detailed data about the individual readings for delayed, on hold, and abandoned projects can be found at: https://www.constructconnect.com/construction-economic-news