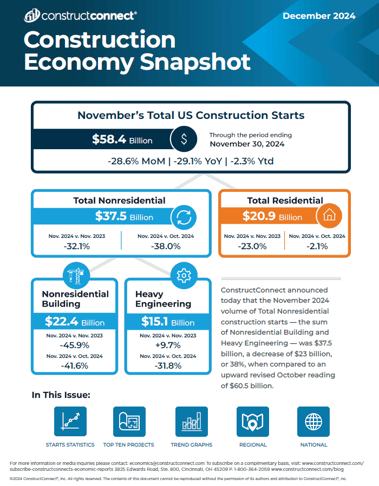

ConstructConnect reported today in the Construction Economy Snapshot that the November 2024 volume of Total Nonresidential construction starts—the sum of Nonresidential Building and Heavy Engineering—was $37.5 billion, a decrease of $23 billion, or 38%, compared to an upward-revised October reading of $60.5 billion.

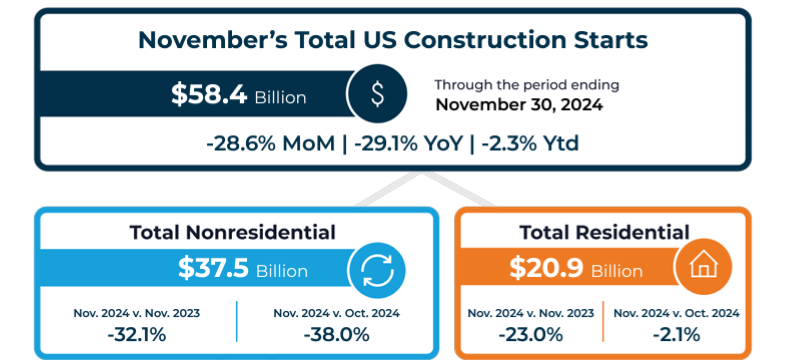

Total US Construction Starts, the combined total of Nonresidential and Residential Starts, finished November with an underwhelming $58.4 billion.

Chief Economist Michael Guckes, the report’s author, said, “Compared to the prior month and the same month one year ago, spending was down a hefty 28.6% and 29.1%, respectively.”

November 2024 Total US Construction Starts. Image: ConstructConnect

Guckes added, “The year-to-date “YTD” total now stands at $878.9 billion. When measured YTD vs. YTD one year ago, spending is now down 2.3%; however, much of this is a result of November’s weak reading.”

Michael Guckes, Chief Economist, ConstructConnect

Guckes said that YTD results, “especially those during the first half of 2024, were much more favorable, indicating growth of between 5% and 7%. The slowing and now contraction in YTD vs year-ago results can be largely attributed to contracting activity in residential and nonresidential building starts.”

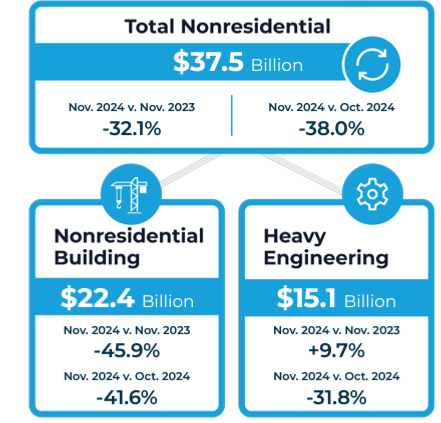

Nonresidential Building (NRB)

Year-to-date Nonresidential Building (NRB) construction starts currently total $350.2 billion, down $36.4 billion, or 9.4%, from the comparable period a year ago.

November 2024 Total Nonresidential Building Starts. Image: ConstructConnect

Heavy Engineering

Heavy Engineering construction spending continues to be a bright spot for the sector, with YTD spending of $253.4 billion, a gain of 17.0% from the same period one year ago.

Residential Construction

Total construction for Residential construction spending has experienced a YTD contraction of $20.8 billion, or 7.0%.

November 2024 Total Residential Building Starts. Image: ConstructConnect

The report said that the entirety of this contraction has come from decreasing multifamily housing starts, which have fallen by 23.3% YTD or $25.6 billion. In contrast, single-family spending has increased by 2.6%.

Read the Construction Economy Snapshot for more details on construction labor, trend graphs, and regional analysis.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.