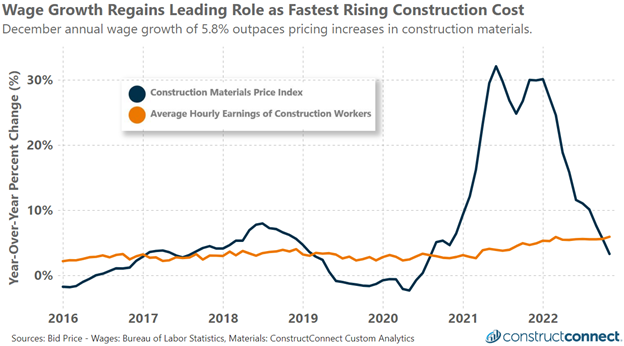

Hourly construction wage data recorded a 5.8% annual gain in December 2022, according to the Bureau of Labor Statistics. Compared to just one month ago, hourly wages rose by 0.42%. In dollar-per-hour terms. These increases represent annual and monthly per-hour gains of $1.80, and $0.15, respectively. These latest readings once again put wage inflation ahead of materials inflation which fell year-on-year to a recent low of 3.3% after increasing briefly by more than 30% YoY in 2021. The history of annualized wage and material cost increases over the years has seen both components successfully contend for the title of leading construction cost driver.

The prospect that wage inflation will decline and relinquish its new lead is unlikely. After accounting for inflation, average weekly earnings are 2.4% below their 2021 level. Inflation-adjusted real weekly earnings during the second half of 2022 were comparable to wages from 2017. In short, the last two years of inflation have consumed workers’ last five years of real wage gains. Put differently, the purchasing power of the present workers’ wage is the lowest it has been since early 2017. The resulting downgrade in their standard of living will only entice construction labor to argue for further wage increases in the future.

These latest data only reaffirm what many industry leaders already know: managing labor will be the greater cost challenge of 2023. Unlike material supplies which have steadily grown in availability in recent quarters thanks to improvements in supply chain conditions and expanding production capacity at plants, labor remains challenged by a historically low labor force participation rate that was made worse by COVID-19. Furthermore, U.S. annual birth rates have remained below the replacement rate for nearly every one of the last 50 years.

The last hope for a quick improvement in America’s labor supply would be from immigration reform. The supply of immigrant labor remains constrained due to immigration and travel restrictions imposed at the onset of the pandemic in early 2020. Lastly, as a wide array of industries seek new workers, the construction industry is competitively disadvantaged due to the more stringent physical demands placed on workers, often coupled with a willingness to endure outdoor weather. All these factors point to an entrenched labor supply problem with no easy solutions and especially so for the construction industry.