When it comes to determining the interest rate that a company must pay to borrow capital, everything is relative. The interest rate that the safest, or least risky, borrowers are charged to borrow is often called the risk-free rate.

Historically the U.S. government has borrowed at this very low interest rate because it is considered to have no risk of default. This also means that, in theory, the risk-free rate of borrowing should match the interest rate paid on government bonds and bills.

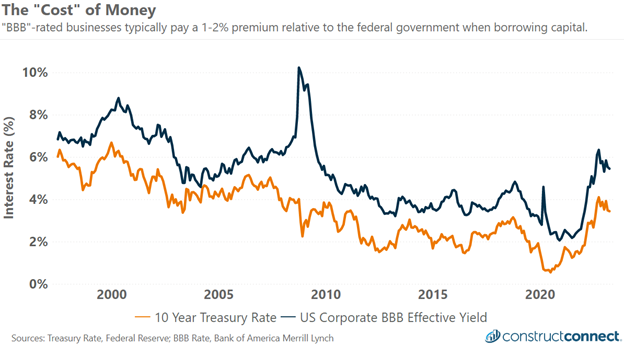

For virtually all other borrowers, however, there is a premium that is added to the risk-free interest rate that determines the rate of interest they will pay to borrow capital. The greater a borrower’s perceived credit risk, the greater the rate premium that the entity must pay.

Small businesses typically pay the highest rates because of their greater perceived risk of default compared to other types of borrowers. Since 2010, this premium, represented as the vertical distance between the 10-year treasury rate and the BBB effective yield shown below, has, with only a few exceptions, hovered between 1-2%.

While not visible in the above graphic, the pending U.S. government debt ceiling crisis has created sufficient concern to raise government debt rates. The 10-year treasury rate has climbed 50-basis points (0.5%) from 1.15% to 1.57%, raising borrowing costs not only for companies seeking to take on long-dated loans but also homebuyers using 30-year mortgages, rates for which are also tied to the 10-year treasury rate.

Short-duration debt markets have felt the impact of the debt crisis most acutely. The 1-month treasury rate, which influences short-term borrowing and revolving credit rates, was as low as 3.36% in late April.

However, as the date upon which the Federal government will no longer be able to pay all its debts nears, and with a resolution still potentially at risk of failure, that rate has climbed rapidly. As recently as May 25, the 1-month rate was 5.95%, marking a 259-basis point, or 80% rise, in the government’s cost of short-term borrowing over the last 40 days.

The process by which rising government debt rates flow into the private sector is neither neatly uniform nor instantaneous. It is, however, an inevitability. As such, business leaders should regularly check with their lending institutions to monitor how much their firms are paying for access to short-term and revolving credit capital.

If the rate is indeed higher than desired, there are many small ways a firm might reduce its short-term borrowings. Those possibilities include the delayed purchase of inventory and allowing accounts payable to increase until after the debt crisis has concluded, and rates have once again normalized.