Recent data from the Bureau of Labor Statistics pointed to a further slowing of inflation and softening GDP and job market strength, making the case for a Federal Reserve interest rate cut more convincing. Michael Guckes, Chief Economist at ConstructConnect, said the decline in housing permits also supports a rate cut.

“Until macroeconomic conditions improve, likely led by interest rates and consumer sentiment, it will be hard to know exactly when the sector can expect its next broad-based rebound,” Guckes wrote in the July Construction Economy Snapshot.

The Fed's Balancing Act

The delicate interest-rate balancing act of the Federal Reserve is based on its charge to keep inflation in check and employment strong—while preventing the economy from tipping into a recession.

Housing Permits as a Leading Indicator

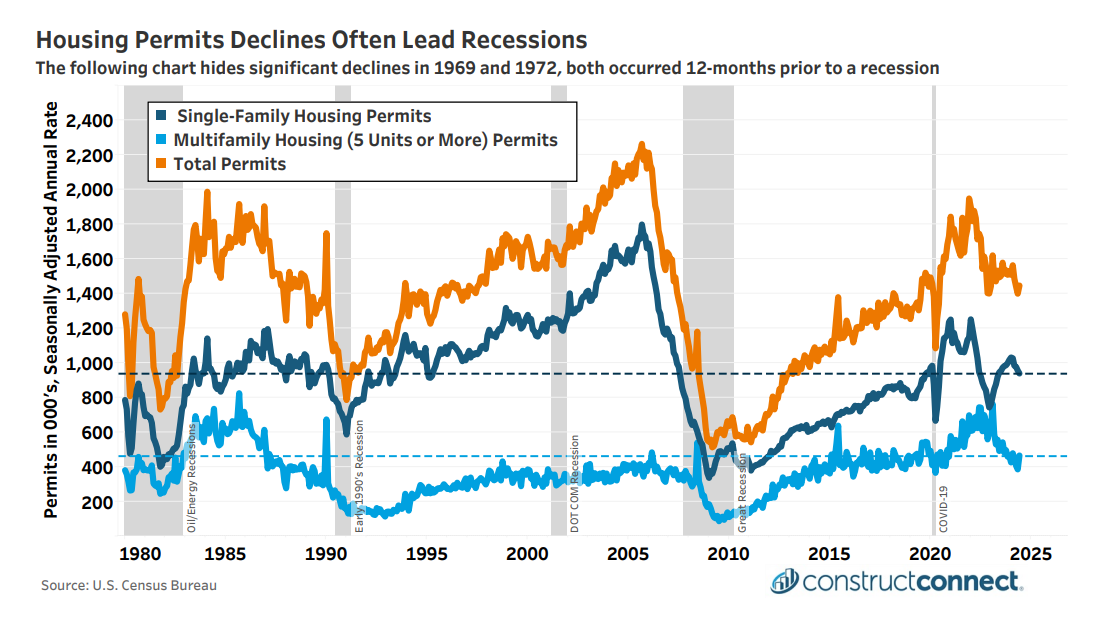

Housing permits for new residential units are a key leading indicator of the construction sector and key to monitoring the strength of this construction market segment. According to the National Association of Realtors and the National Association of Home Builders, today’s higher interest rates and extreme home price appreciation in recent years have brought home affordability to historic lows.

Even when buyers are willing to purchase expensive real estate, bank appraisers are more inclined to block financing due to concerns about lofty pricing.

“Housing starts began falling pre-emptively in 8 of the previous 9 recessions, going back to 1960. Only the Covid-19 recession, which was caused largely by government policy and not economic dynamics, has housing starts activity failed to be a reliable indicator,” Guckes said. The chart above shows the recessions shaded in gray, overlaid with the housing permit data lines. Guckes added, “The falling trends in permits should incentivize the Federal Reserve to start lowering rates soon in order to deter a potential recession.”

Rates and the Construction Project Lifecycle

An interest rate cut could ease banks’ lending policies and drive more projects forward throughout the construction project lifecycle. The Federal Open Market Committee can adjust interest rates at any time, though decisions typically come from their meetings (next scheduled for July 31, followed by September, November, and December).

For more construction economy news and insights, subscribe to our economic reports.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.