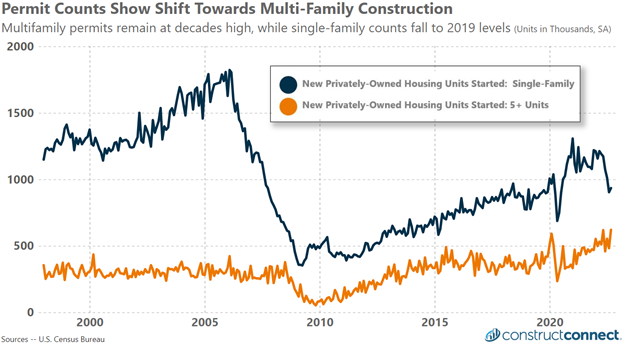

As ConstructConnect has reported previously, the markets for single and multi-family homes have taken divergent paths in recent months. In large part, this has resulted from sweeping interest rate increases coupled with recent years of strongly rising home prices.

This combination of events has created highly unfavorable market conditions for private buyers who are now faced with paying substantially greater monthly mortgage payments compared to just a year ago for all homes, but especially single-family homes.

In the multi-family market, the ability to raise rents and to finance capital, in some cases below the cost of inflation, has helped support a multi-family market that is much more oriented towards corporations and business owners seeking strong returns.

The latest housing permits data available through August 2022 clearly illustrates the diverging paths each of these markets has taken. The August multi-family permit count at 621,000 marks the highest, seasonally adjusted reading since at least 1997.

In contrast, the latest single-family permits reading at 935,000 is the second-lowest permits reading since the start of the pandemic and is only higher than the July reading from the month prior. Furthermore, these latest readings are both well below comparable figures in the months just before the start of the COVID-19 pandemic.

Looking to the future, the Federal Reserve Bank recently signaled that it would continue to raise the Fed Funds rate through 2023 as an essential part of its plan to combat inflation. The consequence of this action for home buyers will be yet higher interest rates and higher monthly payments, barring a correction in home prices. The high price for materials and labor would also suggest that the single-family market isn’t likely to experience a swell in new-home construction that would help to reduce home prices.