ConstructConnect’s Expansion Index is a monthly measure of the dollar value of planned or contemplated construction projects compared to the same month one year ago. The Index geographically covers Canada, the United States, and their respective states and metropolitan statistical areas.

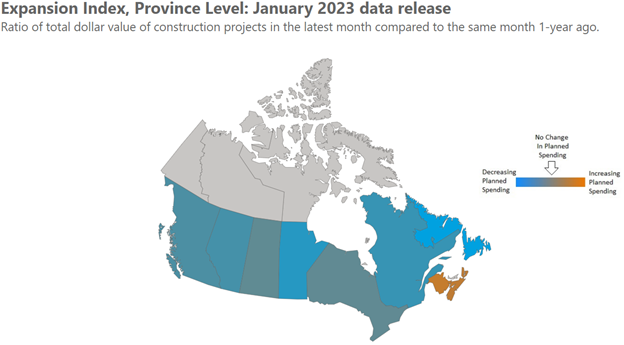

January’s release, which reports on data collected in the prior month, extended several of the industry trends that ConstructConnect has previously identified. The Index’s latest national reading for Canada at 1.05 extended the slowing expansion trend first observed in mid-2022. The dollar volume of new planned construction spending for the country in December of 2022 was 5% higher compared to the same month a year ago. The greatest planned spending expansion was recorded in New Brunswick, followed by Ontario and Saskatchewan, with each reporting identical expansion readings.

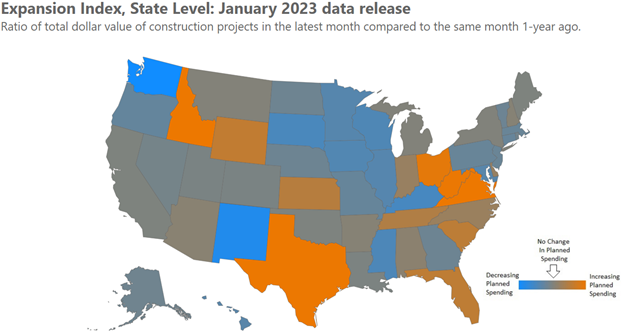

In the United States, the latest expansion index readings pointed to a continuation of the strong readings issued in prior months. The latest reading at 1.21 represents a 21% increase in the total dollar value of contemplated projects in December of 2022 as compared to the same month a year ago. The latest reading marks the fifth consecutive month in which the expansion reading has exceeded 1.20. Among the fastest-expanding states, Idaho remained in the lead, followed by strong state-level readings for Virginia, Texas, West Virginia, and Ohio.

Regionally, the Ohio River Valley and the Southeast United States between Texas and Florida continue to be areas with the greatest expected construction spending growth. Note that geographies with lower readings do not necessarily indicate market weakness, as lower readings can be caused by exceptionally high planned construction spending in the comparable year-ago month period.

Verticals Analysis

Among the eight major verticals* monitored by ConstructConnect, over half of all U.S. states reported industrial planned spending was up in excess of 20% from a year ago. This is a trend that has continued since at least mid-2022. This was followed by more than 40% of all states reporting similar expansion expectations in the government and community verticals.

Unfortunately, challenging conditions were reported in the commercial and medical verticals, with over one-third of all states reporting a decline or contraction in contemplated spending. Among all verticals, commercial continues to be the weakest as measured by the percentage of states expecting planned commercial spending of 20% or more compared to the same month a year ago.

The latest data on contemplated spending in Canada indicated another month in which more than three-quarters of all provinces expect greater than 20% expansion within their community vertical. This was followed by over 40% of all provinces expecting more than 20% expansion in retail. Based on the verticals with a notable proportion of provinces reporting strong (-20% or more) contraction were commercial, industrial, and medical. In each of these verticals, more than 40% of provinces issued a strong contractionary reading compared to year-ago levels.

Metropolitan Statistical Area Analysis

At the more granular Metropolitan Statistical Area level, ConstructConnect tracks 23 Canadian and 378 U.S. MSAs. In some instances, a large expansionary reading for a given MSA can result from the introduction of a megaproject to the area or an increase in the number of planned projects at present compared to a year ago. Furthermore, the introduction of a megaproject one year ago can also negatively affect an MSA’s current readings. The month’s top 5 MSAs by country and ranked in descending order are as follows:

|

Top 5 Canadian MSAs by Expansion Index Reading

|

Top 5 USA MSAs by Expansion Index Reading

|

|

Kitchener, ON

|

Port Saint Lucie-Fort Pierce, FL

|

|

Saguenay, QC

|

Alexandria, LA

|

|

Victoria, BC

|

Decatur, AL

|

|

Quebec, QC

|

Goldsboro, NC

|

|

Saint John, NB

|

Syracuse, NY

|

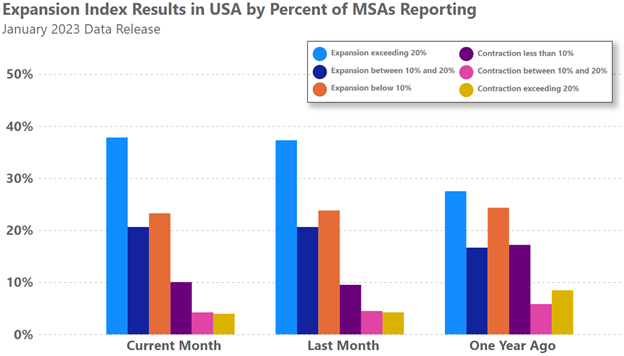

Within the United States, the proportion of MSAs that reported a 20% or greater increase in planned spending remained more optimistic as compared to results from a year ago and very similar to the prior month. Furthermore, the proportion of MSAs expecting any amount of contraction in their contemplated spending remains historically low.

*ConstructConnect monitors expansion activity data by the following verticals: civil, commercial, community, educational, government, industrial, medical, residential, and retail.

Learn More:

Each month ConstructConnect provides construction activity insights thanks to its suite of proprietary market monitoring products. The results shared in our public reports provide only a small glimpse of the total capabilities of our offerings. Fortunately, ConstructConnect makes the entire Expansion Index data series publicly available, including its cross-sectional analytics that monitors planned construction activity at each combination of market vertical and MSA levels. Users are invited to dive deeper into the data underlying the Expansion Index. References to the Expansion Index should cite ConstructConnect and the website.