Chief Economist: "welcomed news to the construction industry"

The Federal Open Market Committee (FOMC) cut the federal funds rate by 0.5% following its two-day meeting on September 17-18. The 50 basis point cut positions the target overnight lending rate between 4.75% and 5% and marks the first rate cut in over four years.

Federal Reserve Chair Jerome Powell said in a news conference following the meeting, “The US economy is in a good place, and our decision today is designed to keep it there.”

A rate cut between 25 and 50 basis points was expected. In the news conference, Powell added, “We know it is time to recalibrate our policy to something that’s more appropriate given the progress on inflation.”

“Welcomed News to the Construction Industry”

ConstructConnect Chief Economist Michael Guckes said, “This week's interest rate cut by the Federal Reserve suggests that they are more concerned about the economy experiencing a “hard landing” than many had expected. This latest aggressive cut should be welcomed news to the construction industry given it’s reliance on debt to finance construction.”

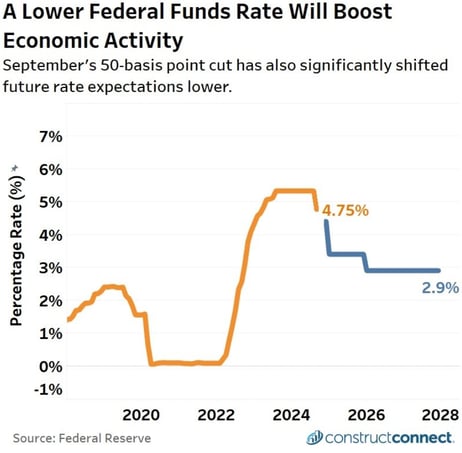

The central bank also released new projections that anticipate key rate cuts of an additional half-point by December of this year and future expected rate reductions. (chart below)

Federal Funds Rate in orange line. Projections in blue.

Guckes added context to the Fed's projections to lower rates, stating, "More important may be the fact that future expectations as far out as 2026 have been significantly lowered as a result of this week's actions."

These rate expectations could benefit the construction industry via relief to the commercial real estate segment. Guckes said, "This could be the best news for the industry as significantly lower rates will help to resolve the glut to underperforming CRE loans that are hanging over the financial system like a dark cloud. Banks which have been "pretending and extending" financing to underperforming CRE loans may receive a bigger reprieve now than previously expected."

The effects of falling rates are a relief since the heightened cost of financing any type of real estate constrains construction activity.

Behind the Rate Decision

The central bank supported the decision to cut rates in a statement, saying US economic activity continued to expand, inflation made progress toward reaching the 2% target, and the unemployment rate remained low.

Recent figures on economic activity, inflation, and unemployment are:

- GDP growth annual rate of 2.2% in the first half of 2024 (BEA).

- Inflation rate of 2.5% on all items for the 12-month period ending in August, according to the Bureau of Labor Statistics, which was the smallest 12-month increase since February 2021.

- Unemployment registered a historically low level of 4.2% through August.

Powell added that the rate cut "will help maintain the strength of the economy and a strong labor market." Last month, the Chair affirmed a forthcoming rate cut, saying "the time has come" to reverse the monetary tightening that began during the COVID-19 pandemic to counter inflation. The Federal Reserve raised interest rates by 4.25% in 2022 and 1% in 2023.

The next scheduled FOMC meeting is November 6-7, 2024.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.