In 2024, the construction industry got off to a strong start, with commercial spending at the end of the first quarter 14% above 1Q2023 levels. A similar situation unfolded for total institutional spending, up more than 12% through March.

The first quarter of 2024 also reported solid single-digit gains for residential and civil construction, with 9% and 6% increases, respectively. Total starts spending for the first quarter was 4.3% higher than during the same period in 2023.

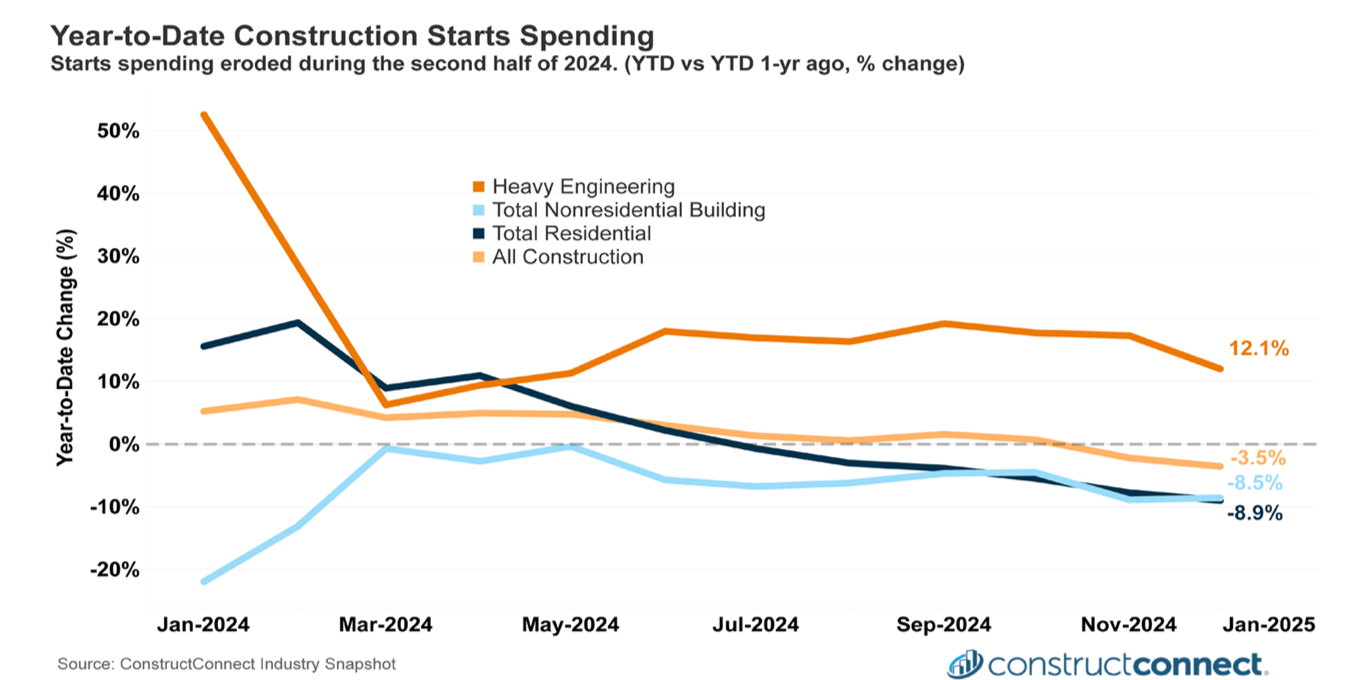

Unfortunately, this promising start to the year was short-lived, with first-half 2024 results almost universally weaker. Commercial spending slowed from 14% to just 2% as Retail/Shopping spending contracted during the second quarter.

The segment was pulled further down by steep declines in sports and convention centers (down 37%), miscellaneous commercial (down 30%), and transportation terminal starts (down 23%).

Exceptionally weak construction starts spending in November and December had an outsized impact on the weakness reported during 2H2024. Starts activity during these two months totaled just $119.2 billion.

Michael Guckes, Chief Economist, ConstructConnect

Total institutional spending did modestly better, with first-half year-on-year growth of 6.3%, thanks to sustained growth in schools, accelerating construction spending in courthouses, police and fire stations, and the groundbreaking of several multibillion-dollar prison projects.

Similarly, residential spending growth at the end of the first half of the year slowed to 2.3%.

This mid-year slowdown masked diverging trends within the residential market as single-family spending grew by 9.5% while multifamily spending contracted by 9.1%.

Full-year 2024 construction starts spending. Image: ConstructConnect

The second half of the year saw mixed conditions. Compared to 2H2023, total commercial starts spending increased by 6.8% thanks to strong gains in Amusement, Government Offices, and Sports and Convention Centers, more than offsetting double-digit contractions in Hotel/Motels, Shopping, and Warehouses.

Likewise, total institutional spending in the second half increased by 8.2% compared to year-ago levels as rising schools, college/university, and hospital spending counteracted steep contractions in Military, Nursing Home, and Prison spending.

Lastly, total residential starts spending eroded across the board as single-family’s small first-half gain turned into a second-half contraction of 7.9%. Multifamily’s small contraction in the first half of the year quickly and severely worsened into a 42% contraction during the second half.

Exceptionally weak construction starts spending in November and December had an outsized impact on the weakness reported during 2H2024. Starts activity during these two months totaled just $119.2 billion.

The last time any two consecutive months totaled so little was in late 2021.

You can read the Construction Economy Snapshot, January 2025 edition, for more full-year 2024 results and analysis.

Construction economy news and insights you can act on.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.