On January 12, 2023, the Bureau of Labor Statistics released its Consumer Price Index results for December, measuring the change in prices of goods and services. To Wall Street’s relief, the numbers pointed to a notable decline in the inflation rate compared to a month ago.

December’s annualized reading of +6.5% marked the smallest percentage increase in prices since October 2021’s reading of 6.2%. That later reading was recorded when inflation was accelerating toward its most recent peak of 9.1% in June 2022. The last two years of CPI readings have clearly illustrated the difficulty for the Federal Reserve to maintain its 2% inflation rate goal.

Of the multiple levers the Fed has at its disposal to affect supply and demand—and hence prices—one is the federal funds rate. An increase in the fed funds rate indirectly increases the interest rate on loans, thus making them more expensive. As the cost of borrowing money increases due to Fed rate increases, consumers and businesses moderate their debt-enable purchases, reducing overall demand and ultimately lowering the supply and demand equilibrium where pricing is determined.

The sooner and faster the annualized CPI readings falls to the 2% target level, the sooner the Fed might relax its use of the Fed Funds Rate to weaken demand, allowing the economy to grow more freely once again.

Headline Inflation is NOT Construction Inflation

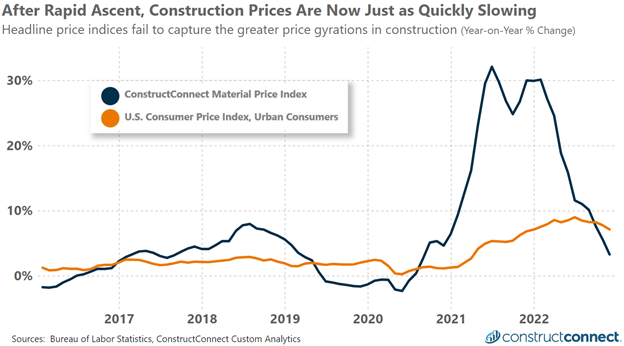

Recent months of headline inflation figures have pointed to a gradual and controlled deceleration in overall inflation. However, construction materials price data over this same period have exhibited a much faster deceleration, akin to the way that rising construction costs greatly outpaced overall inflation earlier in the pandemic. In both the earlier and present situations, construction prices changed sooner, faster, and with greater amplitude relative to the overall economy.

Falling from 30% to 3% in the 10 months ending November 2022, ConstructConnect’s construction prices index has tracked a rapid deceleration in construction prices. Presently, the Bureau of Labor Statistics’ own special price index of materials for construction indicates an even greater deceleration in construction prices.

Were the Fed singularly focused on reaching a 2% target for construction prices, their policy actions would almost certainly be different than they are now. Seeing the extreme pace of pricing deceleration, in theory, the Fed would be strongly inclined to immediately lower interest rates to reinflate demand and get ahead of the current slowing momentum that could send prices into contraction.

Unfortunately, the Fed’s focus on managing the overall economy means it is virtually certain to pursue monetary policy in 2023 that will be ill-suited for the construction sector. Consequently, construction leaders this year will need to be extremely mindful as they walk a tightrope between unresolved supply chain constraints and the risk of holding extra inventory that is at risk of losing substantial value.

In an ominous sign, spot market prices for copper and lumber—leading indicators of the wider construction material market—have already fallen significantly since mid-2022. In total, the strategy over the last two years of holding extra inventory to avoid supply chain troubles could be substantially more dangerous in 2023 than many may realize.