Supply chain data collected by Federal Reserve banks across the United States have all reported quickening supplier delivery times since at least the end of 2022. In some geographies, supply chain performance has been steadily improving since mid-2022, and the pace at which improvement is occurring continues to accelerate rapidly. The greatest supply chain improvement appears to be along the East Coast, according to data collected by the Federal Reserves of New York and Philadelphia.

Performance improvements appear to be genuine as well and not the result of a weakening in new orders. The dollar value of new orders for construction materials and supplies continues to remain plateaued near their all-time high set just one year ago. Even after adjusted for inflation, the value of new orders remains well above pre-pandemic levels. According to ConstructConnect’s calculations, between June 2022 and February 2023, the total value of new construction material orders increased by nearly 4%, while construction prices simultaneously fell by over 5%

The quickening of supply chain delivery times and performance comes at an important time for international product manufacturers as ocean-going container shipping prices have fallen by over 75% from year-ago levels, bringing prices on par with those last seen in 2018. April’s composite readings from Drewry cited 40-foot container prices near $1,700, marking only a modest premium over pre-pandemic prices. Those firms which put their international aspirations on the sidelines during the pandemic while they waited for ocean transport prices to return to normal levels should reevaluate those plans now.

Why This Matters to Construction

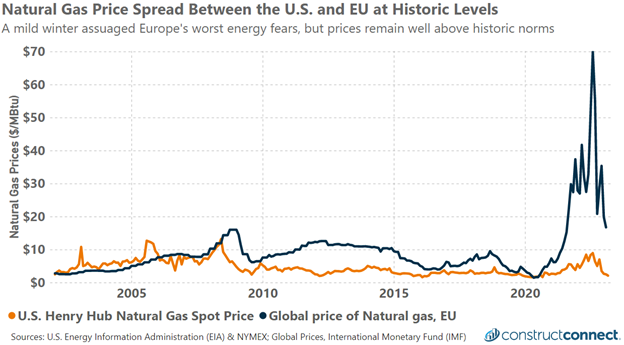

As this group has publicized over the last year, North American building product manufacturers have a unique opportunity to support their European customers who face an ongoing energy insecurity crisis, and with it, abnormally high energy costs. The ability of North American firms to supply Europe with energy-intensive building products and materials using their substantially lower energy costs, and now with greatly reduced shipping costs, will help mitigate the euro area’s inflation problems which remain fundamentally driven by energy and food prices.