Industrial construction spending is composed of three sub-categories: Manufacturing, Warehouses, and Industrial and School Laboratories.

Of these three, Manufacturing spending over the last two decades has constituted nearly 63% of the category’s total value, followed by Warehouses at 31% and laboratories making up the rest. In a delayed response to the COVID pandemic, manufacturing starts spending exploded starting in the second half of 2021 and climaxed in the first half of 2022.

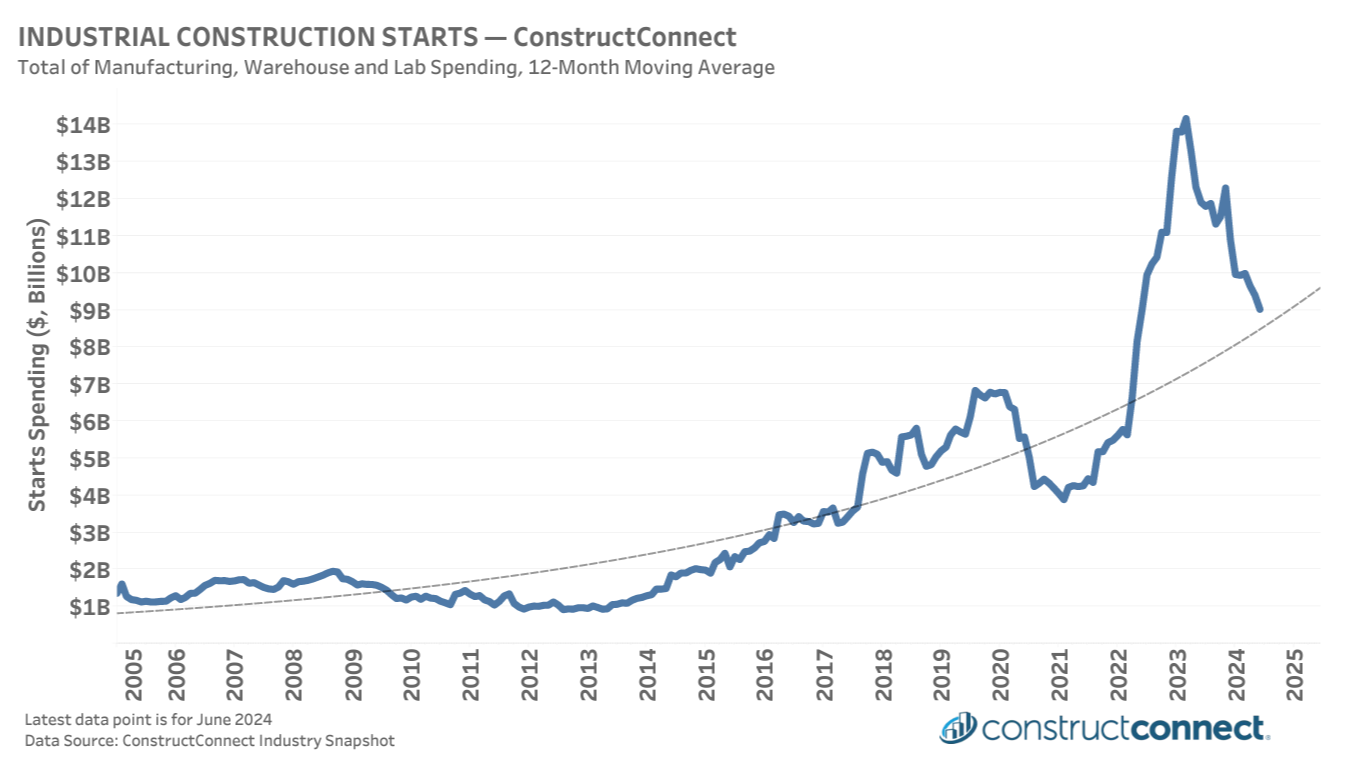

Industrial starts spending, which totaled a record-breaking $81 billion in 2019, nearly doubled by 2022, with annual spending that year cresting above $150 billion. From this point onward, monthly spending began slowly and unevenly trending lower. During 2023, total spending remained exceptionally strong by historic standards at $130 billion, largely due to megaprojects in the first and fourth quarters of the year.

However, as the pace of spending continued to slow through 2024 year-on-year and year-to-date results began to reflect the shadow left behind by the former boom period. In the first-half 2024 industrial starts totaled $37.8B, down 37% and 55% from the same periods in 2023 and 2022 respectively.

Despite these difficult comparisons, industrial spending actually remains above its long-run trend. Average monthly starts spending over the past 12 months of $9.02B is 34% above the average level in the 12 months ending December 2019. Even when accounting for inflation, which pushed construction costs higher by 35% over this period, what we see is that today’s industrial construction spending is still comparable in real terms to the record levels of 2019. This context should help reassure those who have been discouraged by the negative spending figures of the recent past.

For more construction economy news and insights, subscribe to our economic reports.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.