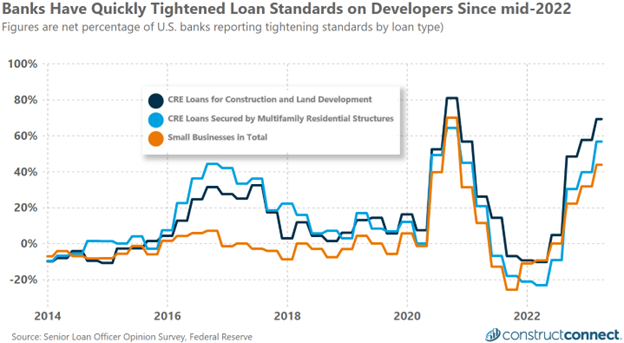

As the banking industry reels from some of the largest bank failures in history, many banks—and in particular regional banks—have quickly tightened their lending standards for fear of making loans that may one day sour. This means that many quality construction firms with good credit histories are being denied loans that they would have received just a year ago.

The reason for this change in behavior by the banks has little to do with the borrower and much more to do with decision made by banking risk managers in recent years. In short, many banks since the Great Recession have been strongly encouraged by banking regulators to take deposits, for which they have been paying almost nothing, and use them to make “safe” purchases of low-interest home mortgages and treasury bonds. This worked for the last decade in part banks could pay virtually zero interest on customer deposits while offering low rate mortgages, or buy multi-year treasury bonds and bills at 3-5% and profit off the difference.

However, as the Federal Reserve has acted to reduce inflation, it has consequentially turned the last decade on standard banking behavior upside down. Small and regional banks are now paying more than 4% interest for deposits while still having a stockpile of bonds and mortgages assets on their books that are paying the banks at the low rates of past years.

This miniscule spread between what the bank is paying on deposits now and what it continues to earn in interest on past loans has squeezed out room for lending risk. Every bad loan the bank makes now will further deplete their already undersized reserves. This is much of the reason why loan officers have made it vastly more difficult for borrowers to receive loans since late 2022.

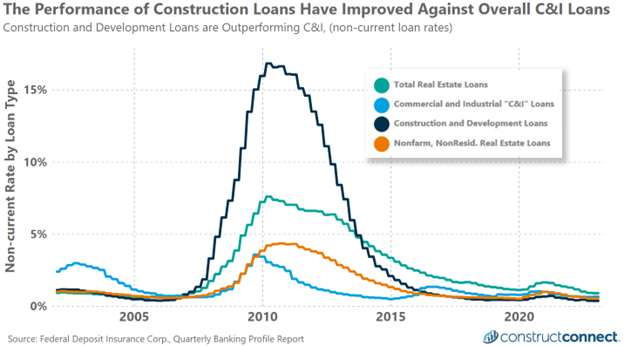

The timing of this is unfortunate for the construction industry because it has rarely been safer for a bank to make a construction and development, or nonresidential construction loan than at any time in nearly the last 20 years. The noncurrent rate—a measurement of the percentage of loans that are not present on their payments and covenants—of construction and development loans is almost half that of commercial and industrial loans at large.

The relative safety of construction and development and nonfarm, nonresidential real estate loans is even more apparent when compared to total real estate loans. For this reason, contractors of nonfarm, nonresidential and development projects need to emphasize to lenders that they present a far safer risk than their generic real estate peers.

If You Don’t Succeed, Try, Try Again

If your firm falls into one of the safer lending groups above and you still can’t get a loan through your preferred bank, don’t allow your discouragement to keep you from shopping other banks. While regional banks are in a particularly delicate situation for providing loans at present, the same is not necessarily true of larger national banks.

In fact, many of the bank deposits that are fleeing small and regional banks are finding their way into larger national banks in the belief that larger banks offer greater deposit protection. This unexpected inflow of deposits into large institutions could make now an ideal time for construction companies to begin or reestablish relationships at such institutions.

If you cannot succeed with the banks after shopping around there is yet another option. Private equity groups loan money and profit from the return, earning them the moniker of shadow banks. Such entities are governed by fewer government regulations and restrictions, but beware that this money may have more strings attached.

However, if you are a construction firm with a solid book of future business and a clear plan for how you would used borrowed capital, private equity may be worthy of your consideration. While this is a less frequent source of capital for construction firms, a quick internet search will provide information of hundreds of private equity firms specializing in construction finance across every part of the United States.