This year, the jobs market has frequently been cited as a cause for economic optimism; however, recent jobs data suggest this most important pillar of the economy may be faltering.

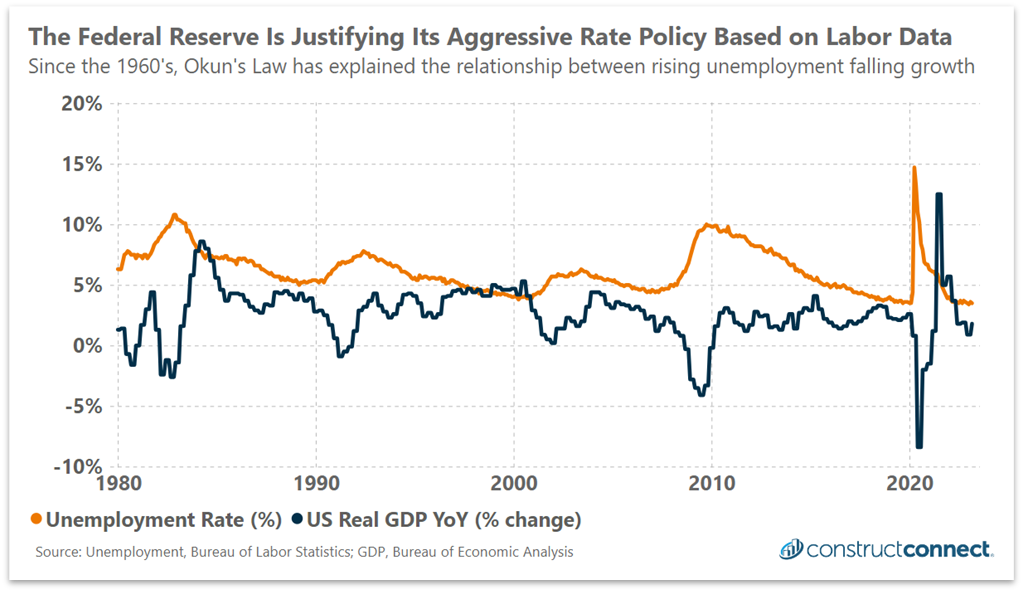

The Federal Reserve’s Chairman, Jerome Powell, has spent much of the last 18 months attempting to slow the economy to curtail inflation while minimizing the risk or severity of a recession. To successfully achieve this balance, he must carefully monitor inflation and the economy’s broad health measures. For this reason, the Federal Reserve (Fed) has kept a careful eye on employment statistics. The strong relationship between employment and economic growth is known in economics as Okun’s Law. This law, named after its creator and Yale economist, states that a 1% drop in employment tends to be accompanied by a 2% drop in GDP.

The primacy of this law explains why the Fed has frequently cited employment statistics at each of its recent Fed meetings. As other measures of the economy’s health have degraded, especially in the financial sector, the Fed has justified its historically aggressive policy moves this year by frequently responding with the strength of the jobs market.

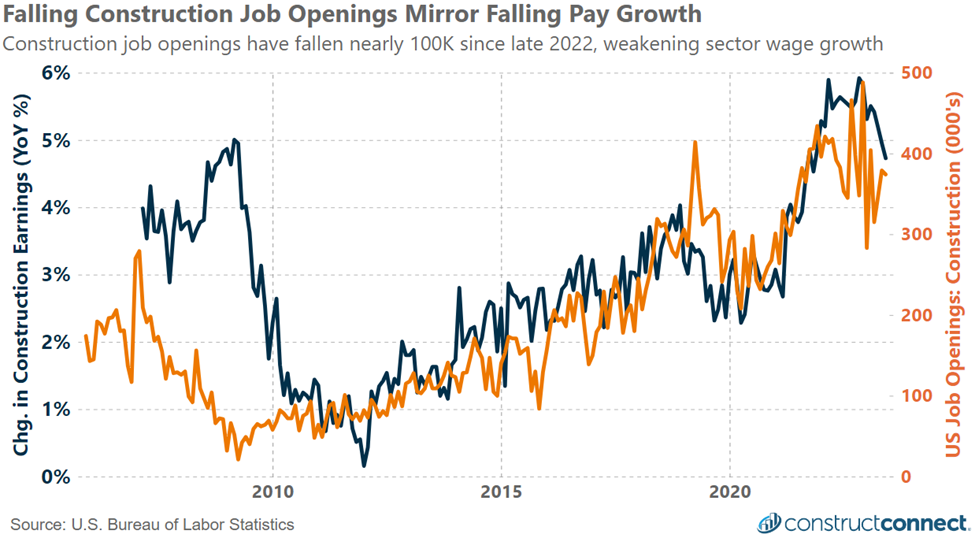

However, the Fed’s use of employment data to justify its aggressive slowing of the economy may soon happen as recent jobs data shows early signs of weakening. The total number of nonfarm job openings has fallen by 22%, representing 2.4M jobs, since the start of the year, while concurrently, there has been an 18% rise in new claims for unemployment since mid-January. The pullback in labor demand is also becoming more apparent within the construction sector as job openings fall from their 2022 highs and wage growth has slowed in sequential months since February.

For construction industry leaders, the latest data are a double-edged sword. The high interest-rate environment engineered by the Fed is broadly slowing the overall economy and some segments of the construction sector. However, this slowing is also beginning to relieve earlier tightness in the construction labor supply and ensuing wage increases. This will leave the sector with a wait-and-see approach to balancing potentially weaker construction demand with lower labor costs. Those firms considering wage adjustments in 2024 and beyond would be wise to monitor the coming months of labor data to see if labor market conditions begin to move toward the advantage of the employer.