By: Marshall Benveniste on December 3, 2024

Nonresidential Construction Starts Up $3.8 billion, or 6.8% in October

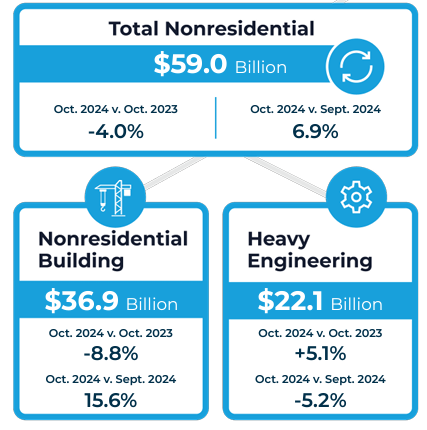

ConstructConnect reported today in the Construction Economy Snapshot that the October 2024 volume of Total Nonresidential construction starts — the sum of Nonresidential Building and Heavy Engineering — was $59.0 billion, an increase of $3.8 billion, or 6.8%, when compared to an upward revised September reading of $55.2 billion.

October 2024 Total US Construction Starts. Image: ConstructConnect

October 2024 Total US Construction Starts. Image: ConstructConnect

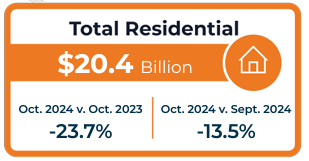

Total US Construction Starts, the combined total of Nonresidential and Residential Starts, finished October at $79.4 billion, up 0.8 percent from the prior month and down 10 percent from October 2023. Year-to-date, they have retreated 0.6 percent.

Diverging Trends Across Key Pillars of Construction

Chief Economist Michael Guckes, the report’s author, said, “Although total construction spending is little changed compared to measures from the recent past, the three underlying pillars of construction spending — Residential, Nonresidential Building, and Heavy/civil engineering — illustrate significant and diverging trends within the industry.”

Residential Construction- Year-to-date (YTD) spending contracted by $18.2 billion ( down 6.8%), primarily due to a 22.7% decrease in multifamily housing starts.

- However, single-family construction saw a modest 2.7% increase, fueled in part by a 1.8% year-over-year rise in the cost of building single-family homes.

October 2024 Total Residential Building Starts. Image: ConstructConnect

- YTD spending totaled $323.2 billion, decreasing by $21.9 billion (down 6.3%) from the previous year.

- Eight sectors within the 25 verticals (or subcategories) of Nonresidential Building reported YTD growth above 10 percent. Four reported growth under 10 percent, and eight contracted more than 10 percent.

- Notable discrepancies include Airports, which saw a robust 74.5% increase, contrasted with Military spending, which declined sharply by 47.2%.

October 2024 Total Nonresidential Building Starts. Image: ConstructConnect

- YTD spending rose to $238.4 billion, a standout for the industry, a gain of 17.5% compared to the same period in 2023.

Navigating Industry Volatility

The construction industry faces a challenging environment marked by rising costs, fluctuating demand, and the impact of interest rates. The disparity among Nonresidential Building subcategories—from high-growth sectors like Airports to contractions in Military construction—illustrates the volatility. Guckes wrote that these conditions necessitate flexibility and proactive strategy from construction firms to capitalize on emerging opportunities while managing risks.

Bright Spot in Heavy Engineering

Unlike Residential and Nonresidential Building, Heavy Engineering has consistently emerged as a growth driver for 2024. Critical infrastructure projects continue to anchor this sector, reiterating its role as a stabilizing force amid broader fluctuations.

Read the Construction Economy Snapshot for more details on construction labor, trend graphs, and regional analysis.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

About Marshall Benveniste

Marshall Benveniste is a writer and Senior Content Marketing Manager at ConstructConnect with the Economics Group. Marshall has written on various topics for the construction industry, including strategies for building product manufacturers, artificial intelligence in construction, and data-driven decision-making. Before joining ConstructConnect in 2021, Marshall spent 15 years in marketing communications for financial services and specialty construction firms. He holds a PhD in organizational management.

Sign In

Sign In