Chief Economist: “2024 emphasized the importance of geography”

ConstructConnect Chief Economist Michael Guckes reported in the January Construction Economy Snapshot that regional nonresidential starts results in 2024 emphasized the importance of geography.

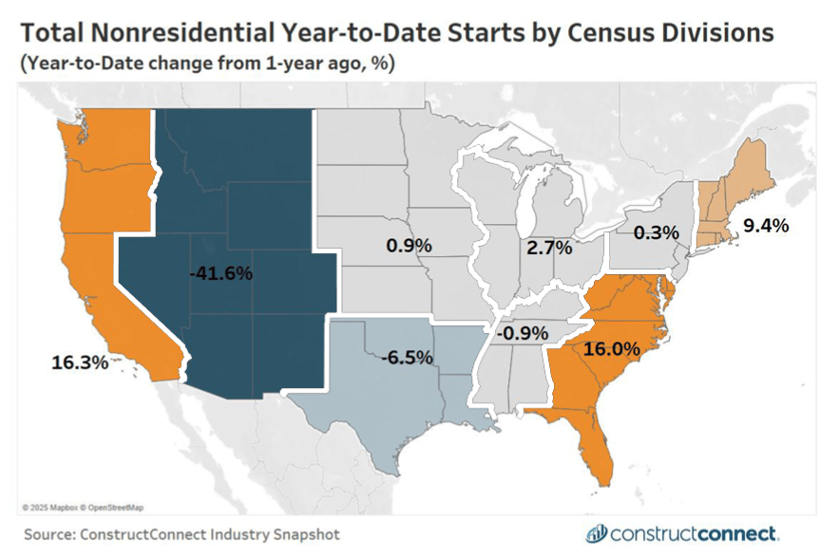

“Nonresidential building (NRB) starts activity was a significant drag on the construction sector in 2024 with six regions of the country reporting contracting year-on-year results and only three being positive,” Guckes said.

Continuing a 2024 recap, Guckes added, “The mountain region was disproportionately impacted as it reported a greater than 50% decline in nonresidential starts spending activity.”

He said the northern and southern plains followed with contractions of slightly greater than 10%.

The South Atlantic, those states south of Kentucky through Alabama, and the Pacific Coastal regions showed positive nonresidential building regional gains in 2024.

COASTAL AND MOUNTAIN REGIONS

In 2024, most Pacific and Atlantic coastal regions grew at double-digit rates. However, it was a much more difficult year for the nation’s Mountain region, with total nonresidential spending down 42% from the prior year.

Map of Total Nonresidential Construction Starts through December 2024 by Census Divisions, from The Construction Economy Snapshot, January 2025. Image: ConstructConnect

SOUTH ATLANTIC

Strong nonresidential building starts lifted the region, with the District of Columbia, South Carolina, and Virginia each growing more than 50% in 2024.

THE PLAINS

The Northern Plains spending increased by less than 1%, while the Southern Plains states—which includes Texas—contracted by over 6%.

Chief Economist Michael Guckes, ConstructConnect

MIDWEST

Heading further East, the Midwest regions from Wisconsin through Alabama reported little change for the year.

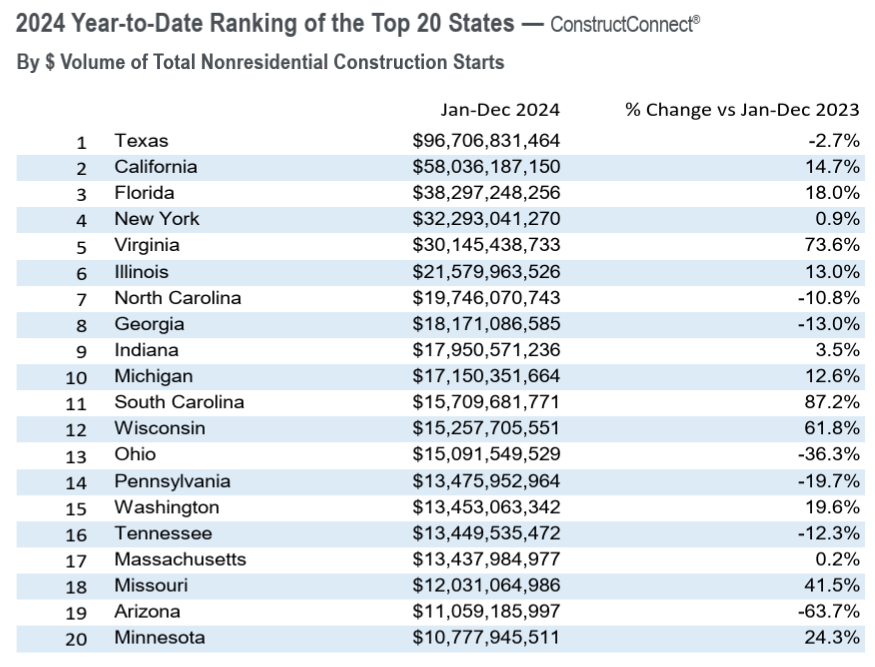

Nonresidential construction starts Top 20 US states, ranked by dollar volume for 2024. Image: ConstructConnect

CIVIL CONSTRUCTION A “BRIGHT SPOT”

“Civil construction activity was a bright spot for much of the country during 2024”, Guckes said. His analysis showed that coastal states again led the geographic growth in civil work, followed by the northern plain states.

Every region was not as fortunate. The economist noted that civil spending in the Mountain region finished 2024 down 27% after being in positive territory during the first three-quarters of the year.

Download the January Construction Economy Snapshot

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com.