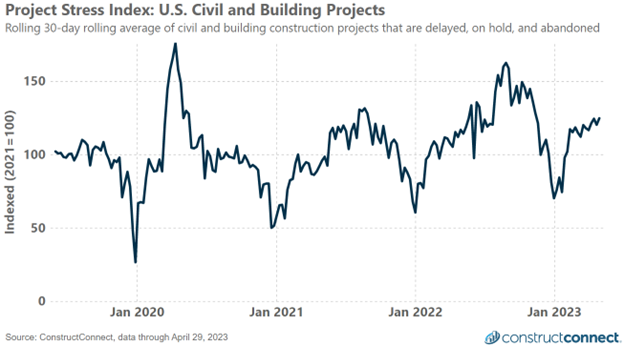

Earlier this year ConstructConnect began publishing the Project Stress Index, a proprietary resource that tracks the weekly level of projects failing to move towards expected completion. The strength of the Project Stress Index resides in its ability to monitor the weekly level of projects that have had their bid date delayed, have been put on hold, or have been abandoned.

The independent rise and fall in the level of projects experiencing each type of event, along with their interdependent behavior, may better allow market watchers to distinguish normal market volatility from actual turns in the market.

The Project Stress Composite Index is the average of the indexed readings for the level of projects with delayed bid dates, the level of projects on hold and the level of projects abandoned.

The Project Stress Composite Index is the average of the indexed readings for the level of projects with delayed bid dates, the level of projects on hold and the level of projects abandoned.

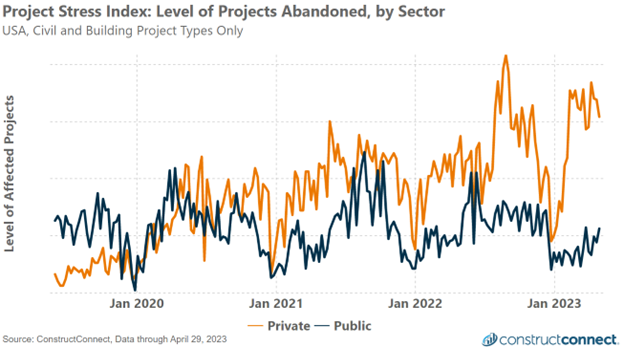

Beyond monitoring the total level of delayed, on hold, and abandoned projects, ConstructConnect’s project database also makes it possible to separately monitor the level of public and private projects failing to move towards completion. When assessed by sector, even a cursory review of project stress data illustrates the stark difference in how private and public projects uniquely cope with rising levels of market and economic uncertainty.

Since COVID-19, private projects have constituted the vast majority of abandoned projects. Elevated levels of abandoned projects in YTD-2023 may be the result of both an eroding economic outlook for the United States, and the quickly rising cost of private financing over the last 12 months. Public projects, on the other hand, are funded by state and federal taxes along with irregular legislation such as the recently passed Infrastructure Investment and Jobs Act.

For this reason, public projects are not subject to the same market constraints as their private sector counterparts. These differing dynamics were evident through the first quarter of 2023 with the level of federal projects abandoned at or near multi-year lows, while the level of abandoned private projects trended towards highs not experienced since at least 2019.

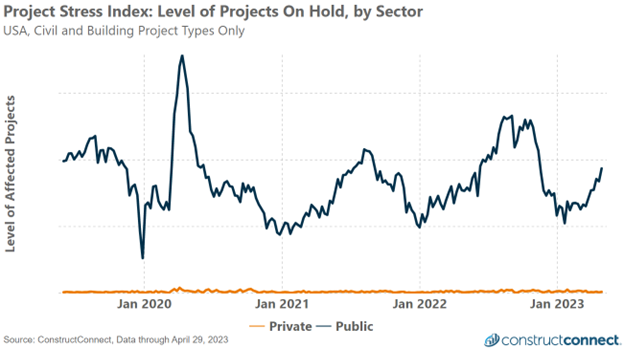

The substantial difference in abandonment levels should not lead one to believe that public projects are completely insulated from economic realities. Rather, one needs to understand that the way in which public projects exhibit rising stress conditions is simply different. Graphing the level of projects on hold by sector reveals that, when under duress, large numbers of public projects can quickly be put on hold. In contrast, the level of private projects newly placed on hold barely changes.

Overlaying the level of public projects on hold and level of private projects abandoned over time provides a definitive picture of how public and private projects address rising stress conditions differently. During rising periods of industry stress, private projects are far more likely to be abandoned while public projects are placed on hold rather than abandoned.

As the state of the economy in mid-2023 continues to be buffeted by banking crises and the level of overall economic uncertainty rises, construction firms may find that increasing their future backlogs with public projects may provide them with a more guaranteed level of work even if the timing of that work can’t be precisely predicted.

Secondly, contractors with large volumes of private backlogs work may do well to carefully limit their receivables due them along with the amount of their own capital they are willing to use for the purchase of materials in anticipation of future work.