Full-year outlook for Nonresidential, Residential, and Civil Sectors

TOTAL US CONSTRUCTION STARTS

Moving into the new year, our growth forecast for Total US Construction Starts in 2025 is 8.5%.

The growth forecast is driven largely by the positive economic outlook, strong government spending, and falling interest rates, which help to support growth in the Residential and Nonresidential Building sectors.

TOTAL NONRESIDENTIAL AND TOTAL RESIDENTIAL STARTS

Total Starts are the sum of Total Nonresidential and Total Residential Starts. In these categories, the 2025 forecast is:

- Total Nonresidential Starts are expected to grow at 6.9%.

- Total Residential Starts up 12%.

NONRESIDENTIAL BUILDING AND CIVIL ENGINEERING

Looking deeper into Nonresidential Starts, which is the sum of Nonresidential Building and Civil Engineering:

- Total Nonresidential Building activity is forecast to rise by 8% in 2025.

This is off the back of declines seen in 2024, although this is down from record levels after strong post-pandemic growth. This is especially prominent in new Manufacturing Starts, where growth of 229% in 2022 meant declines in 2023 and 2024 were likely. However, we do think that 2025 will see growth as the strength of the pipeline suggests there are still many projects going ahead.

- Civil Engineering growth is expected at 5.3%.

Investment in Power Infrastructure is a strategic area for growth as part of the green transition and has seen plenty of government investment. However, there are fewer large upcoming construction projects than in previous years.

TOTAL RESIDENTIAL BUILDING

After two years of large declines, we expect Total Residential Building to return to growth in 2025, expanding by 12%.

The anticipated expansion is driven by both Single-family and Multi-family construction growing as the impact of declining interest rates spurs construction activity. Headwinds have persisted in the sector as sticky inflation and high interest rates hit construction in 2024.

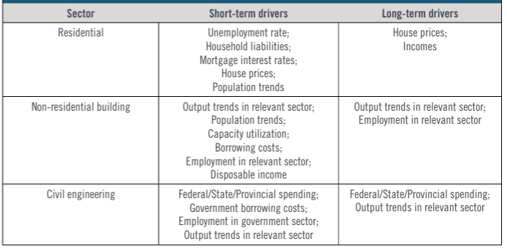

Drivers of headline sectors from ConstructConnect Construction Starts Forecast Q4 2024.

As these pressures abate, Residential construction is expected to return to growth. Single-family Residential Starts are expected to grow by 13.1%, while we see Multi-family Starts growing 9.5% after two years of sharp declines.

Overcapacity and high financing costs remain a particular downside risk in the Multi-family segment, given apartment vacancy rates. The 2025 rise should also be seen in the context of the last two years of poor performance, especially in Multi-family building where new apartment building still lags its level in 2022. However, we think that 2025 will see growth, as the strength of the pipeline suggests there are still many projects going ahead.

Read the Construction Starts Forecast for more economic analysis from Chief Economist Michael Guckes.

Construction economy news and insights you can act on.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.