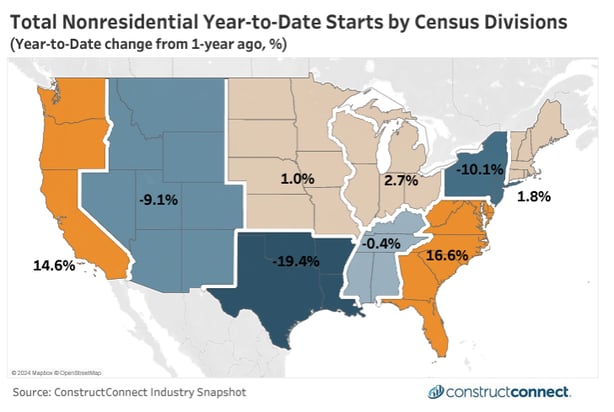

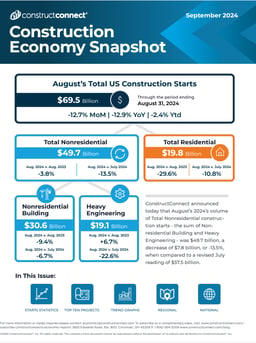

ConstructConnect Chief Economist Michael Guckes reported in the September Construction Economy Snapshot that regional, nonresidential construction activity has been generally positive for most coastal regions but more difficult for the nation’s central southern and mountain areas.

Guckes noted that through August 2024, construction spending expanded the fastest in the South Atlantic, adding 16.6% in total nonresidential construction starts year-to-date (YTD). The economist reported that the region was lifted by a steady flow of energy and data center megaprojects, which cost $1 billion and up.

Map: ConstructConnect, The Construction Economy Snapshot through August 2024.

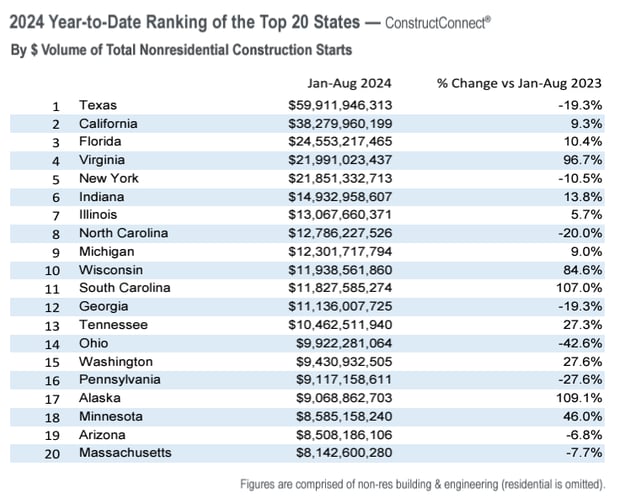

Virginia starts are up 97% YTD, and South Carolina tacked on 107% YTD, contributing to the South Atlantic region’s robust nonresidential construction growth through August. These two states have vastly outperformed the average US state, which turned in 8.4% growth this year.

Virginia and South Carolina have amassed nearly $34 billion in new construction starts year-to-date by dollar volume. Only Rhode Island, up 178% YTD, and Alaska, which gained 109% YTD, have performed better on a percentage basis, Guckes indicated. Next in line are the South Atlantic region, with $94.1 billion in YTD starts, and the Pacific division, which added 14.6% YTD with starts worth $65.8 billion.

Chart: ConstructConnect, The Construction Economy Snapshot through August 2024.

The remaining regional YTD performance that reported positive territory was considerably lower, with single-digit growth. The East North Central region ended up by 2.7% in August, followed by the New England region, which added 1.8%.

According to Guckes, the negative results across the country’s middle are far more concerning. In the West South Central region (Arkansas, Louisiana, Oklahoma, and Texas), total nonresidential starts spending is down 19.4% YTD. Guckes identified the region’s challenge as its dominance of nonresidential building activity, which dragged starts down 26.6% YTD. He added context by noting that the area received no assistance from heavy engineering, which is facing its own mild contraction.

Arizona, Colorado, and Wyoming led the group of eight Mountain region states in construction spending but not enough to return positive starts through August. Total nonresidential year-to-date performance was down 9.1%, again led by a disproportionate contraction in nonresidential building spending and nearly unchanged spending in heavy engineering.

Read the Construction Economy Snapshot for more details, including trend graphs, analysis, and commentary from Chief Economist Michael Guckes.

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com.