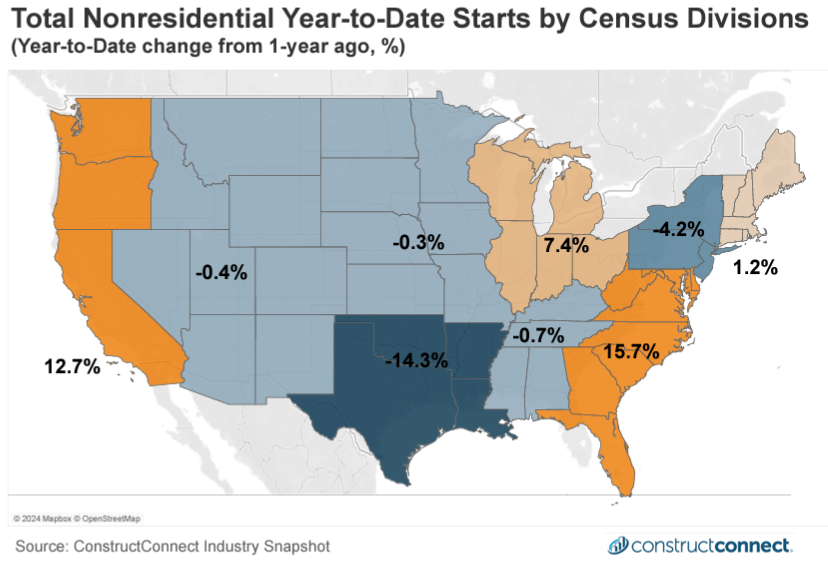

ConstructConnect Chief Economist Michael Guckes reported in the October Construction Economy Snapshot that regional, nonresidential construction activity has generally been positive for many Coastal regions but more difficult for the nation’s Central, Southern, and Mountainous regions.

South Atlantic Up 15.7% Year-to-Date

Guckes reported that construction spending through September expanded the most in the South Atlantic (up 15.7%) year-to-date. He added that the results include the “steady flow of energy and data center megaprojects” (over $1 billion in cost) in the region. September data for the South Atlantic benefited from multiple new data centers, a warehouse, and an apartment complex—most of them individually valued at over $400 million.

The region has now exceeded $100 billion year-to-date (YTD) in total nonresidential starts spending.

Map: ConstructConnect, The Construction Economy Snapshot through September 2024.

Pacific Region Second Highest Year-to-Date Starts

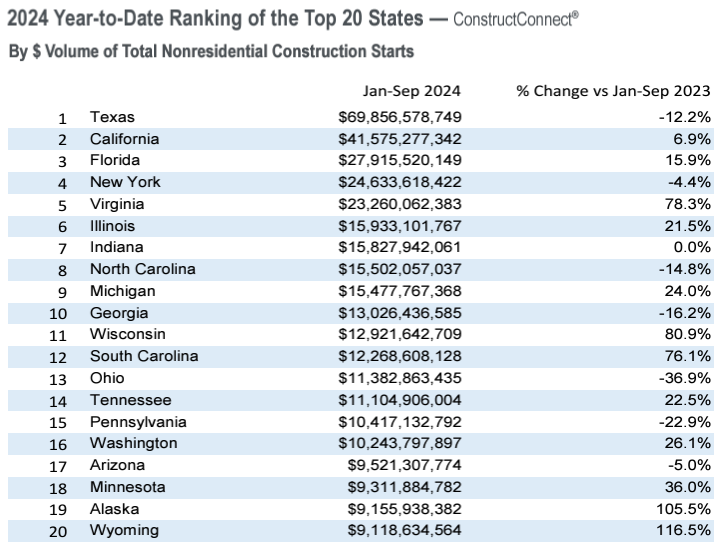

The Pacific region has the second-highest YTD construction starts spending of $70.4 billion, up 12.7% compared to the year prior. In this region, Alaska has been the fastest-growing state (up 106%), followed by Oregon (up 23.3%) and California (up 9.4%).

Middle of the Map Struggles

Excluding the Midwestern states from Wisconsin to Illinois and Ohio, nonresidential construction starts in “much of the middle of the country continues to struggle significantly in 2024”, Guckes reported in The Construction Economy Snapshot. “The region composed of Texas and most of its neighboring states have collectively reported a YTD shrink in spending of 14%,” Guckes added.

Chief Economist Michael Guckes, ConstructConnect

“Mid-America spending is slightly better outside of this region, yet spending remains modestly contractionary when accounting for inflation,” Guckes indicated. He added that spending on heavy engineering projects across the country “has helped improve regional results everywhere, less the previously defined Midwestern states.”

Heavy Engineering Continues to Offset Shrinkage

Heavy Engineering is a bright spot in the report. It is up more than 10% YTD in most Mid-America regions and above 30% along most of both coasts. Guckes previously reported that heavy engineering offset the significant contractions occurring in nonresidential building construction.

Chart: ConstructConnect, The Construction Economy Snapshot through September 2024.

Read the Construction Economy Snapshot for more details, including trend graphs, analysis, and commentary from Chief Economist Michael Guckes.

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com.