Construction spending expected to rise by 4.1% in 2025

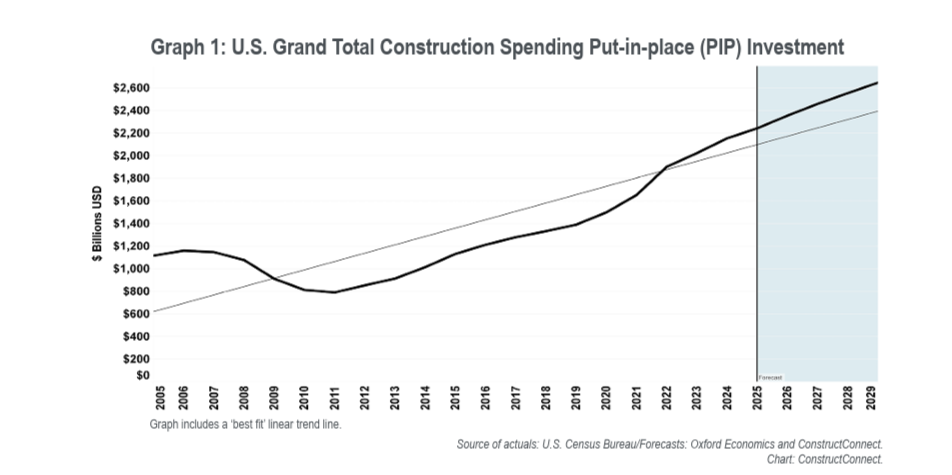

ConstructConnect Chief Economist Michael Guckes unveiled the U.S. Put-in-Place Construction Forecasts for Spring 2025 today. The forecast projects total construction spending to rise by 4.1% to $2.24 trillion this year and anticipates continued growth, with spending expected to reach $2.65 trillion by 2029.

The three primary construction categories—residential, nonresidential building, and engineering—are all expected to grow in 2025. Engineering work leads the categories with a projected 7.3% increase, followed by residential construction at 4.3% and nonresidential building at 1.9%.

“The U.S. construction sector is poised for steady expansion in 2025,” Guckes stated. He added, “The latest outlook marks a downshift in the sector’s growth rate after reporting greater than 6% growth in each of the last two years.”

Put-in-place spending data are comparable to work-in-progress payments as buildings under construction proceed to completion.

It remains essential for business leaders to closely monitor these fluctuations and industry nuances to direct their efforts on emerging opportunities and maximize profits.

Michael Guckes, Chief Economist, ConstructConnect

Highlights from the Put-in-Place forecast also include:

- Nonresidential construction, comprising heavy engineering (also known as civil construction) and nonresidential building, is projected to grow by 4.0% in 2025, reaching $1.27 trillion.

- The total commercial construction outlook is mixed, with offices expecting to grow 6.6% in 2025. The category includes data center construction, which has experienced rapid growth in recent years.

- Engineering and civil work is projected to lead overall construction growth through 2027, with expectations to exceed $500 billion and 7.3% growth in 2025.

- Industrial and manufacturing construction, which had been a significant growth engine in 2023 and 2024, is expected to decline by 2.7% in 2025.

- Power construction is set to grow by 13.1% in 2025 and 17.9% in 2026, highlighting the significance of the economy’s “electrification.”

U.S. Grand Total Construction Spending Put-in-place (PIP) Investment. Image: ConstructConnect

Guckes said the forecast’s “diverse performance highlights the volatile nature of the construction sector.” He recommends paying close attention to the construction economy.

His bottom line: “It remains essential for business leaders to closely monitor these fluctuations and industry nuances to direct their efforts on emerging opportunities and maximize profits.”

The ConstructConnect Put-in-Place Construction Forecasts is produced in partnership with Oxford Economics.

Explore the commentary and analysis in the Spring 2025 Put-in-Place Construction Forecasts.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

About Marshall Benveniste

Marshall Benveniste is a writer and Senior Content Marketing Manager at ConstructConnect with the Economics Group. Marshall has written on various topics for the construction industry, including strategies for building product manufacturers, artificial intelligence in construction, and data-driven decision-making. Before joining ConstructConnect in 2021, Marshall spent 15 years in marketing communications for financial services and specialty construction firms. He holds a PhD in organizational management.

Sign In

Sign In