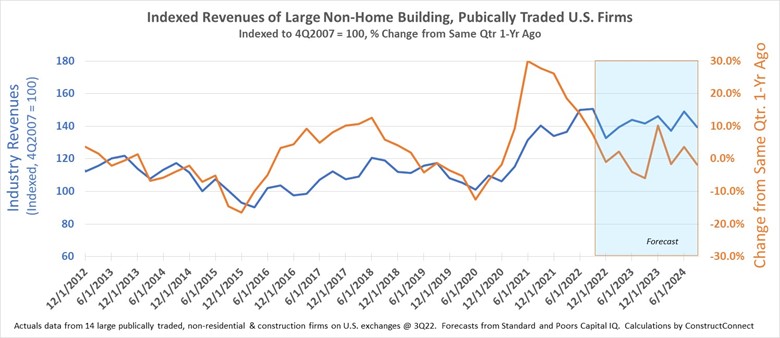

The collective revenues of the 14 largest U.S. publicly-traded firms in the nonresidential construction industry grew at a historic pace during the seven-quarter period between the end of 2020 and the third quarter of 2022, the latest quarter for which actual results are available. Total revenues during the period increased by nearly 50%, with the fastest growth occurring during the second half of 2022 as demand for construction surged.

Part of this rapid growth was the result of an industry on the rebound after several difficult quarters stemming largely from COVID-19. Prior to COVID-19, collective revenues among these select firms last climaxed in the second quarter of 2018. Measuring peak-to-present revenue growth is still strongly impressive as it represents a 24.8% gain over the period. Represented as a compounded annual growth rate (CAGR), revenues from Q2 2018 to Q3 2022 grew at 10.4%.

Unfortunately, Wall Street’s expectations for future revenue growth are far more tepid. Slowing revenue growth in the second half of 2022—a common precursor to a market peak—is anticipated to have led to a contraction in the final quarter of 2022. Thereafter, the industry is expected to begin a gradual rebound. Year-on-year change readings in 2023 will move deeply negative as ominous revenue expectations in mid-2023 are compared against 2022’s peak readings. However, a comparison of 2022’s peak against the average expected results after mid-2023 suggests only a modest 6% decline in revenues which we would use as a proxy of industry size.

At least one factor which is making 2023’s forecasting more complicated than in past years is the growing importance of megaprojects, defined as projects with a cost of more than $1 billion. The value of these projects as a proportion of total nonresidential construction spending reached an all-time high in 2022 and continues to move higher. However, such projects frequently have more complex financing, and supply chains, and have longer construction times. All these factors will add to the potential future volatility of the industry, making such forecasts more suspect.