Read this article to understand the level of U.S. non-residential construction projects that have been delayed, on hold, or abandoned.

COMPOSITE OVERVIEW

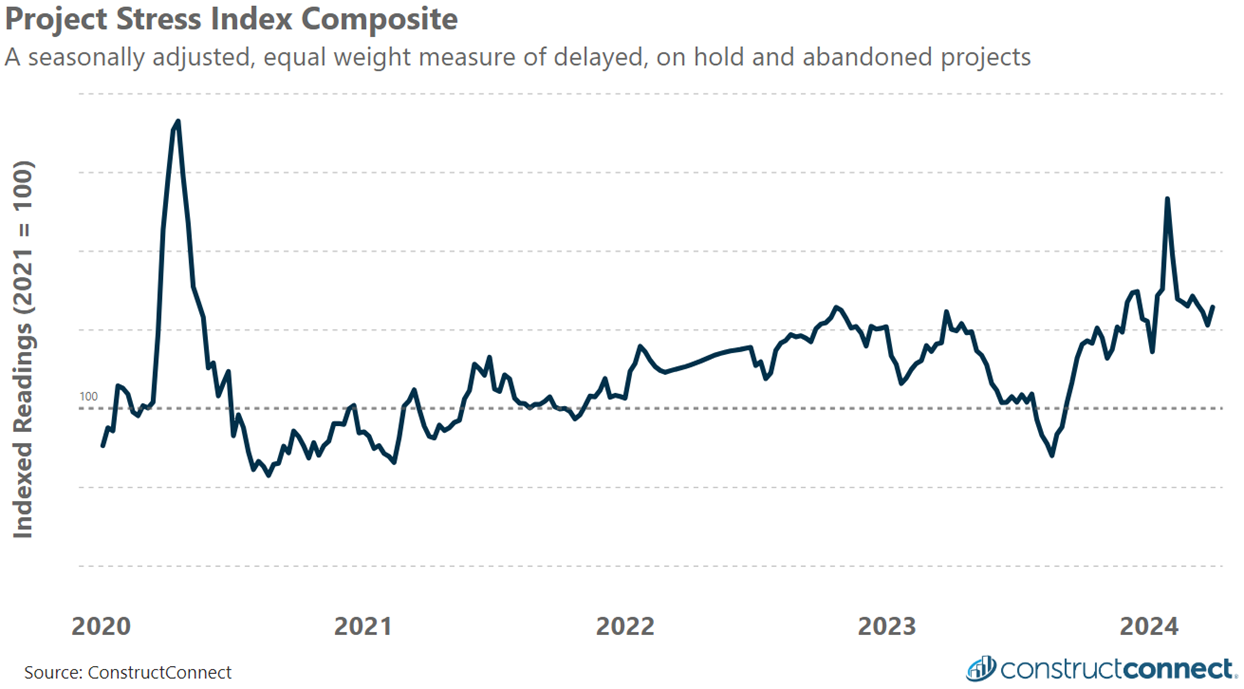

For the week ending March 31st, 2024, the Project Stress Index composite rose by 3.8% to close at 125.7. The most notable change during the week was a 9.4% increase in Abandoned activity which impacted both public and private work. It was followed by no change in On Hold activity and a slight 0.3% decline in Delayed Bid activity.

Over the course of the last month, the Composite fell by 2% thanks to a significant decline in On Hold activity which was more than enough to offset rising Abandoned projects. The narrow range of weekly readings since early February of between 128 and 121 indicate that around 25% more projects are being impacted by some type of stress event as compared to the PSI’s base year reading using 2021 average values.

The Composite’s gains continue to be disproportionately driven by Abandoned activity which is up 60% from its base year level, while Delayed Bid and On Hold projects have notched smaller gains of 25% and 12%, respectively.

COMPONENTS MONITOR

| Delay Bid Date |

On Hold |

Abandoned |

|

|

|

Sector Status Update

Public and private projects often have different stress trends because they are financed by different means. This has resulted in more public projects being impacted by holds since 2023. Simultaneously private sector projects have been disproportionately impacted by abandonments.

For the week ending March 31st, both sectors continued to report steady levels of Delayed Bid activity as compared to previous weeks. However, a similar analysis among projects placed On Hold indicated a divergence with declining levels in the private sector and rising levels among public projects.

During the last week of March, both sectors reported rising Abandonment activity. However, looking back at the entire month, the PSI reported modest declines, with private and public abandonments down 15% and 7%, respectively.

About the Project Stress Index

The Project Stress Index (PSI) composite represents an equal-weight measure of the seasonally adjusted level of pre-construction projects that have experienced a delayed bid date, have been placed on hold, or have been abandoned in the last 30-days. The PSI monitors nonresidential and multifamily projects in their preconstruction phases only and thus excludes any single-family home construction. Each component has been seasonally adjusted and then indexed against its 2021 average weekly reading. The independent tracking of each status type gives unique insights into the timing, direction, and amplitude of market changes.

Additional information about the PSI, including detailed data about the individual readings for delayed, on hold, and abandoned projects can be found here.