Read this article to understand the level of U.S. non-residential construction projects that have been delayed, on hold, or abandoned.

COMPOSITE OVERVIEW

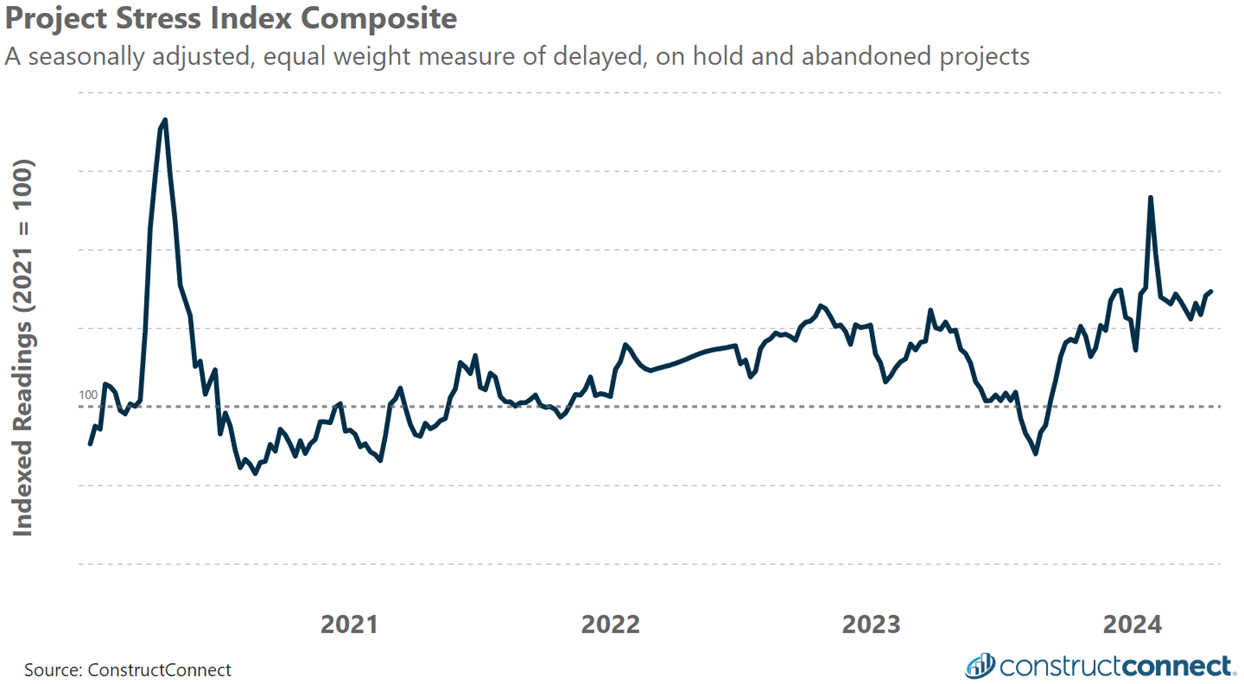

For the week ending April 20th, 2024, the Project Stress Index composite closed at 129.5, up 0.8% from a week ago and up 6% over the past month.

The week’s increase resulted from higher On Hold activity that was partially offset by a smaller decline in Delayed Bid activity. No notable change in abandonment activity was observed.

Over the latest month, Delayed Bid, On Hold, and Abandoned activity has increased by 4%, 6%, and 7%, respectively, sending the PSI Index higher by 6%.

At the Federal Reserve’s last meeting, the Committee made clear its intention to keep interest rates higher than previously expected. As a result, markets are now pricing in higher interest rates throughout most, if not all, of 2024. These higher rates will continue to erode returns on new construction projects and could further erode existing commercial real estate prices.

COMPONENTS MONITOR

| Delay Bid Date |

On Hold |

Abandoned |

|

|

|

Sector Status Update

Public and private projects often exhibit distinct stress trends due to their varied financing sources. Six months after the Federal Reserve initiated interest rate hikes in early 2022, conditions for private sector projects deteriorated noticeably, as evidenced by a significant increase in abandonments.

Simultaneously, public projects reported a modest increase in the level of delayed and on hold projects, but with little change in abandonments. However, since the fourth quarter of 2023, both sectors have reported elevated levels of abandonments compared to historical norms.

As a result, and for the first time in recorded history, the last six months of composite readings have been dominated by abandonment activity.

About the Project Stress Index

The Project Stress Index (PSI) composite represents an equal-weight measure of the seasonally adjusted level of pre-construction projects that have experienced a delayed bid date, have been placed on hold, or have been abandoned in the last 30 days. The PSI monitors nonresidential and multifamily projects in their preconstruction phases only and thus excludes any single-family home construction. Each component has been seasonally adjusted and then indexed against its 2021 average weekly reading. The independent tracking of each status type gives unique insights into the timing, direction, and amplitude of market changes.

Additional information about the PSI, including detailed data about the individual readings for delayed, on hold, and abandoned projects can be found here.