COMPOSITE OVERVIEW

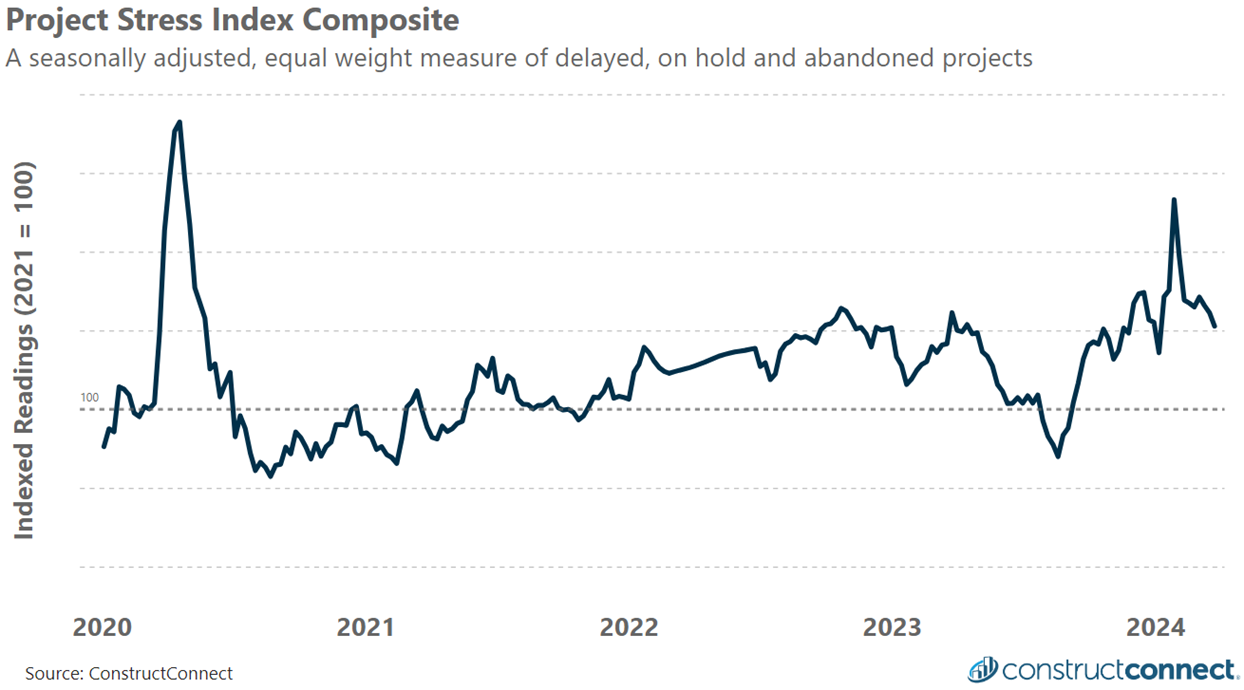

For the week ending March 23rd, 2024, the Project Stress Index composite fell by 2.8% to close at 121.1. The most significant change during the week was a 5.9% decline in On Hold activity. It was followed by a smaller 2.5% decline in Abandonment activity and lastly a rise in Delayed Bid activity of 0.5%. Over the last six weeks, the Composite —representing the average of all three activity metrics— has fallen a total of 5 points. This modest decline, however, conceals the unique motion of the individual metrics. In recent weeks Abandoned activity has remained generally steady although holding at historically elevated levels. This contrasts sharply with Delayed Bid activity which has been trending lower recently and is near a 1-year low. Finally, On Hold activity has reported an arc motion that began at a low point in early February, then peaked in late March, and has been falling at an accelerating pace since.

COMPONENTS MONITOR

| Delay Bid Date |

On Hold |

Abandoned |

|

|

|

Sector Status Update

Public and private projects often have different stress trends because they are financed by different means. For the week ending March 23rd, both sectors continued to report unremarkable levels of Delayed project activity. However, readings for On Hold activity indicate a notable divergence by sector. Currently, the level of private projects On Hold remains at more than 70% above the level recorded during the same week a year ago. Its public sector equivalent is performing better, with recent weekly results around 20% higher compared to the same week levels also from a year ago. In both sectors, abandoned project levels have begun falling from their recent highs. For the first time this year, weekly private sector abandonment levels have fallen below the previous all-time highs set in 2023. In the public sector, however, weekly results continue to set new week-of-year highs. Recent weekly abandonment readings have been 35% or more above the same week levels recorded in any prior year going back to at least 2020.

About the Project Stress Index

The Project Stress Index (PSI) monitors the level of U.S. construction projects, excluding single family residential, that have experienced a bid date delay, have been placed on hold, or have been abandoned over the last 30 days. Each component has been indexed against the average of their weekly values recorded during 2021. The independent tracking of each status type gives unique insights into the timing, direction, and amplitude of market changes.

Additional information about the PSI, including detailed data about the individual readings for delayed, on hold, and abandoned projects can be found here.