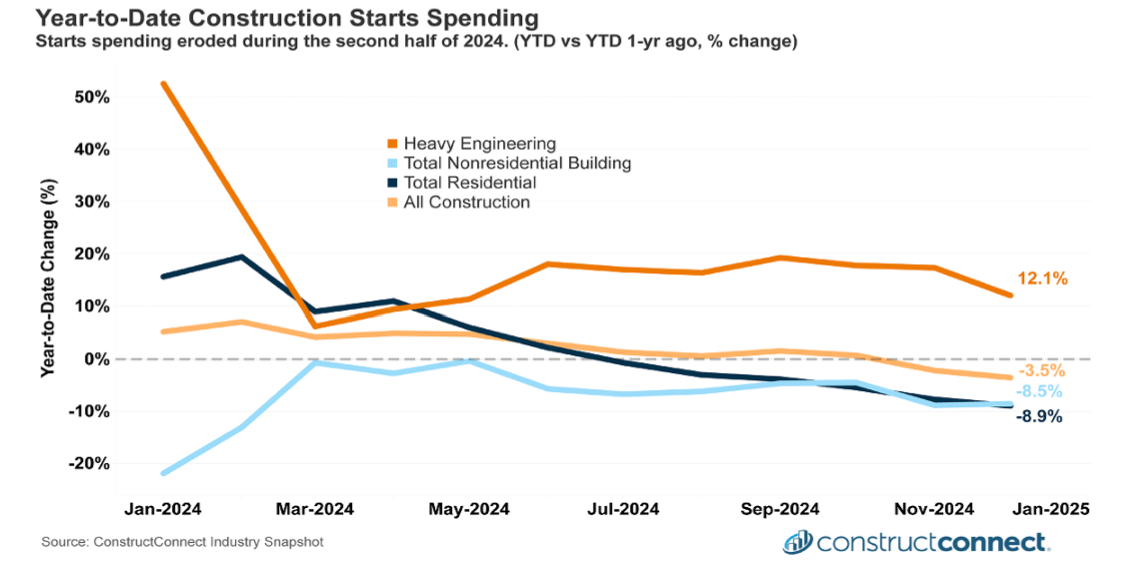

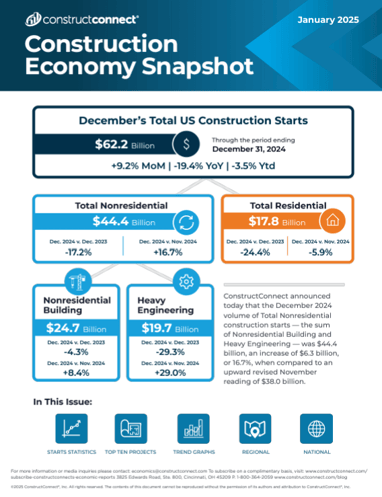

Last week, ConstructConnect reported in the Construction Economy Snapshot that Construction Starts through December 2024 fell 3.5 percent and total nonresidential building (NRB) construction fell 8.5 percent.

These results, by themselves, suggest an uninspired year for construction. But there’s more to the story.

A more complete picture of the nonresidential construction economy looks beyond total starts and into the category and subcategory results.

Total Nonresidential Construction

Remember that total nonresidential construction is the sum of nonresidential building and heavy engineering, or:

Total Nonresidential construction starts = Nonresidential Building + Heavy Engineering

This chart (light blue line) illustrates the big picture of total nonresidential building construction starts in 2024, which were down 8.5%.

2024 Construction Starts Spending. The image reveals the erosion of expenditures in the second half of the year. Image: ConstructConnect Construction Economy Snapshot

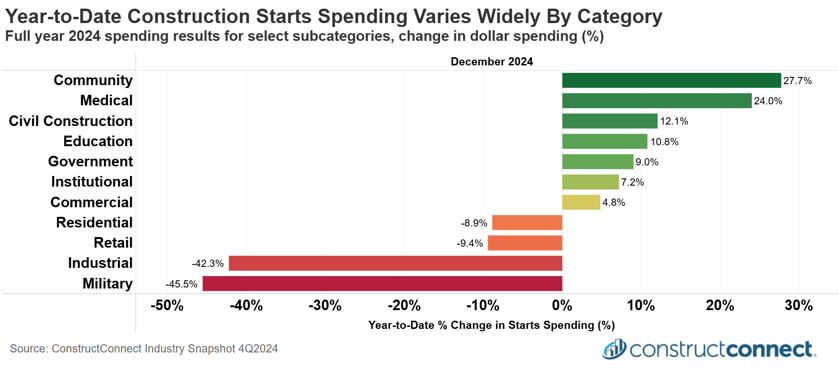

Construction Starts by Category

Beyond the “big picture” view of nonresidential building starts, the category level provides more insight into the range of construction starts, by dollars spent, and among the type of structure.

The chart below of select categories displays, for instance, the variation in Medical spending, which was up 24% in 2024, and Military spending, which retreated 45.5%.

You can read more about these categories in my latest review and analysis: Fourth Quarter Results Cap Off Weak Close to 2024.

Construction starts at the category level for 2024, by percentage change in dollar spending, showing the variation among select categories. Image: ConstructConnect

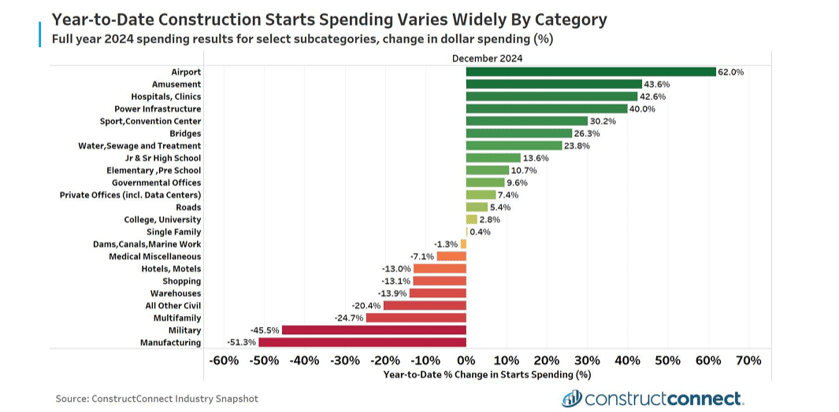

Construction Starts by Subcategory

Slicing the nonresidential categories to an additional degree reveals subcategory (or vertical) construction starts in more detail by type of structure.

Among the twenty-five subcategories that make up NRB spending, eight reported 2024 spending growth of over 10%, while another seven reported less than 10% growth. (Categories, Subcategories, and performance are in the monthly Construction Economy Snapshot).

Among the ten subcategories that contracted were Retail/Shopping, Manufacturing, Warehousing, and Military. Collectively, these four subcategories saw year-on-year starts spending contract by $66 billion.

Construction starts by select subcategories (or verticals) for 2024, by change in dollar spending, shows the variation in spending among type of structure. Image: ConstructConnect

In this week’s Construction Starts article, I mentioned that industry leaders in 2025 will need to take a more nuanced view of the construction sector. That suggestion includes an awareness of category, subcategory, and geographic construction data as it applies to particular business objectives.

Read the Construction Economy Snapshot for more details on construction labor, trend graphs, and regional analysis.

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com