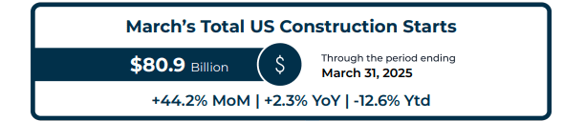

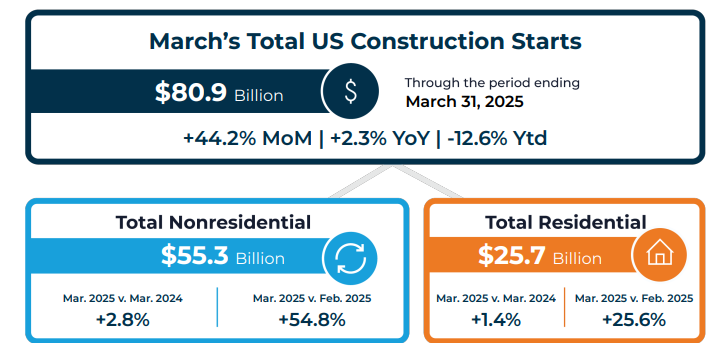

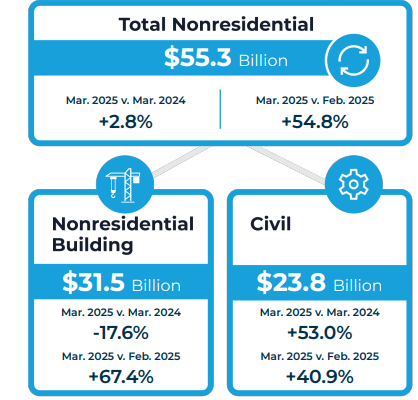

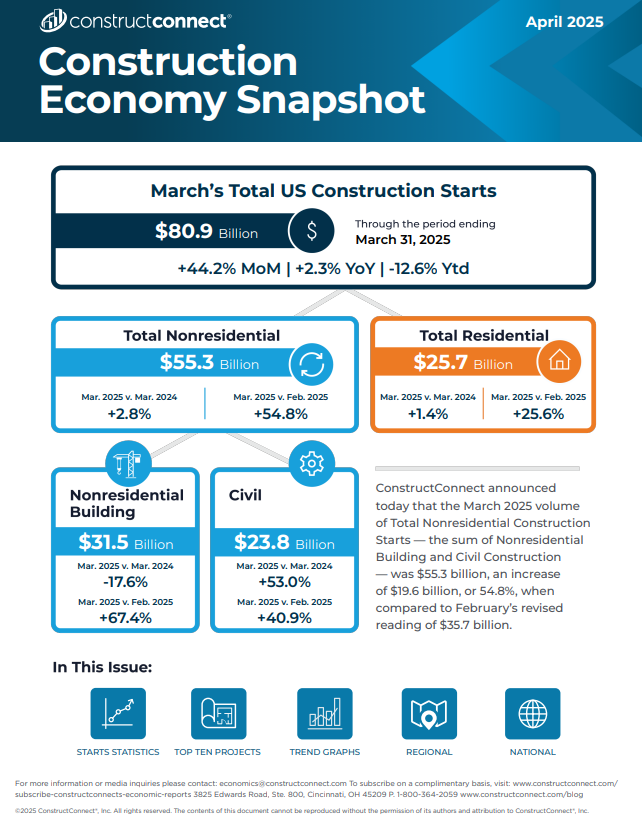

ConstructConnect announced today in the Construction Economy Snapshot that the March 2025 volume of Total Nonresidential Construction Starts — the sum of Nonresidential Building and Civil Construction — was $55.3 billion, an increase of $19.6 billion, or 54.8%, when compared to February’s revised reading of $35.7 billion.

Chief Economist Michael Guckes said, “March Nonresidential Starts activity rose to $55.3 billion, providing a much-needed boost to construction activity, which had been struggling since November 2024.”

“The March reading was not only the highest in the last five months but also comparable to 2024’s monthly average starts reading of $55.3 billion,” Guckes added.

Primary segments of the March 2025 Total US Construction Starts. Image: ConstructConnect Construction Economy Snapshot

Highlights by Subcategory

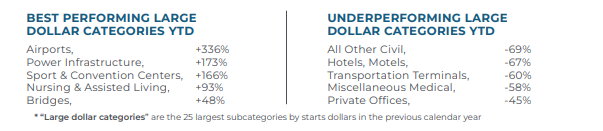

The latest gains were widespread with Sports Arenas & Convention Centers, Airports (Civil Construction), and Power Infrastructure all posting year-to-date “YTD” gains of more than 100%, Guckes reported.

Thanks to March’s bump, ten of the thirty-two subcategories tracked by ConstructConnect are now in positive territory. Two large sports arenas along the East Coast contributed almost $2.3 billion to the latest total.

March 2025 Total Nonresidential Construction Starts. Image: ConstructConnect Construction Economy Snapshot

Additionally, a $1 billion airport expansion started in March marked the third airport megaproject start this year. Through March, Airport starts in 2025 are more than 300% higher than in 2024.

Chart of the Best Performing and Underperforming Large Dollar, nonresidential subcategories (year-to-date) from ConstructConnect through March 2025. Image: ConstructConnect Construction Economy Snapshot

Three Data Center and three Apartment megaprojects also added another $6 billion to March’s total, significantly lifting year-to-date results for both Multifamily and the greater Offices category, which includes data center activity.

January and February were very difficult months for Manufacturing construction, recording only $348 million and $2.1 billion, respectively.

However, March made up a significant amount of lost ground thanks to five large Manufacturing projects worth a collective $7.8 billion. Among these projects was a $500 million copper production plant upgrade

in Illinois. These projects helped raise the monthly total to $8 billion, almost double 2024’s monthly average of $4.6 billion, Guckes reported.

Read the Construction Economy Snapshot for more details on construction labor, trends, and regional analysis.

Construction economy news and insights you can act on.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.