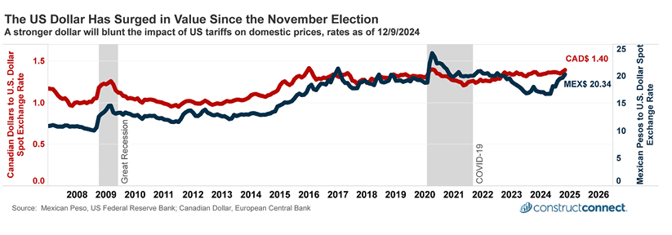

Even before President-elect Trump announced his international trade plans and intentions, North American currency markets were already favoring the US dollar (USD). In fact, the dollar has strengthened against the Mexican peso by 22% since April 2024.

The exchange rate held steady in Canada for much of 2024, with each US dollar purchasing around $1.35 in Canadian dollars (CAD). However, beginning in October, the Canadian dollar began to weaken quickly against the USD. That weakness accelerated again after America’s November elections.

The US dollar has surged in value since the November election. A stronger dollar will blunt the impact of US tariffs on domestic prices. Rates as of December 9, 2024. Image: ConstructConnect

From the start of 2024 to the present, the USD has appreciated by a full 7.3% against the CAD and 19.7% against the peso. Given that currency markets heavily favored the USD before the November election and then even more so thereafter, there is little reason to expect the USD to weaken before the US, Canada, and Mexico enter into a potential tariff trade war in 2025.

It is essential to understand that a stronger USD will weaken the impact of Trump’s future proposed tariffs on Canadian and Mexican goods when sold in their native currency.

Conversely, any potential retaliatory tariffs instituted by the Mexican and Canadian governments on US goods (sold in USDs) combined with their weakened domestic currency exchange rate will make the US goods their citizens purchase far dearer.

Consumers will not only have to pay the tariff cost but also spend more of their native currency to buy each US dollar. American firms selling goods in CAD or pesos will have to carefully monitor exchange rates to ensure that their prices reflect shifts in foreign exchange rates (in accounting terms, this is known as “translation risk” and can be consequential to firms during periods of significant exchange rate volatility).

Firms that want to learn more about translation risk and prepare themselves for the possibility of future volatile currency fluctuations have many options, including:

- Accounting software packages often have tools to ensure real-time currency conversion, allowing firms to know that their foreign pricing is sufficient to cover their total unit cost after being converted to the firm’s domestic currency.

- Hedging strategies, such as Forward Contracts and Exposure Netting, can help firms manage the inherent risks associated with volatile movements in currency exchange rates.

These and other business strategies will help firms manage the inherent risks associated with volatile movements in currency exchange rates.

Construction economy news and insights you can act on.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.