Historically, the 30-year mortgage and Federal Funds rates have been highly correlated. However, with the Federal Reserve’s recent series of rate cuts initiated in September this year, we have not seen a corresponding decline in long-dated mortgage rates.

Instead, we have seen rates increase slightly, contradicting the long-run correlation between these series.

The relationship between the Fed Funds rate and 30-year mortgage. Image: ConstructConnect

The powers influencing mortgage rates and the treasury rates that underlie them are clearly being buffeted by a stronger force than just the Federal Reserve. In late 2021, both mortgage rates and the 10-year treasury began moving higher in response to inflation. The Federal Reserve was, in fact, late in responding to rising inflation during 2021, believing that inflation would only be temporary and self-resolving.

Although the Fed’s efforts to reign in inflation worked in 2022 and 2023, thanks to an unprecedented series of abrupt rate increases, inflation has persistently remained above the Fed’s 2% rate target. In late 2024, inflation actually moved higher from a recent low of 2.4% in September to 2.7% as of the latest reading conducted in November.

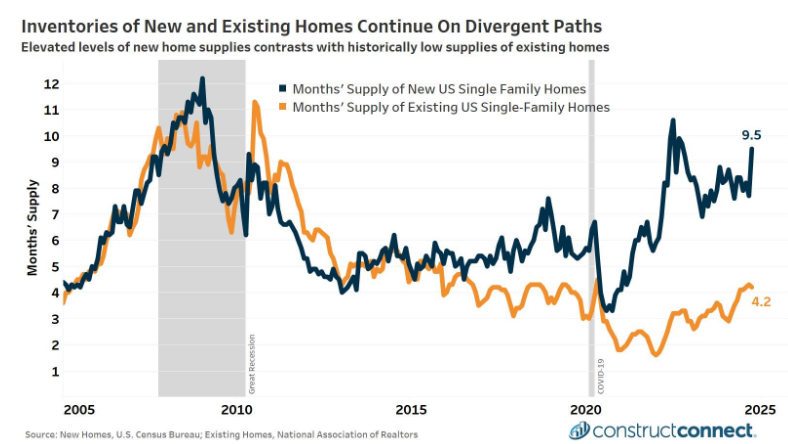

Inventories of new and existing homes continue on divergent paths. Image: ConstructConnect

The lowering of Fed Rates now in December will only undermine efforts to bring inflation down further. Additionally, if expectations become a reality and the Fed makes 3 to 4 more cuts in 2025, it would open the way for inflation to worsen rather than sink, sending mortgage rates higher and not lower.

Such an outcome would only continue the housing market’s current troubles, as evidenced by unaffordable housing, a glut of new home inventory, and more existing homeowners remaining in their current homes, tied to their historically low mortgage rates of past years.

Construction economy news and insights you can act on.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.