Chief Economist: “2025 continues to struggle to find its footing”

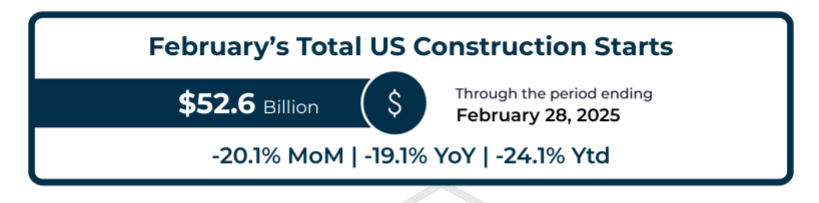

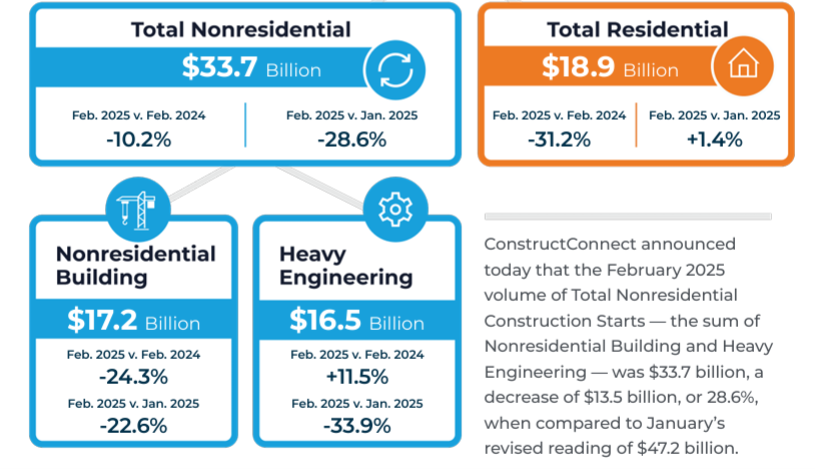

ConstructConnect reported today in the Construction Economy Snapshot that the February 2025 volume of Total Nonresidential construction starts—the sum of Nonresidential Building and Heavy Engineering—was $33.7 billion, a decrease of $13.5 billion, or 28.6%, when compared to January’s revised reading of $47.2 billion.

Chief Economist Michael Guckes said, “Such dour results are not expected to last as the new presidential administration’s pro-growth and pro-business agenda unfolds. However, these expectations will be challenged by stubborn inflation, which clocked in at 2.8% in its latest reading.”

“Higher inflation elevates borrowing costs for owners and developers, erodes the profitability of future construction projects, and with it, hobbles new construction demand,” Guckes added.

Primary segments of the February 2025 Total US Construction Starts. Image: ConstructConnect Construction Economy Snapshot

2025 Continues to Struggle to Find Its Footing

ConstructConnect previously reported that 2025 started with a whimper, as January’s year-on-year Total Construction was 28% below the prior January’s level. February’s comparative performance was only modestly better, with year-on-year results down 19%.

Year-to-date (YTD) through February, Total Construction Starts spending was $118.4 billion, or 24% below the YTD spending level during the same period in 2024.

All three primary construction segments for the month were below their year-ago level

led by Residential Construction (down 32.7%) and followed closely by Nonresidential Building (down 29.9%). Even Civil Construction, which was the best and only positive performer last year, is down 6.1% year-to-date.

Economic Pressures and Bright Spots

The industry faces headwinds from inflation, which currently stands at 2.8%, increasing borrowing costs and dampening new construction project demand.

However, select megaprojects in airports, power infrastructure, and bridges provided some relief, collectively adding $3.2 billion to YTD results, Guckes reported. Conversely, construction sectors like manufacturing and hotels/motels lagged due to unusually strong early 2024 figures. Risks remain for publicly funded projects, especially in governmental offices.

Outlook for the Construction Economy

ConstructConnect’s Economics Group continues to be optimistic about the outlook for the construction economy, given the pro-growth mindset of the new presidential administration, the electrification of the economy, and America’s renewed emphasis on being a world leader in advanced electronics and other manufactured products.

Earlier this month, Guckes delivered his 2025 forecast in the Construction Economy Yearbook. He said the “anticipated rebound is thanks in part to two broad-based factors: a slowly improving interest rate environment and easing financial regulations.”

Read the Construction Economy Snapshot for more details on construction labor, trends, and regional analysis.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.