Full-year Forecast by Building Category

In our quarterly Construction Starts Forecast, we project 8.5% growth for Total US Construction Starts in 2025.

The growth forecast is driven largely by the positive economic outlook, strong government spending, and falling interest rates, which help to support growth in the Residential and Nonresidential Building sectors.

What construction categories by type of structure are forecast to change?

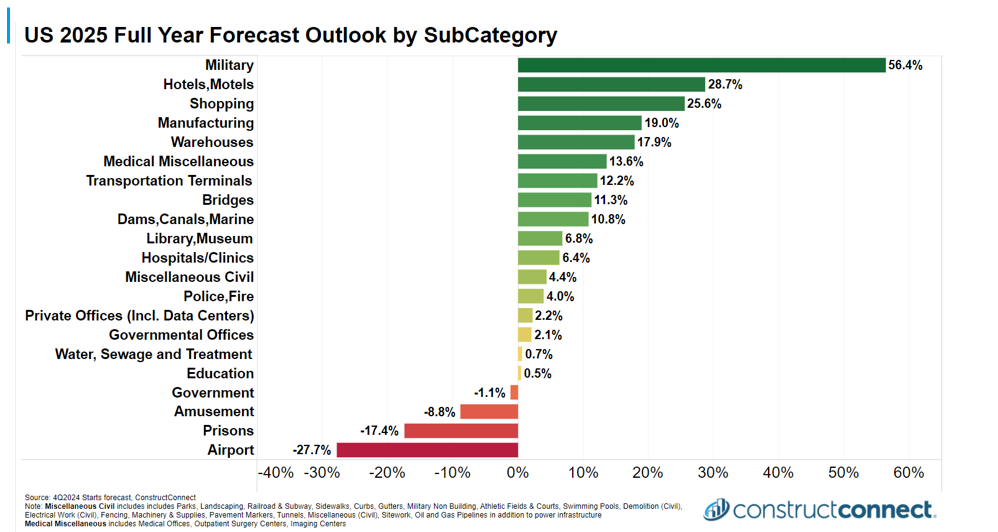

Among institutional subcategories, the most significant decline is expected in Prison Starts, which are set to decline by 17.4%. Religious structures are the only other declining subcategory, by 1.3%.

The largest gains are to be found in the Military and the Nursing Homes subsectors, growing by 56.4% and 36.5%, respectively, which should benefit from a subdued performance in 2024. Commercial construction is expected to grow by 7% in 2025 after broadly stagnating during 2024. High interest rates and concerns around overcapacity in the commercial real estate sector remain a constraint to new construction, but these will ease through 2025.

Strong growth is forecast across Hotels, Shopping/Retail, and Warehouses with some large projects upcoming in the retail space especially. Offices, both private and governmental, are set for growth of around 2% as multiple large data center construction projects in 2025 support the subsector.

Declines will be limited to the Sports Stadium and Industrial Laboratories subsectors, with declines of 14.9% and 11%, respectively.

Unpacking the Civil Engineering Forecast

Civil Engineering will continue to exhibit growth but will not match the highs of the previous few years, with growth expected at 5.3%.

Miscellaneous Civil Engineering starts, including Power projects, Oil & Gas projects, and Tunnels, among others, are set to slow to 4.4% growth, but this still represents strong spending as levels remain extremely high. This is against a backdrop of nearly 50% growth in 2024.

Investment in Power Infrastructure is a strategic area for growth as part of the green transition. It has seen plenty of government investment, although there are fewer large upcoming projects than in previous years.

New Roads, Bridges, and Dams are expected to have a good 2025, with growth hovering around 11% for all three subsectors. Multiple large projects are in the pipeline for Roads, the largest Engineering subsector, which is forecast to grow more than it did in 2024. However, 2024 is set to be the final year of extraordinary growth in Civil Engineering as government infrastructure spending comes down from its current elevated level.

Airport Starts are the only declining civil subsector, with a predicted drop of 27.7%. However, it should be stressed that this is in large part due to simply not being able to match extraordinary growth rather than poor performance.

Read the full Construction Starts Forecast for more economic analysis from Chief Economist Michael Guckes.

Construction economy news and insights you can act on.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.