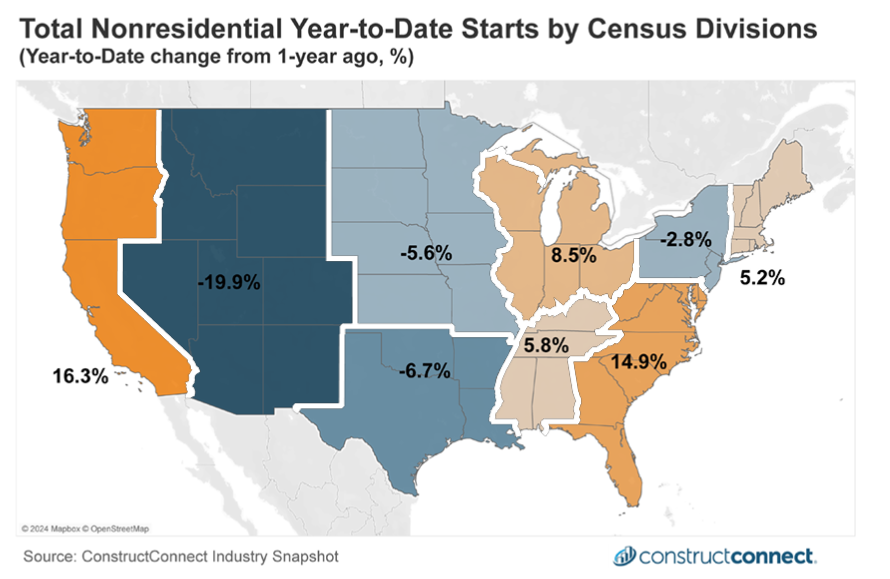

ConstructConnect Chief Economist Michael Guckes reported in the November Construction Economy Snapshot that regional, nonresidential construction activity year-to-date (YTD) has been generally positive for many coastal regions but more difficult for the nation’s central southern and mountainous regions.

Through October, YTD nonresidential construction spending expanded the fastest in the South Atlantic (14.9%). The region’s results were assisted by high-value hospital and data center projects worth several billion dollars and a nearly 50% increase in heavy engineering work this year.

Chief Economist Michael Guckes, ConstructConnect

Further up the eastern seaboard, however, spending growth has been less ambitious. Guckes reported that although Middle Atlantic and New England regional spending has been bolstered by double-digit gains in heavy engineering work, much —if not all— of these gains have been unwound by contracting nonresidential building results.

Map of Total Nonresidential Construction Starts through October 2024 by Census Divisions, from The Construction Economy Snapshot, November 2024.

On the other side of the country, year-to-date Pacific region spending at $79.6 billion is up 16.3% compared to the year prior. In this region, the fastest-growing states include Alaska (up 100%), Washington (up 26%), and Oregon (up 20%).

California, which has reported YTD total nonresidential spending of nearly $50 billion, also continues to perform well, with year-on-year growth of nearly 14%. Such growth has been made possible thanks to the region’s heavy engineering construction activity, which is up 35% this year. In contrast, the region’s nonresidential building activity thus far in 2024 has changed little at a sub-2% growth.

Total nonresidential construction spending remains challenged across the Mountain, West North Central, and West South-Central regions. This includes all states between Idaho, Arizona, Louisiana, and Minnesota.

In the Mountain region, in particular, YTD spending is down 20% from a year ago. Many states in these regions have deeply contractionary nonresidential building spending this year without offsetting gains in heavy engineering work.

Regional spending is better in the East North Central and East South-Central Regions, which include all states between Wisconsin, Mississippi, Alabama, and Ohio, where stronger nonresidential building spending has not needed heavy engineering spending to offset declines.

Read the Construction Economy Snapshot for more details, including trend graphs, analysis, and commentary from Chief Economist Michael Guckes.

Download the November Construction Economy Snapshot

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com.