In mid-September, the Federal Reserve, or the Fed, aggressively cut the Federal Funds rate by 50 basis points (0.5%). This will indirectly lower interest rates in the private sector, thereby stimulating investment and bolstering economic growth and employment.

Leading up to this latest cut, the Fed had been signaling to market observers that a September rate cut was a near certainty, although many had expected a cut of only 25 basis points. Many perceived the final larger cut as a sign of the Fed’s determination to bring the economy to a soft landing — in which inflation falls to, or below, its 2% target while continuing to achieve its employment goals.

At 2.44%, inflation has fallen by over 1% in just the last five months. Were inflation to continue to fall at this pace, it would not only reach but even exceed the Fed’s 2% inflation target before year-end. Although inflation has quickly decelerated this year, employment conditions have been signaling worrying signs of weakening.

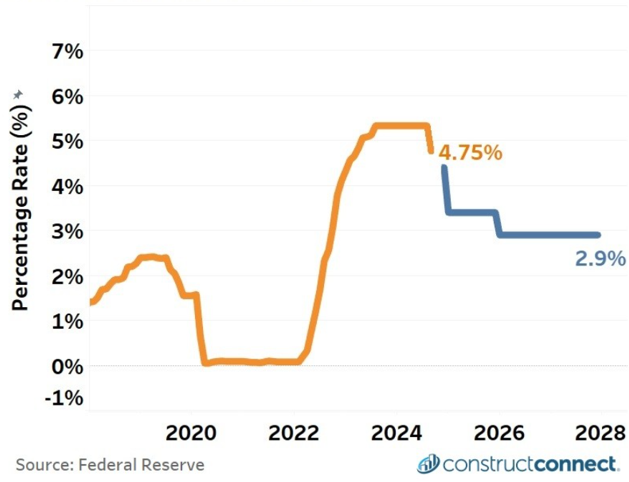

The Federal Funds rate is shown as the orange line, and the expected Federal Funds rate is the blue line.

The US unemployment rate in July reached a multi-year high of 4.3%, well above the 3.4% recorded as recently as April. Additionally, the total non-farm job openings rate, the percentage of total employment positions that are unfilled and actively being recruited by employers as a percentage of total openings and employment remains on a multi-year downward trend and recently posted a 3-year low.

In contrast, construction labor indicators continue to point to a historically tight market with elevated levels of unfilled job openings and over 8.3 million total workers, a record. As a result, the real benefit of lower interest rates to the industry will come in the form of a greater willingness by banks to refinance existing commercial real estate (CRE) debt and to expand lending for new construction.

Reports by the Federal Reserve released earlier this year specifically mentioned underperforming CRE loans as a risk to the health of the banking sector. However, falling interest rates will allow modestly underperforming CRE loans to once again “pencil out”, as tenant revenues exceed the monthly cost refinanced loans with lower rates and thus smaller mortgage payments.

Banks may be encouraged to expand their existing CRE portfolios with new construction debt as CRE loan performance improves in this lower-rate environment.

For more construction economy news and insights, subscribe to our economic reports.