Chief Economist: “construction labor market remains a primary structural concern for the industry.”

Tariff activity certainly made a lot of noise during March, causing many in the construction industry to exasperate themselves over tariffs and rising materials prices. Certainly, tariffs can create steep and rapid disruptions to price stability.

However, as was experienced during the 2018-2019 tariffs imposed during the first Trump presidency, the long-run impacts were far more muted. Domestic production ramped up, and metal prices fell below pre-tariff levels.

In contrast, today’s construction labor market remains the industry’s primary structural concern and one to monitor despite any other disruptions in 2025.

Although some reports thus far in the year have suggested that labor tightness is easing, this may be for seasonal reasons. The early months of every calendar year typically see a decline in total construction employees before payrolls surge as the calendar moves into the early summer months.

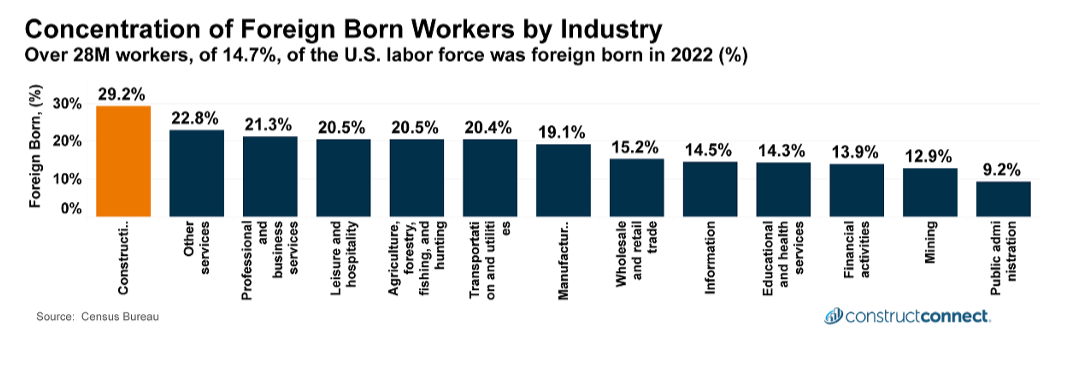

This seasonal easing may be hiding the symptoms of today’s eroding supply of construction workers, resulting in part from the removal of unauthorized workers from the construction labor market. According to data provided by the Census Bureau in 2022, nearly 30% of construction workers self-identified as foreign-born. That percentage is well above the 20% reading for the next six industries when ranked by concentration of foreign-born workers.

Construction leads the concentration of foreign-born workers by industry in this chart. The Census Bureau reported that in 2022, nearly 30% of construction workers self-identified as foreign-born. Image: ConstructConnect

A recent survey estimates suggest that 10% of the total construction workforce could be unauthorized to work and at immediate risk of deportation. Certain sub-trades —led by roofing—appear to be especially at risk of losing unauthorized workers. One survey suggested that nearly 40% of roofers may be unauthorized.

...today’s construction labor market remains a primary structural concern for the industry and one to keep an eye on, despite any other disruptions that come along in 2025.

Michael Guckes, Chief Economist, ConstructConnect

This year’s unprecedented changes mean that many construction firms will have to choose between spending their working capital on increasing inventories in an attempt to get ahead of tariffs, or spend that capital nearer the peak of this year’s construction season to ensure they can hire sufficient workers.

One could argue that stockpiling lower-priced materials with too few qualified installers is a worse outcome than passing along higher material prices while keeping the crews essential for their installation.

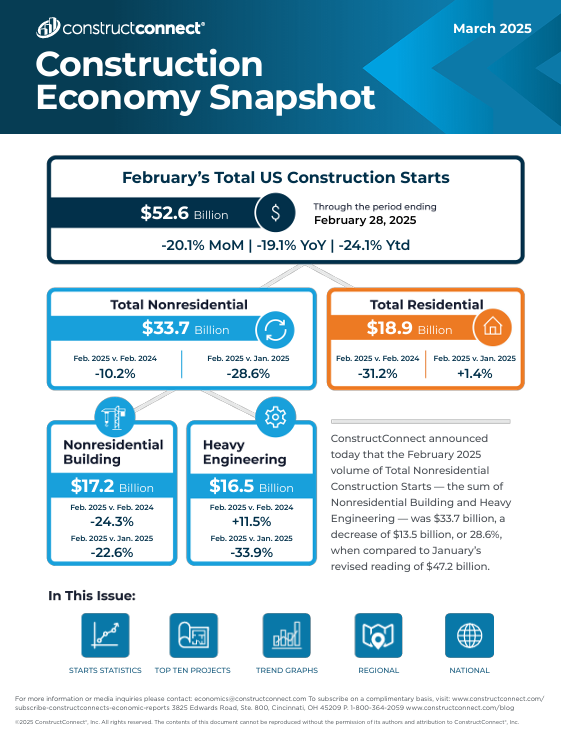

Read the Construction Economy Snapshot for more details on construction labor, trends, and regional analysis.

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com.