The Construction Economy Today

Overall, 2024 has been a period of considerable challenges for the construction industry

since rebounding from COVID in 2021. Year-over-year total construction growth, which

started at 3.0% during the first quarter, by the third quarter, turned into a 5.4%

contraction.

Forecasts for the entire year predict a 2.4% decline in total construction, with

decreases in both residential and nonresidential building construction more than

offsetting the record spending growth seen in heavy engineering projects.

Fortunately, many of the factors that resulted in 2024’s challenging conditions may soon

give way to falling interest rates, lower tax rates, and relaxed federal regulations among

other factors work to bolster future construction spending.

A portion of the new year’s anticipated rebound is thanks to two broad-based factors.

Michael Guckes, Chief Economist, ConstructConnect

Leading Drivers of Future Construction Activity

ConstructConnect’s 2025 Construction Starts Forecast for total construction spending growth of 8.5% is broad-based, with both residential and nonresidential building construction expected to expand by 12% and 8%, respectively.

A portion of the new year’s anticipated rebound is thanks to two broad-based factors.

1. An Improving Interest Rate Environment

The first is falling interest rates made possible by the Federal Reserve’s cutting of the Fed Funds Rate is the instrument that indirectly influences private sector borrowing rates. Lower interest rates will function as a first and necessary step in reinvigorating nonresidential construction activity, but more importantly, residential housing market activity.

Lower rates and the ensuing improvement in housing affordability as a result will significantly ease the current gridlock in sales caused by a combination of high home prices and high interest rates, which have made homes historically unaffordable.

Michael Guckes, Chief Economist, ConstructConnect

2. Easing Financial Regulations

The second of the broad-based factors will be the relaxing of financial regulations under a Republican-controlled government. This can bring commercial real estate (CRE) developers and financiers closer together after the banking sector stopped expanding new CRE lending in late-2022. The annualized growth in CRE lending peaked at the end of 2022 at 12.8%. Since then, lending growth has tumbled, falling to 1.6% in the latest 12-month period for which data are available.

When adjusted for inflation, CRE loan growth contracted in real terms during the second half of 2024. As a result, total CRE lending growth stalled during 2024, remaining stuck near $3 trillion. Although banks continue to maintain tight lending standards relative to pre-pandemic norms, the net percentage of banks tightening standards over the last year have fallen significantly.

Further improvements in banking conditions should renew CRE lending growth during the first half of our outlook period.

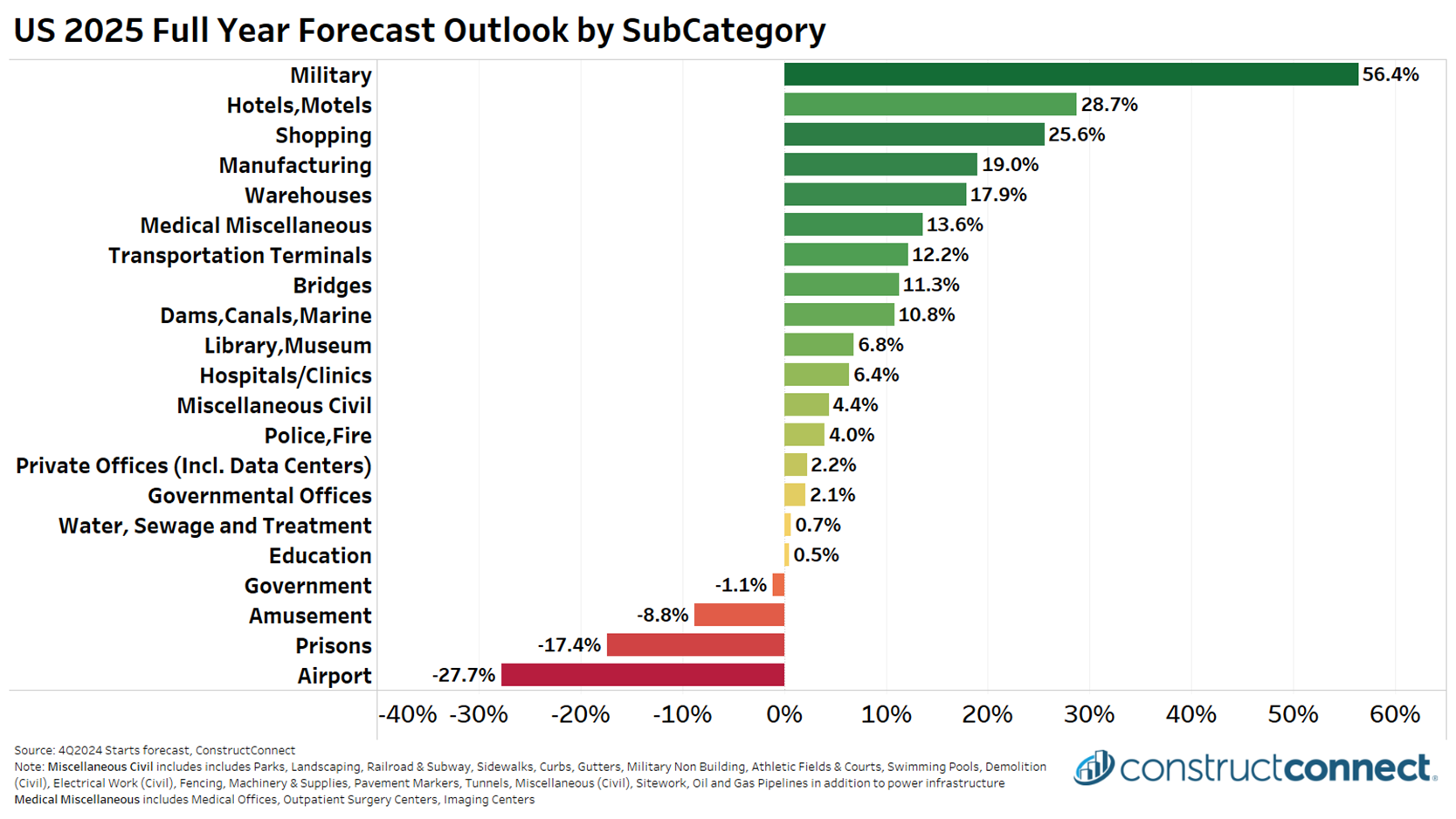

Chart of the US full-year forecast construction outlook by subcategory from the 4Q2024 ConstructConnect Starts Forecast.

3. The Electrification of the Economy

The electrification of the economy will continue to drive significant demand for power

generation and power infrastructure projects. Private office spending for 2024, which

includes the construction for power-hungry data centers, has increased by 20% in the year-to-date period ending in September compared to the same period a year earlier. However, this figure masks the reality that the increase in data center construction has more than offset contracting spending on office buildings.

The growth of artificial intelligence, the increasing adoption of electric vehicles, and the growing reliance on electric appliances and devices will further stimulate the need for electric generation and infrastructure construction in the coming years. The response to the rising demand for electricity is evident in the number of recent power generation construction project starts with valuations exceeding $1 billion, known as megaprojects.

Notable examples include a $10 billion wind power farm off the coast of Virginia and a $4 billion next-generation nuclear power plant in Wyoming, among many others.

ConstructConnect’s strong outlook for miscellaneous civil construction, which includes power generation commercial construction projects, reflects this trend.

Construction economy news and insights you can act on.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.