It is not particularly notable that construction added 13,000 jobs in March, considering that over the last year, monthly results have ranged anywhere from 30,000 jobs (September 2024) to a negative 3,000 jobs (January 2025).

What is remarkable about the latest reading is the spread between nonresidential and residential subtrades, with nonresidential adding 19,000 jobs and residential losing 13,000 jobs.

The significant drop in residential sub-trades jobs is the third-largest monthly loss since February 2021. It extends an accelerating contraction in residential jobs that begins all the way back to the third quarter of 2024.

In contrast, nonresidential subtrades added 19,000 jobs, marking the highest one-month gain in nearly 3 years. Explaining such a large single-month leap is very difficult under the present circumstances. What early 2025 figures show is the relative strength of civil construction, which is already up 10.5% YTD.

Additionally, megaprojects continue to play a significant role in the tremendous growth of many nonresidential subcategories. Two key elements may be at play, resulting in March’s conflicting labor movements.

Historically, residential construction labor has been more reliant on unauthorized workers. According to data from Pew Research in 2016, and more recently, the National Association of Home Builders in 2019, a significant share of labor in residential trades is foreign-born, and a non-trivial portion of that is composed of unauthorized laborers.

As immigration actions against unauthorized workers intensify, anecdotal evidence is growing that both foreign-born and unauthorized workers are abruptly leaving job sites for fear of being caught up in immigration enforcement efforts.

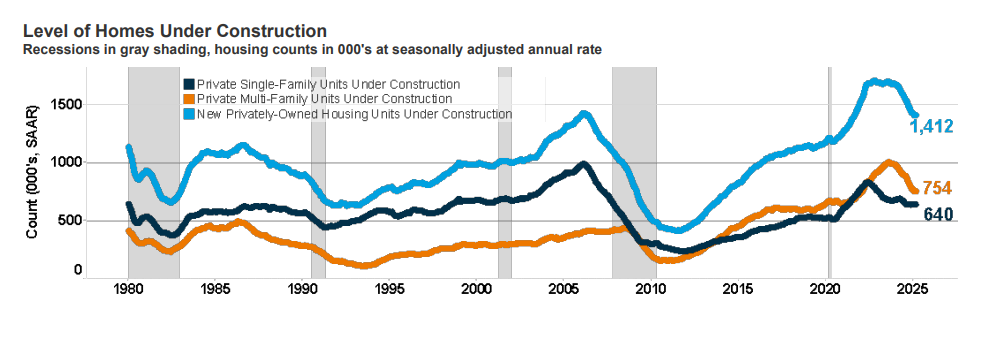

The second and less publicized factor is the slowing of residential activity. The number of U.S. private, single- and multifamily homes under construction has fallen precipitously since their peaks in August 2023 (single-family) and June 2022 (multifamily).

Measured from their peaks, single-family is down by 24% and multi-family activity is down by 22%. Additionally, new home inventories are at an 8.9-month supply, well above the five-month historic norm. In fact, the last time there was such a large supply of new homes for sale outside of COVID was at the start of the Great Recession in late 2007.

Both trends suggest that 2024’s pace of housing starts, which exceeded

1 million, which was one of the strongest years in recent history, is unsustainable. The combination of extremely high home prices and an excess supply of new homes in inventory could put significant downward pressure on future home prices, resulting in a potential upheaval in residential construction.

The average construction wage in March rose modestly to $39.24/hr, and the average number of hours worked per week rose by over 30 minutes to 39.3 hours. Comparable total private sector figures were $36/hr, while weekly hours were unchanged at 34.2.

The collective difference in wages and hours worked provided the average construction worker with a $311 premium, or 25%, as compared to their average private-sector peer.

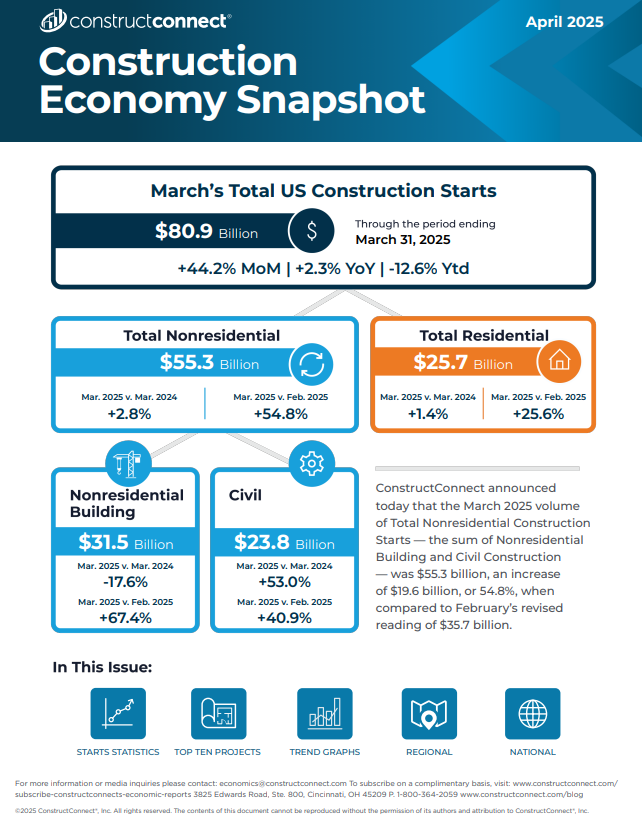

Read the Construction Economy Snapshot for more details on construction starts, trends, and regional analysis.

About ConstructConnect

At ConstructConnect, our software solutions provide the information that construction professionals need to start every project on a solid foundation. For more than 100 years, our keen insights and market intelligence have empowered commercial firms, building product manufacturers, trade contractors, and architects to make data-driven decisions, streamline preconstruction workflows, and maximize their productivity. Our newest offerings—including our comprehensive, AI-assisted software—help our clients find, bid on, and win more projects.

ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.

For more information, visit constructconnect.com.